Ryan: Tax bill 'profound change,' right path

Ryan: Tax bill 'profound change,' right path Stocks dip as House passes tax bill

Stocks dip as House passes tax bill After lively arguments, House passes tax bill

After lively arguments, House passes tax bill WH: Middle class gains from tax plan, not Trump

WH: Middle class gains from tax plan, not Trump 15 arrested at NYSE for protesting tax bill

15 arrested at NYSE for protesting tax bill GOP: Tax plan is a 'promise made, promise kept'

GOP: Tax plan is a 'promise made, promise kept' White House says tax bill 'hook up' for all of America

White House says tax bill 'hook up' for all of America Here's what's inside the latest tax reform bill

Here's what's inside the latest tax reform bill WH 'proud' of work done with Sen. Rubio on bill

WH 'proud' of work done with Sen. Rubio on bill Pelosi, Ryan clash over tax reform

Pelosi, Ryan clash over tax reform AP reporter breaks down tax legislation

AP reporter breaks down tax legislation Democrats livid over tax bill at conference

Democrats livid over tax bill at conference Democrats slam tax bill as favoring wealthy

Democrats slam tax bill as favoring wealthy Trump praises deal on Republican tax cuts

Trump praises deal on Republican tax cuts GOP Leaders Confident in Tax Bill Passage

GOP Leaders Confident in Tax Bill Passage Tax bill, government shutdown top of House agenda

Tax bill, government shutdown top of House agenda Families Visit White House for GOP tax plan push

Families Visit White House for GOP tax plan push Ryan: Tax bill is 'monumental reform'

Ryan: Tax bill is 'monumental reform' Why tax reform must go to a conference committee

Why tax reform must go to a conference committee- 3 ways Trump benefits from his own tax plan

It's time to resolve the differences between the 2 GOP tax bills

It's time to resolve the differences between the 2 GOP tax bills McConnell: Tax cuts won't grow deficit

McConnell: Tax cuts won't grow deficit McConnell, Mulvaney talk taxes

McConnell, Mulvaney talk taxes Senate Passes Bill to Overhaul Tax Code

Senate Passes Bill to Overhaul Tax Code Trump Takes Victory Lap in NY Remarks

Trump Takes Victory Lap in NY Remarks 10 changes got Senate Republicans the votes to pass tax plan

10 changes got Senate Republicans the votes to pass tax plan Analysis: Tax bill will increase deficit

Analysis: Tax bill will increase deficit GOP, Democratic senators spar over tax plan

GOP, Democratic senators spar over tax plan Trump: Tax cuts 'rocket fuel' for economy

Trump: Tax cuts 'rocket fuel' for economy Donald Trump says he won't benefit from tax plan

Donald Trump says he won't benefit from tax plan Senators on tax and budget struggle, Trump meeting

Senators on tax and budget struggle, Trump meeting Trump arrives at Capitol to meet GOP Senators

Trump arrives at Capitol to meet GOP Senators GOP Senators: Tax Plan Good for Small Businesses

GOP Senators: Tax Plan Good for Small Businesses Senate GOP tax bill could hurt low-income americans more than expected

Senate GOP tax bill could hurt low-income americans more than expected GOP wants vote on Senate tax plan this week

GOP wants vote on Senate tax plan this week Trump promises Americans 'huge tax cut' for Christmas

Trump promises Americans 'huge tax cut' for Christmas Pence promising tax reform this year

Pence promising tax reform this year House approves massive GOP tax overhaul bill

House approves massive GOP tax overhaul bill Flake urges speedy tax vote amid Moore scandal

Flake urges speedy tax vote amid Moore scandal Senators Hatch, Brown Trade Barbs in Tax Debate

Senators Hatch, Brown Trade Barbs in Tax Debate House approves GOP tax bill in Trump win

House approves GOP tax bill in Trump win Sen. Ron Johnson is the first Republican to defect on tax bill

Sen. Ron Johnson is the first Republican to defect on tax bill House GOP celebrates passing tax overhaul bill

House GOP celebrates passing tax overhaul bill Trump: 'The tax is going really well'

Trump: 'The tax is going really well' Trump arrives on Capitol Hill for tax talks

Trump arrives on Capitol Hill for tax talks Hatch defends 'Obamacare' repeal in tax bill

Hatch defends 'Obamacare' repeal in tax bill Repeal of Obamacare mandate will be added to tax bill, senator says

Repeal of Obamacare mandate will be added to tax bill, senator says Dems talk tax bill, Dream Act and sexual assault

Dems talk tax bill, Dream Act and sexual assault- Dem. leaders: Tax plan will hurt country & GOP

GOP tax bills: Senate vs. House

GOP tax bills: Senate vs. House Senate GOP releases tax proposal as House version passes committee

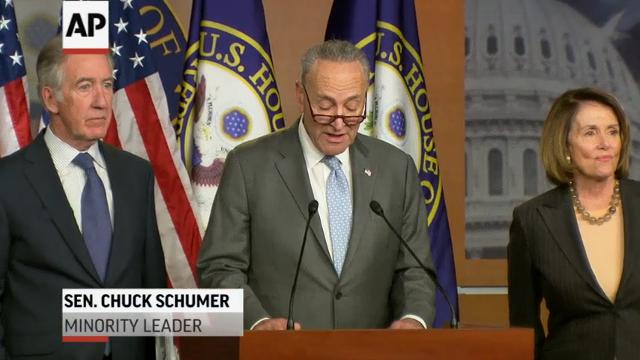

Senate GOP releases tax proposal as House version passes committee Schumer: Tax plan spells trouble for Republicans

Schumer: Tax plan spells trouble for Republicans The GOP tax plan is making grad students really nervous

The GOP tax plan is making grad students really nervous Tax-writing committee takes on GOP overhaul Plan

Tax-writing committee takes on GOP overhaul Plan Pelosi: GOP tax plan makes suckers of Americans

Pelosi: GOP tax plan makes suckers of Americans Why middle class Americans might not get a tax cut

Why middle class Americans might not get a tax cut- GOP tax bill cuts rates, popular breaks

Dems: GOP Tax Plan Hurts Middle Class

Dems: GOP Tax Plan Hurts Middle Class Trump Plants Kiss on Republican Tax Plan

Trump Plants Kiss on Republican Tax Plan Paul Ryan speaks about the GOP tax plan

Paul Ryan speaks about the GOP tax plan Trump Pushing Tax Overhaul Ahead of Asia Trip

Trump Pushing Tax Overhaul Ahead of Asia Trip What you need to know about House Republicans' new tax bill

What you need to know about House Republicans' new tax bill House Republicans reveal much awaited tax plan

House Republicans reveal much awaited tax plan What’s going on with the Trump tax plan?

What’s going on with the Trump tax plan? Ryan, Pelosi Divided as House Budget Passage

Ryan, Pelosi Divided as House Budget Passage The House just passed a budget bill that will make tax reform easier

The House just passed a budget bill that will make tax reform easier Ivanka Trump eyes child credit in tax plan pitch

Ivanka Trump eyes child credit in tax plan pitch House Dems take aim at GOP tax, budget proposals

House Dems take aim at GOP tax, budget proposals Trump: Tax cuts will restore U.S. competitive edge

Trump: Tax cuts will restore U.S. competitive edge Trump pitches tax plan to conservative group

Trump pitches tax plan to conservative group Tax reform fight clips the wings of GOP 'deficit hawks'

Tax reform fight clips the wings of GOP 'deficit hawks' Trump touts tax plan as 'middle class bill'

Trump touts tax plan as 'middle class bill' President Trump says tax plan would give Americans 'a $4,000 raise'

President Trump says tax plan would give Americans 'a $4,000 raise' Dems decry Medicare, Medicaid cuts in tax plan

Dems decry Medicare, Medicaid cuts in tax plan Donald Trump promotes 'giant, beautiful, massive' tax plan

Donald Trump promotes 'giant, beautiful, massive' tax plan WH: Tax cut aimed at middle-class

WH: Tax cut aimed at middle-class Trump makes his pitch for tax reform

Trump makes his pitch for tax reform Trump's tax plan aims to help the middle class and businesses

Trump's tax plan aims to help the middle class and businesses Trump touts 'once in a generation' tax plan

Trump touts 'once in a generation' tax plan Trump on tax reform: 'Not going to help' rich people

Trump on tax reform: 'Not going to help' rich people Ryan calls tax reform 'pro-growth, pro-family'

Ryan calls tax reform 'pro-growth, pro-family' Analysis: GOP tax plan would cut rates for many

Analysis: GOP tax plan would cut rates for many Trump, Republicans planning big tax cuts for the rich and corporations

Trump, Republicans planning big tax cuts for the rich and corporations Trump unveils rough outline of tax cut package

Trump unveils rough outline of tax cut package Trump singles out Missouri Sen. Claire McCaskill in tax reform speech

Trump singles out Missouri Sen. Claire McCaskill in tax reform speech

At this point, Republicans couldn't sell a toupee to John Travolta.

Only 26% of Americans favor a new tax-cut bill working its way through Congress, with 47% of respondents opposing the bill, according to a Monmouth poll released Monday. In only a matter of months, Republicans have sullied the primary reason Republicans have been getting elected for decades. If the Monmouth poll is right, about 5% more Americans favor keeping their own money than believe a UFO crashed in Roswell, N.M., in 1947.

Undoubtedly, the tax bill's unpopularity is tied to the sagging public opinion of the GOP. In the public's eyes, the Republican Party makes apologies for people accused of child molestation, dismisses sexual assault claims and craves power over principle. Over the past year, the GOP's motto has become, "If you ignore everything we do or say, we’re the party looking out for you."

Of course, it is difficult for members of Congress to explain a major tax overhaul when they are constantly responding to the daily tumult created by the nation's histrionic president. Questions such as, "How does this tax cut benefit the middle class?" have been shoved aside in favor of ones like, "Would it be OK for Donald Trump to fire the man investigating whether he broke the law by firing the man who was investigating him?"

Although Trump had little to do with formulating the tax bill, the proposal wears his name like a pair of cement shoes. According to a CNN poll released Tuesday, only 35% of American voters approve of the job Trump is doing — by far the worst showing of any president at this point in his term. As good as the tax bill is, it's like selling the public a diaper-scented candle.

And while Democrats in Congress are frequently wrong, they are not stupid. They see Trump's weaknesses and know that with the 2018 elections coming up, they must #resist at all times, lest they become tainted by complicity in Trumpism. All the major tax cuts of the past 50 years, from John F. Kennedy's marginal-rate cuts to Ronald Reagan's cuts in 1986 to Bill Clinton's capital-gains rate cut in 1997, had significant Democratic involvement. Even President Barack Obama once called for lowering the corporate tax rate from 35% to 28% in order to make U.S. businesses more competitive. But in 2017, Democrats are acting as if a corporate tax cut will have us all riding Mastodons to work by next week.

Predictably, the Democrats' newfound talking points against providing middle-class tax relief have been happily scooped up by a press determined to distort the bill beyond recognition. According to the Monmouth poll, 50% of Americans believe their taxes will actually go up under the bill, while only 14% believe the bill will cut their taxes. According to the left-leaning Tax Policy Center, more than 80% of taxpayers will receive a tax cut in 2018 (averaging $2,140), while less than 5% will see their taxes increase.

This mismatch of perception and reality is a result of commentators on the left claiming taxes will go up once the bill expires, and yet ignoring all the money families save while the cuts are in effect.

It hasn't helped that Republicans can't seem to explain the need for the bill.

The most effective conservative politicians can take even small issues and explain them in a broader context. A tax cut isn't merely more money in your pocket; it represents a retreat from government control and influence over your life. Even if taxpayers don't feel they need tax relief, do they believe the federal government will spend that money more wisely?

A federal government headed by Donald Trump, no less?

Christian Schneider is a Journal Sentinel columnist and blogger. Email christian.schneider@jrn.com. Twitter: @Schneider_CM