For stock rally in 2018, earnings need to improve

, ET Bureau|

Updated: Dec 13, 2017, 11.11 AM IST

It is often said that equity markets move in kilter with corporate earnings, and that both remain largely in lockstep over the long term. The ongoing unidirectional rally in Indian stocks appears to have gone against the established tenets of investing, although 2018 is likely to bring the focus back to the hitherto elusive profit recovery.

Rich valuations mean that gains will be limited unless earnings revive. Hence, profit growth in mid-teens is needed for stocks to sustain the momentum.

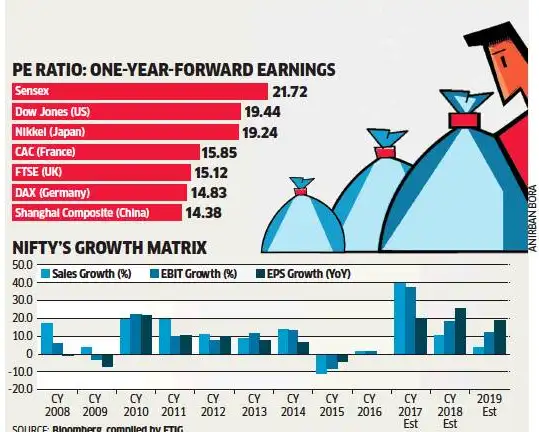

The Nifty now trades at 22 times its FY19 earnings, making India one of the most expensive among the top 20 by market capitalization. Such valuations suggest that the Street is discounting a sharp recovery next year.

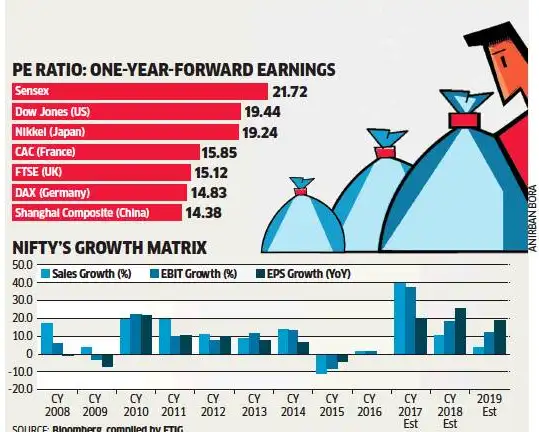

Earnings for the Nifty rose 0.8 per cent a year between 2014 and 2016, according to Bloomberg, while the market rallied 63 per cent in the last three years. The Nifty earnings growth in the first half of the current fiscal has not been very encouraging. But global profit growth is showing signs of improvement, with no downward revision in 2017 for the first time in a decade.

US corporate profits reached 9.5 per cent of the GDP, compared with the long-term average of 6.6 per cent since 1950, and operating margins are now near record highs. The Euro zone is also catching up, as it witnesses earnings upgrades for the first time in 17 years.

Consensus earnings for the Nifty are 25 per cent and 18 per cent , respectively, for 2018 and 2019. In the past five years, projected earnings had been revised downward in the range of 5-9 per cent .

Earnings growth of 25 per cent will be an uphill task, given structural changes in banking, pharmaceutical and telecom industries. For instance, earnings growth in the banking sector, which makes up a fourth of the Nifty, has trended lower on higher loss provisioning and mounting bad assets.

Rich valuations mean that gains will be limited unless earnings revive. Hence, profit growth in mid-teens is needed for stocks to sustain the momentum.

The Nifty now trades at 22 times its FY19 earnings, making India one of the most expensive among the top 20 by market capitalization. Such valuations suggest that the Street is discounting a sharp recovery next year.

Earnings for the Nifty rose 0.8 per cent a year between 2014 and 2016, according to Bloomberg, while the market rallied 63 per cent in the last three years. The Nifty earnings growth in the first half of the current fiscal has not been very encouraging. But global profit growth is showing signs of improvement, with no downward revision in 2017 for the first time in a decade.

US corporate profits reached 9.5 per cent of the GDP, compared with the long-term average of 6.6 per cent since 1950, and operating margins are now near record highs. The Euro zone is also catching up, as it witnesses earnings upgrades for the first time in 17 years.

Consensus earnings for the Nifty are 25 per cent and 18 per cent , respectively, for 2018 and 2019. In the past five years, projected earnings had been revised downward in the range of 5-9 per cent .

Earnings growth of 25 per cent will be an uphill task, given structural changes in banking, pharmaceutical and telecom industries. For instance, earnings growth in the banking sector, which makes up a fourth of the Nifty, has trended lower on higher loss provisioning and mounting bad assets.