How to create new PPF account through SBI website onlinesbi.com

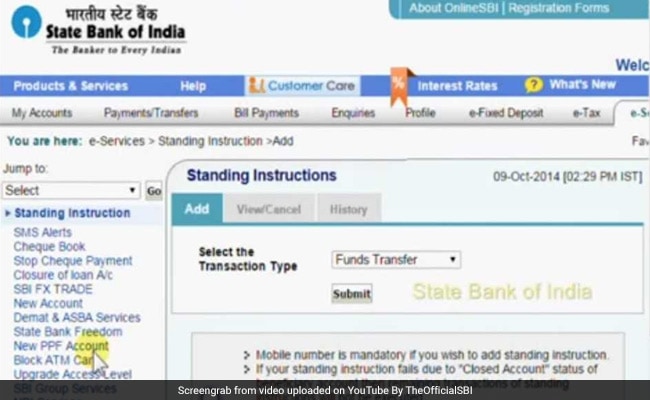

Once you have logged in at SBI's Internet Banking portal onlinesbi.com, find the 'New PPF Account' option under the 'e-services' section and click on it. (Also read: How to link SBI account with Aadhaar card)

(After login, the SBI portal displays the 'New PPF Account' link)

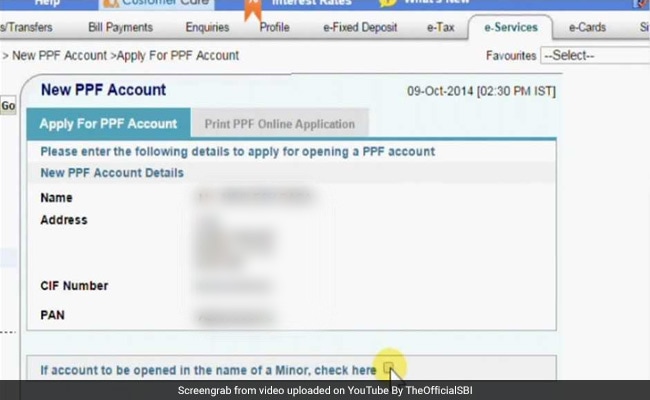

This leads to the 'New PPF Account' page on the SBI portal. Existing customer details including his or her PAN (Permanent Account Number) are displayed on this page.

Using this facility, SBI customers can also open a new PPF account in the name of a minor.

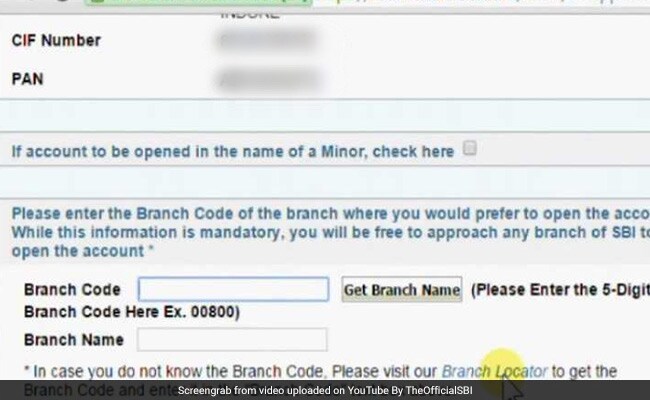

Enter the branch code in the specified field. This is a five-digit code. SBI's onlinesbi.com portal also enables customers to search the branch code of their desired SBI branch through the 'Branch Locator' tool.

Once you enter the branch code and proceed to the next field, the portal automatically displays the respective branch name.

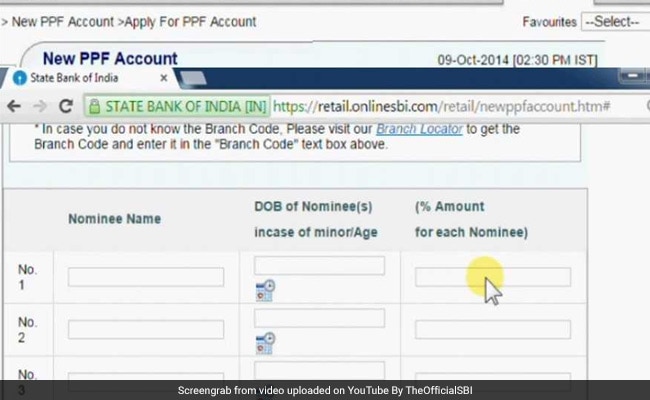

After this step, the customer is required to give names of any nominees to the PPF account.

After filling in the required details, proceed by clicking on 'Submit'.

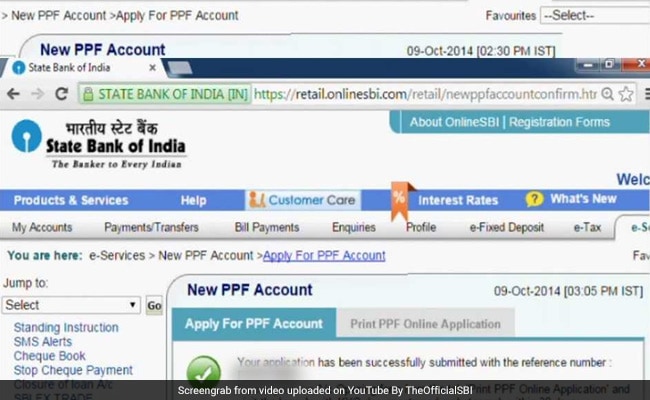

After a successful submission, the SBI portal issues a reference number.

Please print the account opening form from the tab 'Print PPF Online Application' and visit the branch with KYC documents and a photograph within 30 days, SBI adds on its portal.

This form is saved in a user's internet services profile. "Please note that the A/c opening form will be deleted after 30 days from the date of submission," SBI adds.

This form can be accessed in its digital form (in PDF format) from the 'Print PPF Online Application' tab.

The form is partially filled with details provided by the customer on the SBI portal in the earlier steps. The customer can print this application, fill in the PPF amount, affix a photograph and necessary details including signature and submit it at the bank branch along with KYC documents.

The application also includes Form E, meant for mentioning any nominees to the new PPF account.

SBI adds in the video tutorial that the customer is also required to give details of any PPF accounts held previously.

Investments in PPF currently get an interest rate of 7.8 per cent. PPF enjoys EEE or exempt, exempt, exempt status in terms of income tax implications - contribution, interest and maturity proceeds all are tax free. Interest rate on PPF and other small savings scheme are currently being reset every quarter from April last year. Previously, the PPF interest rates were recalibrated annually.