Sundaram Diversified Equity Fund: Not among the best tax saving funds

We examine the key fundamentals of the fund, its portfolio and performance to help you make an informed investment decision.

Sundaram Diversified Equity Fund

How has the fund performed?

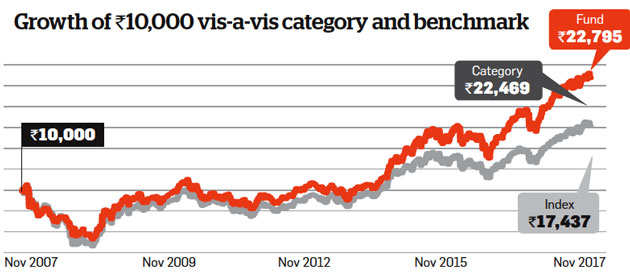

With a 10-year return of 8.59%, the fund mirrors the category average (8.43%), but has outperformed its benchmark index (5.72%). The fund’s long-term performance is similar to the category average.

As on 6 Dec 2017

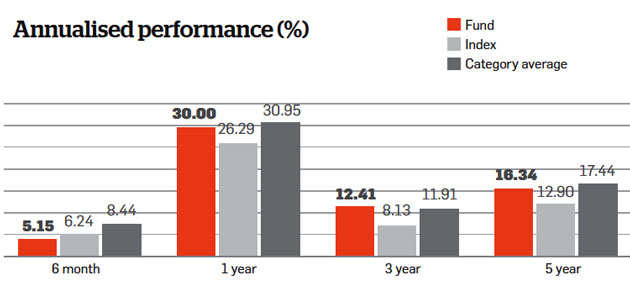

Annualised performance (%)

This fund has underperformed peers over 1- and 5-year periods.

As on 6 Dec 2017

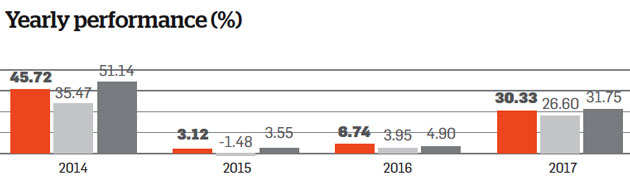

Yearly performance (%)

The fund outperformed peers last year, but has struggled in recent years.

As on 6 Dec 2017

BASIC FACTS

Date of launch : 22 Nov 1999

Category : Equity

Type : Tax Saving

Average AUM : Rs 2,261.20 cr

Benchmark : S&P BSE 200 Index

WHAT IT COSTS

NAVS*

Growth option : Rs 102

Dividend option : Rs 14

Minimum investment : Rs 500

Minimum SIP amount : Rs 250

Expense ratio (%)^ : 2.38

Exit load: 0%

*As on 6 Dec 2017

Fund manager : S. Krishna Kumar

Tenure: 2 years and 7 months

Education: BTech, MBA

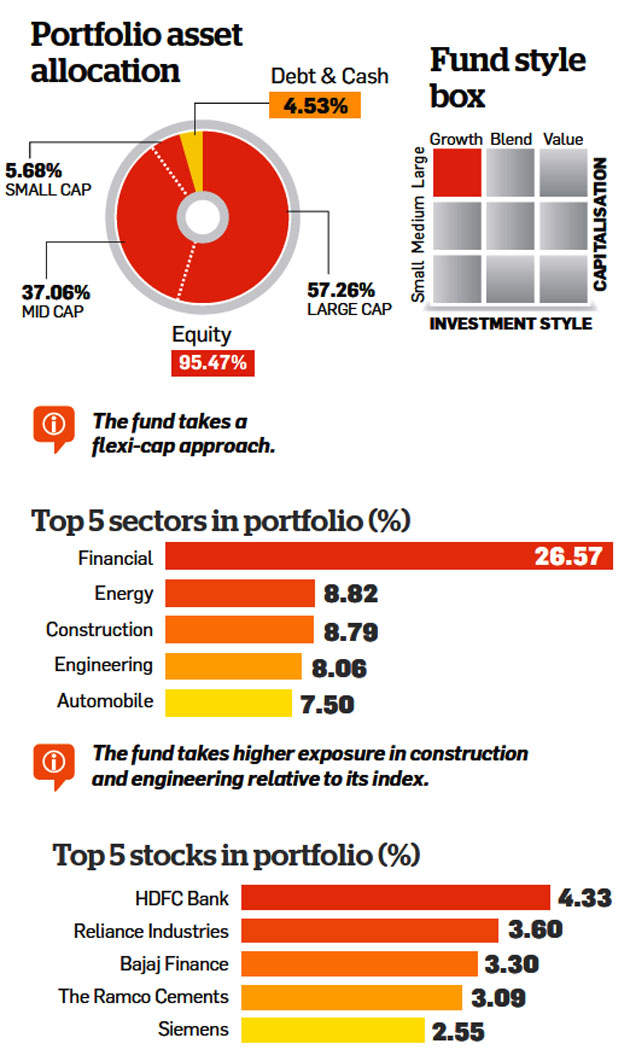

WHERE DOES THE FUND INVEST?

The fund’s portfolio is heavily diversified with modest exposure in top bets.

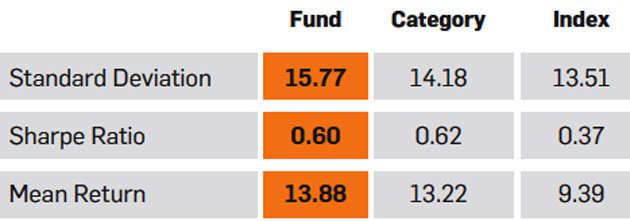

HOW RISKY IS IT?

The fund’s risk-return profile is similar to the category average.

Wherever not specified, data as on 31 Oct 2017. Source: Value Research

SHOULD YOU BUY?

This fund’s long-term track record is not healthy, having underperformed many of its peers through the years. Earlier known as Sundaram Tax Saver, it has morphed into a flexicap offering from being a large-cap fund.

The current fund manager, who took over only a few years ago, has brought about a change in its investment approach. The portfolio construction is benchmark-agnostic, with modest exposure in individual bets, even as the portfolio has grown in size to around 70 stocks.

Currently, the fund has taken a higher exposure in construction and engineering sectors compared to its index. While the fund has improved its risk-return profile to some extent of late, it is yet to show consistency over a longer period of time. For now, investors may continue to monitor its performance for a sustained turnaround.