20 penny stocks that you bought below Rs 10 zoomed up to 750% in 2017

, ETMarkets.com|

Updated: Dec 08, 2017, 05.51 PM IST

Riding the wave of stupendous rally in the broader equity markets, some of the lesser names too have done wonders this calendar year.

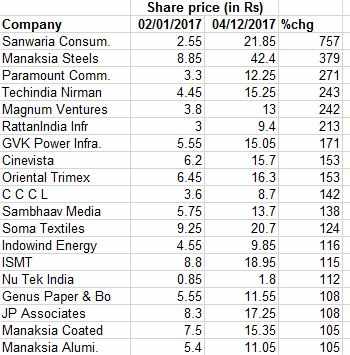

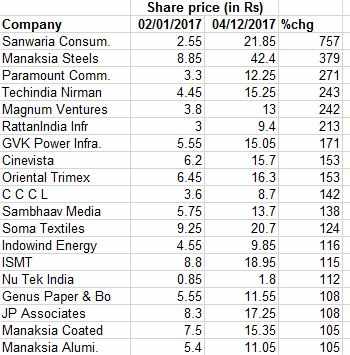

As many as 20 penny companies have surged at least 100 per cent in the ongoing calendar year till December 4, whereas benchmark equity index BSE Sensex is up nearly 24 per cent year-to-date, data available with corporate database Capitaline showed.

Before you read further, here is a disclaimer: Being penny stocks, these businesses need to be studied closely before you decide to invest in them.

With a return of 757 per cent, Sanwaria Consumer emerged as the top gainer on the NSE. The scrip jumped from just Rs 2.55 on January 2, 2017 to Rs 21.85 on December 4, 2017.

Sanwaria Consumer, formerly known as Sanwaria Agro Oils, is a fast-moving consumer goods (FMCG) food processing company. The company is engaged in the manufacturing and selling of rice, edible oil and staple food products, such as pulses, sugar, soya chunks and wheat flour etc.

Manaksia Steels and Paramount Communications climbed 379 per cent and 271 per cent, respectively, on a year-to-date basis till December 4. Shares of Manaksia Steels climbed from Rs 8.85 to Rs 42.40 during the period, while Paramount Communications jumped from Rs 3.30 to Rs 12.25.

According to market experts, risk-averse investors should avoid penny stocks. These types of stocks are highly volatile, as they tend to gain or decline rapidly. This means that while such stocks may give high returns, there is a high risk of losing the entire investment as well.

In addition to this, investors should be extremely careful while investing in speculative operator driven stocks.

Among other top gainers, Techindia Nirman, Magnum Ventures, RattanIndia Infra, GVK Power and Infrastructure, Cinevista and Oriental Trimex gained 243 per cent, 242 per cent, 213 per cent, 171 per cent, 153 per cent and 153 per cent, respectively, on a year-to-date basis.

GVK Power and Infrastructure recently reported a net loss of Rs 76.94 crore for the quarter ended September 30, 2017. The company had posted a net loss of Rs 13.41 crore in the corresponding period a year ago.

CCCL, Sambhaav Media, Soma Textiles, Indowind Energy, ISMT, Nu Tek India, Genus Paper, Jaiprakash Associates, Manaksia Coated and Manaksia Aluminium spurted also between 100-150 per cent since January this year.

Debt-riden Jaiprakash Associates said on November 13 that along with JSW group, it has shown interest in completing real estate projects of group firm Jaypee Infratech as per the insolvency resolution plan. The company also said that the Jaypee Infratech has more assets than liabilities and it is a fit case for resolution.

On the other hand, other penny stocks including FCS Software, Prakash Steelage, Lanco Infratech, Gemini Communication, MPS Infotecnics and Rasoya Protein slipped over 75 per cent during January 2-December 4 this year.

As many as 20 penny companies have surged at least 100 per cent in the ongoing calendar year till December 4, whereas benchmark equity index BSE Sensex is up nearly 24 per cent year-to-date, data available with corporate database Capitaline showed.

Before you read further, here is a disclaimer: Being penny stocks, these businesses need to be studied closely before you decide to invest in them.

With a return of 757 per cent, Sanwaria Consumer emerged as the top gainer on the NSE. The scrip jumped from just Rs 2.55 on January 2, 2017 to Rs 21.85 on December 4, 2017.

Sanwaria Consumer, formerly known as Sanwaria Agro Oils, is a fast-moving consumer goods (FMCG) food processing company. The company is engaged in the manufacturing and selling of rice, edible oil and staple food products, such as pulses, sugar, soya chunks and wheat flour etc.

Manaksia Steels and Paramount Communications climbed 379 per cent and 271 per cent, respectively, on a year-to-date basis till December 4. Shares of Manaksia Steels climbed from Rs 8.85 to Rs 42.40 during the period, while Paramount Communications jumped from Rs 3.30 to Rs 12.25.

According to market experts, risk-averse investors should avoid penny stocks. These types of stocks are highly volatile, as they tend to gain or decline rapidly. This means that while such stocks may give high returns, there is a high risk of losing the entire investment as well.

In addition to this, investors should be extremely careful while investing in speculative operator driven stocks.

Among other top gainers, Techindia Nirman, Magnum Ventures, RattanIndia Infra, GVK Power and Infrastructure, Cinevista and Oriental Trimex gained 243 per cent, 242 per cent, 213 per cent, 171 per cent, 153 per cent and 153 per cent, respectively, on a year-to-date basis.

GVK Power and Infrastructure recently reported a net loss of Rs 76.94 crore for the quarter ended September 30, 2017. The company had posted a net loss of Rs 13.41 crore in the corresponding period a year ago.

CCCL, Sambhaav Media, Soma Textiles, Indowind Energy, ISMT, Nu Tek India, Genus Paper, Jaiprakash Associates, Manaksia Coated and Manaksia Aluminium spurted also between 100-150 per cent since January this year.

Debt-riden Jaiprakash Associates said on November 13 that along with JSW group, it has shown interest in completing real estate projects of group firm Jaypee Infratech as per the insolvency resolution plan. The company also said that the Jaypee Infratech has more assets than liabilities and it is a fit case for resolution.

On the other hand, other penny stocks including FCS Software, Prakash Steelage, Lanco Infratech, Gemini Communication, MPS Infotecnics and Rasoya Protein slipped over 75 per cent during January 2-December 4 this year.