View: The price of bitcoin isn't always what you think it is

Bloomberg|

Updated: Dec 08, 2017, 08.35 PM IST

By Stephen Gandel

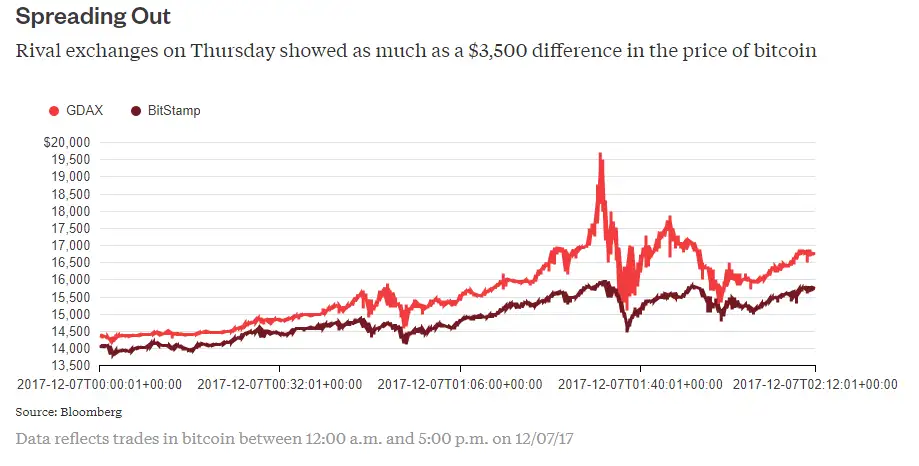

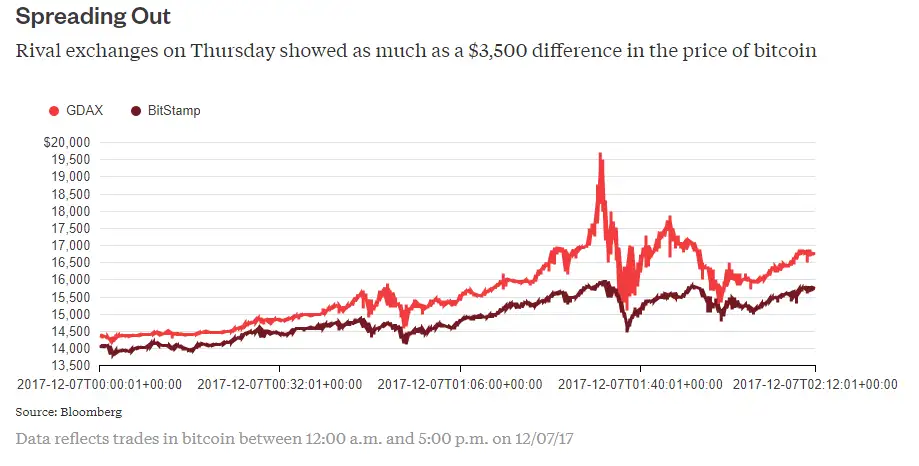

Bitcoin traded above $19,000 on Thursday, but you may have missed it. As it was reaching $19,500 just after 11 a.m. on the GDAX exchange, which is run by the popular bitcoin brokerage firm Coinbase, bitcoin was still stuck in the high $15,000's on other trading platforms. Similarly, most U.S. traders woke up on Thursday to news that bitcoin was above $15,000, unless they were following it on Bitfinex, where it didn't cross $15,000 until soon before 10 a.m.

This is nothing new. Bitcoin trades on dozens of exchanges, and the prices get out of whack at times. But as the price of bitcoin rises more rapidly into the tens of thousands, the gap seems to be getting worse. It was particularly bad on Thursday, when for several hours in the morning the difference between the price of bitcoin on the exchanges remained thousands of dollars, more than the total price of bitcoin just a few months ago.

This may not seem to matter much. Those buying into the GDAX exchange, where prices are higher, had to pay more to get in, so they should get more when they sell, in theory. What's more, technical problems seems to have contributed to the price divergence on Thursday morning. Congestion and execution problems forced one exchange, Gemini, to suspend redemptions for a few hours, making it harder for arbitragers to move between exchanges. And remember, no one is losing money on bitcoin. It's still way up, 1,600 percent or so for the year on even the lowest-priced exchange. But the price-gap problem may be less benign than it looks, and it could soon become more troublesome.

Increase in Bitcoin Price This Year 1,600%

On Sunday, Cboe Global Markets Inc. will begin trading a bitcoin futures contract. CME Group Inc. will start trading one a week later. For essentially the first time, professional and individual investors who want to buy into the bitcoin craze will be able to do so without having to actually buy the digital currency, and they will do it on exchanges that have been around, and regulated, for more than a few years. (Most bitcoin exchanges have never been regulated and essentially still aren't.) This could bring a lot of people into the bitcoin universe with unforeseen consequences.

Jeffery Sprecher, the CEO of Intercontinental Exchange Inc., the owner of the New York Stock Exchange, said earlier this week that the Big Board wasn't going to offer bitcoin futures contracts anytime soon in part because the existing bitcoin markets are not all that transparent or structurally sound. (Some have suggested that Sprecher's comments were sour grapes and that the NYSE may just be behind in getting its bitcoin business off the ground. What's more, Sprecher's company owns a minority interest in Coinbase, adding more doubt to whether he is truly skeptical of the exchanges.)

The price gap creates some structural problems for the futures market. Consider hedging. The Cboe and the CME contracts will reference prices on different exchanges. So if investors are trying to hedge a bitcoin purchase, they will have to make sure they buy bitcoins on an exchange that matches up most closely with a particular contract.

But the bigger problem is that the price gap gives some credence to Sprecher's argument. Large price spreads indicate liquidity problems and a lack of active professional dealers or traders who would normally arbitrage these differences away rapidly. Less liquidity suggests prices will drop more quickly when they inevitability do, though not everyone agrees. Paul Puey, the CEO of Airbitz, a bitcoin wallet company, told me on Thursday that bitcoin's fractured market was a feature, not a bug. If a large trade were to start a tumble in one exchange, the prices would be safe elsewhere, the thinking goes, though I'm not sure I believe that the bitcoin whales wouldn't rush in to sell on a sustained plunge.

I generally have been a fan of the CME getting into the bitcoin futures business. My sense is that investors who want in on the bitcoin action are going to be less likely to lose their money, either by way of hack or unscrupulous dealers, on established exchanges. And more liquidity by way of the futures market should make bitcoin prices less volatile. But it could go the other way, too. A drop in the price could send futures traders heading for the exits, stoking more fears in the traditional bitcoin exchanges. That could create negative feedback loops, like the ones in mortgage markets during the financial crisis. What's more, if there is some pent-up demand to short bitcoin, a rush of traders could cause futures to plunge when they start trading, pushing down the price of bitcoins.

I buy the argument that an established market will add stability to bitcoin, but it's also possible that bitcoin's inclusion will add instability to established markets. That's what the the Futures Industry Association, which represents brokers, argued in a letter to the CFTC on Thursday. The introduction of futures will certainly stress an already fragile cryptocurrency market. The transition promises to be a rocky one.

(This column does not necessarily reflect the opinion of Bloomberg LP and its owners)

Bitcoin traded above $19,000 on Thursday, but you may have missed it. As it was reaching $19,500 just after 11 a.m. on the GDAX exchange, which is run by the popular bitcoin brokerage firm Coinbase, bitcoin was still stuck in the high $15,000's on other trading platforms. Similarly, most U.S. traders woke up on Thursday to news that bitcoin was above $15,000, unless they were following it on Bitfinex, where it didn't cross $15,000 until soon before 10 a.m.

This is nothing new. Bitcoin trades on dozens of exchanges, and the prices get out of whack at times. But as the price of bitcoin rises more rapidly into the tens of thousands, the gap seems to be getting worse. It was particularly bad on Thursday, when for several hours in the morning the difference between the price of bitcoin on the exchanges remained thousands of dollars, more than the total price of bitcoin just a few months ago.

This may not seem to matter much. Those buying into the GDAX exchange, where prices are higher, had to pay more to get in, so they should get more when they sell, in theory. What's more, technical problems seems to have contributed to the price divergence on Thursday morning. Congestion and execution problems forced one exchange, Gemini, to suspend redemptions for a few hours, making it harder for arbitragers to move between exchanges. And remember, no one is losing money on bitcoin. It's still way up, 1,600 percent or so for the year on even the lowest-priced exchange. But the price-gap problem may be less benign than it looks, and it could soon become more troublesome.

Increase in Bitcoin Price This Year 1,600%

On Sunday, Cboe Global Markets Inc. will begin trading a bitcoin futures contract. CME Group Inc. will start trading one a week later. For essentially the first time, professional and individual investors who want to buy into the bitcoin craze will be able to do so without having to actually buy the digital currency, and they will do it on exchanges that have been around, and regulated, for more than a few years. (Most bitcoin exchanges have never been regulated and essentially still aren't.) This could bring a lot of people into the bitcoin universe with unforeseen consequences.

Jeffery Sprecher, the CEO of Intercontinental Exchange Inc., the owner of the New York Stock Exchange, said earlier this week that the Big Board wasn't going to offer bitcoin futures contracts anytime soon in part because the existing bitcoin markets are not all that transparent or structurally sound. (Some have suggested that Sprecher's comments were sour grapes and that the NYSE may just be behind in getting its bitcoin business off the ground. What's more, Sprecher's company owns a minority interest in Coinbase, adding more doubt to whether he is truly skeptical of the exchanges.)

The price gap creates some structural problems for the futures market. Consider hedging. The Cboe and the CME contracts will reference prices on different exchanges. So if investors are trying to hedge a bitcoin purchase, they will have to make sure they buy bitcoins on an exchange that matches up most closely with a particular contract.

But the bigger problem is that the price gap gives some credence to Sprecher's argument. Large price spreads indicate liquidity problems and a lack of active professional dealers or traders who would normally arbitrage these differences away rapidly. Less liquidity suggests prices will drop more quickly when they inevitability do, though not everyone agrees. Paul Puey, the CEO of Airbitz, a bitcoin wallet company, told me on Thursday that bitcoin's fractured market was a feature, not a bug. If a large trade were to start a tumble in one exchange, the prices would be safe elsewhere, the thinking goes, though I'm not sure I believe that the bitcoin whales wouldn't rush in to sell on a sustained plunge.

I generally have been a fan of the CME getting into the bitcoin futures business. My sense is that investors who want in on the bitcoin action are going to be less likely to lose their money, either by way of hack or unscrupulous dealers, on established exchanges. And more liquidity by way of the futures market should make bitcoin prices less volatile. But it could go the other way, too. A drop in the price could send futures traders heading for the exits, stoking more fears in the traditional bitcoin exchanges. That could create negative feedback loops, like the ones in mortgage markets during the financial crisis. What's more, if there is some pent-up demand to short bitcoin, a rush of traders could cause futures to plunge when they start trading, pushing down the price of bitcoins.

I buy the argument that an established market will add stability to bitcoin, but it's also possible that bitcoin's inclusion will add instability to established markets. That's what the the Futures Industry Association, which represents brokers, argued in a letter to the CFTC on Thursday. The introduction of futures will certainly stress an already fragile cryptocurrency market. The transition promises to be a rocky one.

(This column does not necessarily reflect the opinion of Bloomberg LP and its owners)