RBI rejigs MDR: Here's how much you will save on debit card transactions from 1.1.2018

, ET Online|

Updated: Dec 07, 2017, 02.19 PM IST

Come January 1, 2018, debit card transactions are going to pinch a little less. To give a fillip to digital payments, the Reserve Bank of India (RBI) announced on Wednesday that it will rationalise the framework for merchant discount rate (MDR) applicable on debit card transactions.

MDR is the rate charged to a merchant by a bank for providing debit and credit card services. In many cases, the charge is passed on to the customer by the merchant, saying that it eats into his margin. Currently, the MDR is applicable based on the transaction value, but from January, the new rates will be categorised in the following manner:

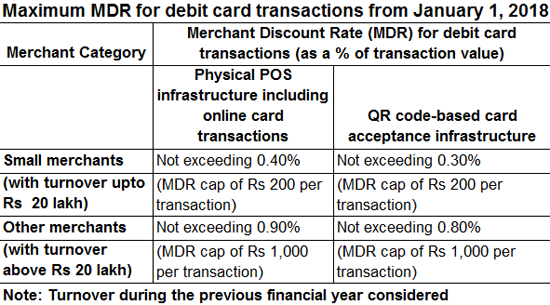

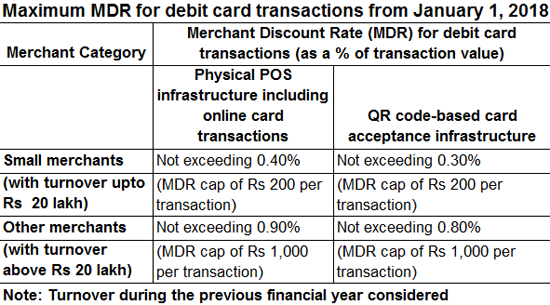

Categorisation of merchants on the basis of turnover - Small merchants have to levy less than bigger ones.

Adoption of a differentiated MDR for QR-code based transactions - Such transactions, even with a smaller merchant, will cost you less.

Specifying a ceiling on the maximum permissible MDR for both 'card present' and 'card not present' transactions - The maximum that a merchant can charge will be capped.

According to RBI, the revised MDR aims at achieving the twin objectives of increased usage of debit cards and ensuring sustainability of the business for the entities involved.

Existing MDR structure

Currently, this how much merchants can charge as mandated by RBI:

•For transaction value up to Rs 2,000, MDR cannot exceed 0.75 percent of the amount.

•For transaction value above Rs 2,000 MDR cannot exceed 1 percent of the amount.

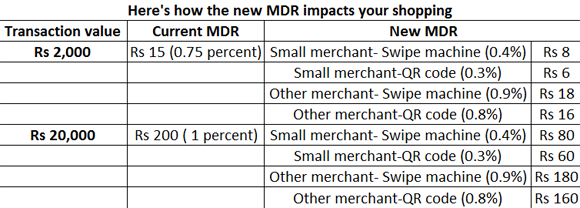

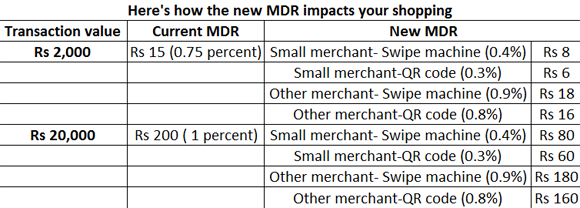

How will this impact you

From January 1, this is how your debit card payments will be effected:

Adherence to the rules

Banks and authorised card payment networks will have to strictly adhere to these directions. There are times when customers are asked to pay extra under the pretext that the swipe machine was installed by another bank. RBI has said that banks will have to ensure that the MDR levied on the merchant shall not exceed the cap rates irrespective of the entity deploying the card acceptance infrastructure at the merchant location. Banks are also advised to ensure that merchants on-boarded by them do not pass on MDR charges to customers while accepting payments through debit cards.

A push to digital payments

Since 2012, MDR structure for debit card transactions was fixed by RBI wherein banks were advised to cap the MDR for debit card transactions.

After demonetisation, in order to facilitate wider acceptance of card payments ( excluding ATM transactions), the following special measures for debit card transactions (including for payments made to the government), were introduced for a temporary period between January 1, 2017 and March 31, 2017:

•For transactions up to Rs 1,000, MDR was capped at 0.25 percent of the transaction value.

•For transactions above Rs 1,000 and up to Rs 2,000, MDR was capped at 0.5 percent of the transaction value.

MDR is the rate charged to a merchant by a bank for providing debit and credit card services. In many cases, the charge is passed on to the customer by the merchant, saying that it eats into his margin. Currently, the MDR is applicable based on the transaction value, but from January, the new rates will be categorised in the following manner:

Categorisation of merchants on the basis of turnover - Small merchants have to levy less than bigger ones.

Adoption of a differentiated MDR for QR-code based transactions - Such transactions, even with a smaller merchant, will cost you less.

Specifying a ceiling on the maximum permissible MDR for both 'card present' and 'card not present' transactions - The maximum that a merchant can charge will be capped.

According to RBI, the revised MDR aims at achieving the twin objectives of increased usage of debit cards and ensuring sustainability of the business for the entities involved.

Existing MDR structure

Currently, this how much merchants can charge as mandated by RBI:

•For transaction value up to Rs 2,000, MDR cannot exceed 0.75 percent of the amount.

•For transaction value above Rs 2,000 MDR cannot exceed 1 percent of the amount.

How will this impact you

From January 1, this is how your debit card payments will be effected:

Adherence to the rules

Banks and authorised card payment networks will have to strictly adhere to these directions. There are times when customers are asked to pay extra under the pretext that the swipe machine was installed by another bank. RBI has said that banks will have to ensure that the MDR levied on the merchant shall not exceed the cap rates irrespective of the entity deploying the card acceptance infrastructure at the merchant location. Banks are also advised to ensure that merchants on-boarded by them do not pass on MDR charges to customers while accepting payments through debit cards.

A push to digital payments

Since 2012, MDR structure for debit card transactions was fixed by RBI wherein banks were advised to cap the MDR for debit card transactions.

After demonetisation, in order to facilitate wider acceptance of card payments ( excluding ATM transactions), the following special measures for debit card transactions (including for payments made to the government), were introduced for a temporary period between January 1, 2017 and March 31, 2017:

•For transactions up to Rs 1,000, MDR was capped at 0.25 percent of the transaction value.

•For transactions above Rs 1,000 and up to Rs 2,000, MDR was capped at 0.5 percent of the transaction value.