SBI branch type vs required MAB

SBI determines the required minimum average balance amount for its customers on the basis of four types of branches. These are metro, urban, semi-urban and rural. Effective October 1, 2017, SBI customers holding savings bank accounts in metro and urban branches are required to maintain a monthly average balance of Rs 3,000, according to the SBI website. (Also read: How to link SBI account with Aadhaar)

Customers in semi-urban SBI branches are required to maintain a monthly average of Rs 2,000. This is unchanged from the last revision.

Those holding SBI savings bank account in rural branches are required to keep a minimum monthly balance of Rs 1,000. This amount is also kept unchanged from previously applicable rates.

SBI penalty charges for non-maintenance of MAB in metro, urban branches

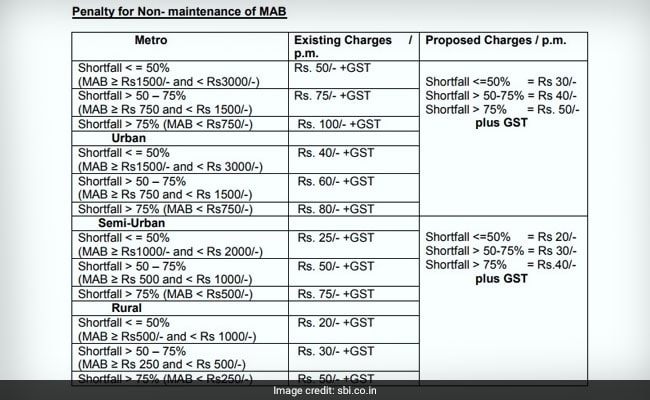

SBI customers holding a savings bank account with a metro or urban branch - who are required to maintain a monthly average balance of Rs 3,000 - are charged a penalty of Rs 30-50 plus GST for non-compliance with its MAB rules.

According to the bank's website, those with a shortfall of up to 50 per cent (monthly average balance of Rs 1,500-3,000) will be charged a penalty of Rs 30 plus GST. In the SBI metro and urban branches, savings bank accounts with a shortfall between 50 per cent and 75 per cent will attract a charge of Rs 40 plus GST, according to the SBI website. Those with a shortfall of more than 75 per cent will attract a charge of Rs 50 plus GST, it noted.

SBI penalty charges for non-maintenance of MAB in rural, semi urban branches

Holders of SBI savings bank accounts at semi-urban and rural branches are required to maintain a monthly average balance of Rs 2,000 and Rs 1,000 respectively. In these categories, SBI will charge a penalty of Rs 20 plus GST for a shortfall of up to 50 per cent as per monthly average balance rules, according to its website. Accounts with a 50-75 per cent shortfall of minimum average balance will attract a penalty of Rs 30 while those with that of more than 75 per cent will be charged Rs 40 plus GST, the SBI website noted.