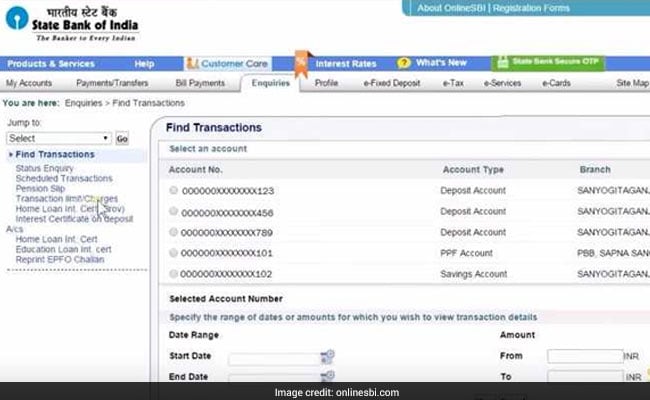

How to access the details, conditions, limits, and charges on online transactions of SBI:

Log into your online SBI account and click on 'Enquiries' tab.

Towards the left, when you click on 'Transaction limits/charges', you will be directed to the same page, whereby you will be able to see different charges for different transaction types.

On the screen, you will be able to see description of transactions, minimum and maximum transaction amounts, overall transaction limit allowed in a day (on the basis of each category) and SBI's charges for each transaction. For example, if you want to transfer a fund from one of your SBI accounts to another one in the same branch, the minimum amount required is Re 1 and the maximum amount limit is Rs 2,00,00,000.

Given below is the entire list of SBI transaction limits and charges:

| Category | Description | Minimum Transaction | Maximum Transaction | Overall limit in a day for the category | Bank’s Charges |

| Amount | Amount | ₹ | |||

| ₹ | ₹ | ||||

| I | Fund Transfer ( within own account (same customer number) in same branch | 1 | 1,00,00,000/- | 1,00,00,000/- | NIL |

| Creation of e-TDR/e-STDR | 1,000 | 99,99,999/- | NIL | ||

| Creation of e - RD (Monthly instalment) | 100 | 99,99,999/- | NIL | ||

| II | Fund Transfer within own account (Same customer number) in different branch | 1 | 1,00,00,000/- | 1,00,00,000/- | NIL |

| III | Fund Transfer within SBI (Other than own accounts) | 1 | 10,00,000/- | 10,00,000/- | NIL |

| Virtual Card | 100 | 50,000/- | NIL | ||

| Transfer through Credit Card (VISA) Bill pay | 1 | 25,000/- Per Transaction (Per day Max. 50,000/- ) | ₹15 per Transaction | ||

| IRCTC Transactions | 1 | 5,00,000 | ₹10 + Goods and Service tax as applicable (wef. 01-04-2014) | ||

| TANGEDCO Transactions | 1 | 5,00,000 | ₹10 per Transaction | ||

| Merchant Transaction | 1 | 5,00,000 | NIL | ||

| Inter Bank Transfer (NEFT) | 1 | 10,000 | ₹1 per Transaction + Goods and Service Tax | ||

| 10,001 | 1,00,000 | ₹2 per Transaction + Goods and Service Tax | |||

| Above 1,00,000 | 2,00,000 | ₹3 per Transaction + Goods and Service Tax | |||

| Above 2,00,000 | 10,00,000/- | ₹5 per Transaction + Goods and Service Tax | |||

| Inter Bank Transfer (RTGS) | 2,00,000/- | 5,00,000 | 08.00 Hours to 16.30 Hours | ||

| ₹5 per Transaction + Goods and Service Tax | |||||

| Above 5,00,000 | 10,00,000/- | 08.00 Hours to 16.30 Hours | |||

| ₹10 per Transaction + Goods and Service Tax | |||||

| Immediate Payment Service (IMPS) | 1 | 1,000 | No Transaction Charges | ||

| 1,001 | 10,000 | ₹1 per Transaction + Goods and Service Tax | |||

| 10,001 | 1,00,000 | ₹2 per Transaction + Goods and Service Tax | |||

| 1,00,001 | 2,00,000 | ₹3 per Transaction + Goods and Service Tax | |||

| IRCTC Fee(on SBI Payment gateway) | 1 | 5,00,000 | ₹10 + Goods and Service Tax | ||

| International Fund Transfer (FOR) | Equiv. of USD 5,000 per transaction, Maximum 4 transactions per month i.e. maximum USD 2,40,000 per calendar year | USD 10 equiv Fixed (@ TT Selling Card Rate for the day) | |||

| IV | Bill Payment | 1 | 5,00,000/- | 5,00,000/- | NIL |

| Demand Draft | 1 | 5,000 | ₹25 per transaction + Goods and Service Tax | ||

| 5,001 | 10,000 | ₹50 per Transaction + Goods and Service Tax | |||

| 10,001 | 1,00,000 | charges ₹5 per thousand or part thereof, Min ₹60 including Goods Service tax | |||

| 1,00,000 | 5,00,000/- | Charges ₹4 (Including Goods Service Tax) per thousand or part thereof, Min ₹ 600(Including Goods Service Tax) * Max ₹2000(Including Goods Service Tax) | |||

| - | - | The courier charges for delivery of demand draft by courier – ₹50 + Goods and Service Tax. | |||

| Donation | 1 | 5,00,000/- | NIL | ||

| Contribution to New Pension System | For Tier-1 : 500 For Tier-2 : 250 | 10,00,000/- | As prescribed by Pension Fund Regulatory and Development Authority (PFRDA) | ||

| V | Transfer to PPF (max 12 transactions per annum) | 500 | 1,50,000/- | NIL | |

| VI | State Bank Collect(i-Collect)(wherever applicable) | 1 | 1,00,000 | 10,00,000/- | ₹10 per Transaction + Goods and Service Tax |

| Above 1,00,000 | 5,00,000 | ₹20 per Transaction + Goods and Service Tax | |||

| Above 5,00,000 | 10,00,000 | ₹40 per Transaction + Goods and Service Tax | |||

| VII | OLTAS (Income Tax etc.) , CBEC and ICEGATE | 1 | 2 Crore | 2 Crore | NIL |

| VIII | All payments to Govt. And semi-govt. Institutions including taxes, statutory dues. | 1 | 2 Crore | 2 Crore | NIL |

| IX | Portfolio Investment Scheme (PIS) for NRIs | 1 | 1 Crore | 1 Crore | NIL |

| X | IPO for Retail investors | 1 | 2,00,000 | 1 Crore | NIL |

| IPO (HNI) | Above 2,00,000 | 1 Crore | NIL | ||

| XI | DMAT (Lien marking) | 1 | 1 Crore | 1 Crore | NIL |

| XII | Stop payment of cheques SB account and CA/CC | No limit | No limit | NA | ₹ 100 + GST per instrument maximum ₹500 + GST per instance |

| XIII | Gift Card | ₹500 and thereafter multiple of ₹1 | Card Balance at any point of time should not exceed ₹50000 | NA | Issuance charge is ₹100 +GST. Waived up to 31.03.2018 . However image based gift cards are chargeable. |