Startups test a brand new crypto-currency: ICO

, ET Bureau|

Dec 06, 2017, 06.49 AM IST

BENGALURU: If crypto-currencies are the future of the digital economy, then initial coin offerings, or ICOs, could be the future of fundraising.

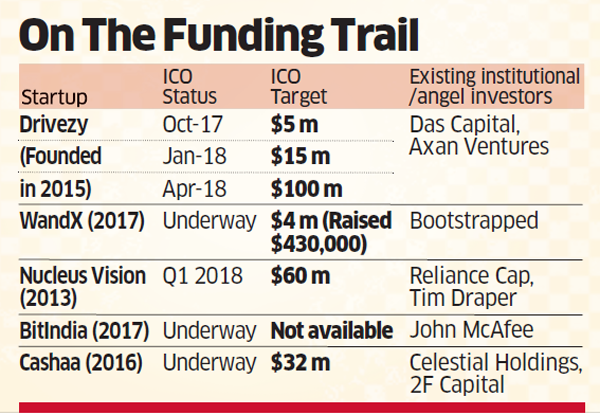

At least a half dozen Indian startups are skipping venture capital dollars to raise funds through ICOs despite the regulatory ambiguity, as investors take longer to scrutinise balance sheets and conduct due diligence before parting with their money.

Bengaluru-based blockchain startup WandX launched its ICO on October 27 and had already raised $430,000 as on December 4. Its target: $4 million. “This is an easier way to raise money. We raised about $400,000 in a month, which would’ve taken at least six months through a VC,” said Abhinav Ramesh, CEO of WandX, which allows users to create and trade in financial products on crypto-assets through its platform. “Moreover, we don’t give away any equity and people who participate are primarily cryptocurrency enthusiasts.”

In October, peer-to-peer bike- and car-sharing platform Drivezy raised a targeted $5 million via an ICO launched in Japan with support from its investor AnyPay, a Japanese financial-technology company. “We got pre-subscribed in 50 seconds after the launch,” said Ashwarya Singh, cofounder of Drivezy, also Bengaluru-headquartered.

The Y Combinator-backed startup has plans to raise $15 million via a second ICO in January, and another $100 million through a third in April.

Founders Issue Digital Tokens

An ICO, simply put, is a new way of crowd-funding a startup. The founders raise money by issuing digital tokens in exchange for crypto-currency without the transfer of any equity. Investors can use the tokens to avail the company’s future services.

For instance, the token offered by Drivezy, Rental Coins 1.0, offers shared ownership of the fleet of cars that the startup will buy in the event of a successful ICO. Investors who buy the Rental Coins can either use the digital tokens for renting a car or receive payouts each time a car is rented out by others. The tokens can also be traded. Essentially, Rental Coin is proof of ownership of a shared asset — cars —making investors in the ICO eligible for a portion of the money the company earns by renting vehicles. Currently, Drivezy has around 1,600 vehicles — 1,100 cars and 500 two-wheelers —on its platform. “We intend to grow by three times through the two ICOs that we have planned in addition to the VC funding that we have raised,” Singh said.

Globally, there have been 234 ICOs this year raising more than $3.6 billion, according to ICO listing website Coinschedule. Though the first ICO, by MasterCoin (now Omni), was in 2013, this investment vehicle has seen an uptick this year.

That said, there exists a dark underbelly to the red-hot market for ICOs. Instances of fraud have flourished in several markets, making it hard to frame a compelling case for ‘the future of fundraising.’ Unlike with initial public offerings of shares by companies, ICOs are not formally regulated by any financial authority. Except for the similarity that both vehicles are means of raising public money, ICOs are almost the antithesis of IPOs. While the latter has strict regulatory compliances to be followed, ICOs are fialmost like the Wild West — lawless and unsupervised.

CHINA, SOUTH KOREA IMPOSED BAN This has prompted a crackdown in some countries. China and South Korea have banned raising public money through ICOs. The US Securities and Exchange Commission has declared digital coins to be securities and thus subject to regulation; so far, it has charged two companies with ICO fraud. Japan requires companies to obtain regulatory approvals for ICOs.

In contrast, the traditional offshore tax havens of Switzerland, the Cayman Islands and the Mauritius have been more welcoming of ICOs. In India, crypto-currency investment is not regulated by the markets regulator or any other agency. The Securities and Exchange Board of India and the Reserve Bank of India did not respond to queries on the legality of ICOs and cryptocurrencies in the country.

RBI, though, has repeatedly issues warnings against any investment in crypto-currencies, stating that digital currencies pose financial and legal risks. “In the wake of significant spurt in the valuation of many Virtual Currencies (VCs) and rapid growth in Initial Coin Offerings (ICOs), RBI reiterates the concerns conveyed in the earlier press releases,” said RBI in a press release dated December 5. “RBI has also clarified that it has not given any licence/authorisation to any entity/company to operate such schemes or deal with Bitcoin or any VC.”

The lack of a central issuer is why crypto-currencies cannot be regulated under existing financial laws in India. But ICOs are about raising money by issuing tokens, comparable to shares issued by a company. “Unlike crypto-currencies, which are purely speculative, an ICO is a financial innovation that should be regulated,” said a former RBI official. “Startups can and should be held responsible in case of irregularities in ICOs.”

Still, investors are cautiously bullish and believe that ICOs will persist as a form of fundraising despite the grey zones. “Blockchain (the underlying technology behind crypto-currencies) is here to stay and ICO as a form of fundraising is here to stay,” said Accel’s Reddy. “However, it would take 3-5 years for some of the blockchain ideas to take fruition because the ecosystem is not ready.”

At least a half dozen Indian startups are skipping venture capital dollars to raise funds through ICOs despite the regulatory ambiguity, as investors take longer to scrutinise balance sheets and conduct due diligence before parting with their money.

Bengaluru-based blockchain startup WandX launched its ICO on October 27 and had already raised $430,000 as on December 4. Its target: $4 million. “This is an easier way to raise money. We raised about $400,000 in a month, which would’ve taken at least six months through a VC,” said Abhinav Ramesh, CEO of WandX, which allows users to create and trade in financial products on crypto-assets through its platform. “Moreover, we don’t give away any equity and people who participate are primarily cryptocurrency enthusiasts.”

|

In October, peer-to-peer bike- and car-sharing platform Drivezy raised a targeted $5 million via an ICO launched in Japan with support from its investor AnyPay, a Japanese financial-technology company. “We got pre-subscribed in 50 seconds after the launch,” said Ashwarya Singh, cofounder of Drivezy, also Bengaluru-headquartered.

The Y Combinator-backed startup has plans to raise $15 million via a second ICO in January, and another $100 million through a third in April.

Founders Issue Digital Tokens

An ICO, simply put, is a new way of crowd-funding a startup. The founders raise money by issuing digital tokens in exchange for crypto-currency without the transfer of any equity. Investors can use the tokens to avail the company’s future services.

For instance, the token offered by Drivezy, Rental Coins 1.0, offers shared ownership of the fleet of cars that the startup will buy in the event of a successful ICO. Investors who buy the Rental Coins can either use the digital tokens for renting a car or receive payouts each time a car is rented out by others. The tokens can also be traded. Essentially, Rental Coin is proof of ownership of a shared asset — cars —making investors in the ICO eligible for a portion of the money the company earns by renting vehicles. Currently, Drivezy has around 1,600 vehicles — 1,100 cars and 500 two-wheelers —on its platform. “We intend to grow by three times through the two ICOs that we have planned in addition to the VC funding that we have raised,” Singh said.

Globally, there have been 234 ICOs this year raising more than $3.6 billion, according to ICO listing website Coinschedule. Though the first ICO, by MasterCoin (now Omni), was in 2013, this investment vehicle has seen an uptick this year.

That said, there exists a dark underbelly to the red-hot market for ICOs. Instances of fraud have flourished in several markets, making it hard to frame a compelling case for ‘the future of fundraising.’ Unlike with initial public offerings of shares by companies, ICOs are not formally regulated by any financial authority. Except for the similarity that both vehicles are means of raising public money, ICOs are almost the antithesis of IPOs. While the latter has strict regulatory compliances to be followed, ICOs are fialmost like the Wild West — lawless and unsupervised.

CHINA, SOUTH KOREA IMPOSED BAN This has prompted a crackdown in some countries. China and South Korea have banned raising public money through ICOs. The US Securities and Exchange Commission has declared digital coins to be securities and thus subject to regulation; so far, it has charged two companies with ICO fraud. Japan requires companies to obtain regulatory approvals for ICOs.

In contrast, the traditional offshore tax havens of Switzerland, the Cayman Islands and the Mauritius have been more welcoming of ICOs. In India, crypto-currency investment is not regulated by the markets regulator or any other agency. The Securities and Exchange Board of India and the Reserve Bank of India did not respond to queries on the legality of ICOs and cryptocurrencies in the country.

RBI, though, has repeatedly issues warnings against any investment in crypto-currencies, stating that digital currencies pose financial and legal risks. “In the wake of significant spurt in the valuation of many Virtual Currencies (VCs) and rapid growth in Initial Coin Offerings (ICOs), RBI reiterates the concerns conveyed in the earlier press releases,” said RBI in a press release dated December 5. “RBI has also clarified that it has not given any licence/authorisation to any entity/company to operate such schemes or deal with Bitcoin or any VC.”

The lack of a central issuer is why crypto-currencies cannot be regulated under existing financial laws in India. But ICOs are about raising money by issuing tokens, comparable to shares issued by a company. “Unlike crypto-currencies, which are purely speculative, an ICO is a financial innovation that should be regulated,” said a former RBI official. “Startups can and should be held responsible in case of irregularities in ICOs.”

Still, investors are cautiously bullish and believe that ICOs will persist as a form of fundraising despite the grey zones. “Blockchain (the underlying technology behind crypto-currencies) is here to stay and ICO as a form of fundraising is here to stay,” said Accel’s Reddy. “However, it would take 3-5 years for some of the blockchain ideas to take fruition because the ecosystem is not ready.”