Family Finance: Salaried Kumar needs to hike equity investment to achieve his goals

, ET Bureau|

Updated: Dec 04, 2017, 08.44 AM IST

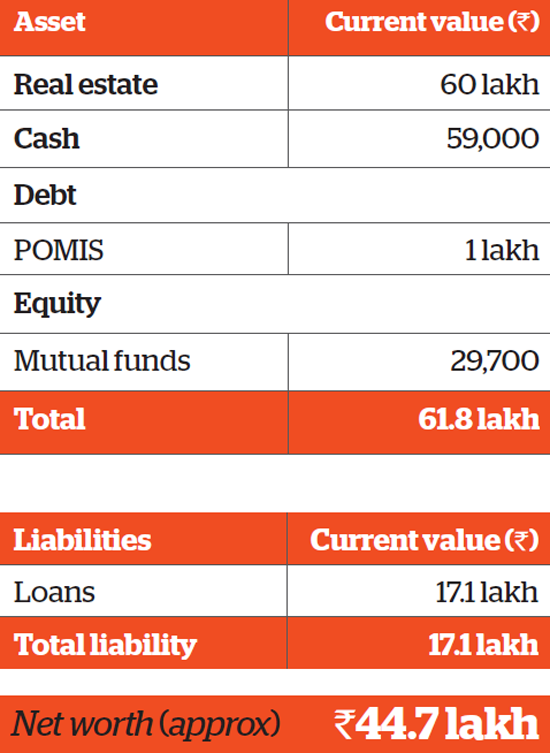

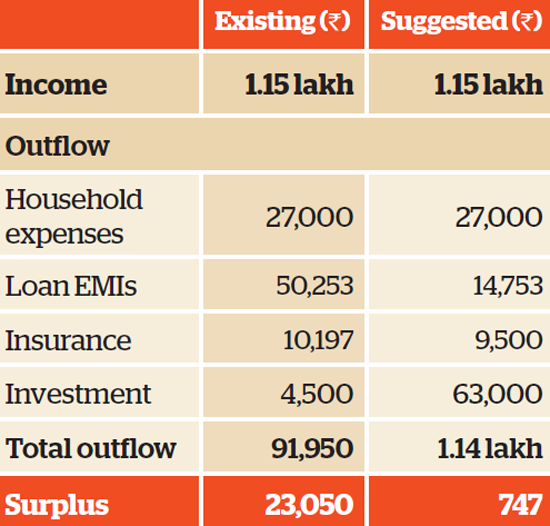

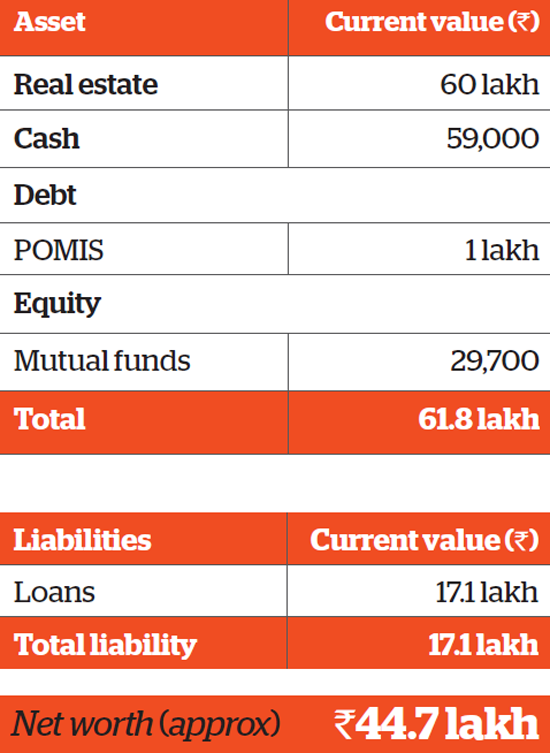

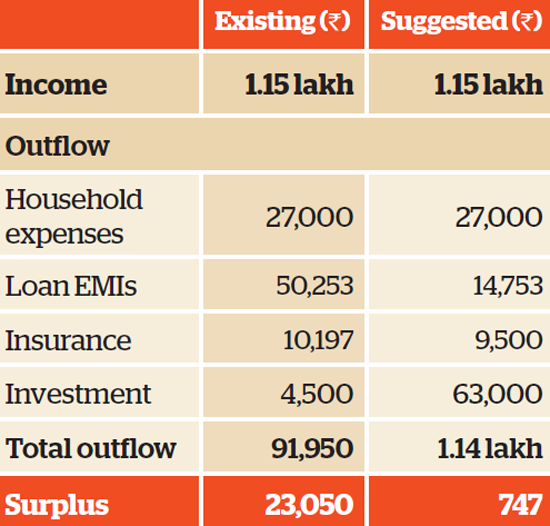

Ravi Kumar is a 32-year-old software engineer, who stays with his homemaker wife and one year-old child, in Bengaluru. He has his own house worth Rs 60 lakh, for which he has taken a loan of Rs 17.1 lakh and is paying an EMI of Rs 50,253. His investments include a post office scheme, EPF and mutual funds. Kumar’s goals are simple and he wants to save for emergencies, his child’s education and wedding, and his own retirement. Financial Planner Pankaaj Maalde suggests that Kumar first reschedule his home loan to reduce the EMI by increasing the tenure. This will free up Rs 35,500 a month to be invested for his goals.

Portfolio

Cash flow

Kumar can start by building an emergency corpus of Rs 3 lakh, which is equal to six months’ expenses. This can be done by using his cash holding (Rs 20,000), liquid fund corpus (Rs 39,000) and the post office scheme corpus (Rs 1 lakh), and investing the amount in an ultra short-term fund. For the remaining amount, he can save Rs 13,000 for a year to reach the goal.

Next, he wants to save Rs 1.5 crore for his child’s education in 17 years. To reach this goal, he will have to start an SIP of Rs 25,000 in an equity fund. For the child’s wedding in 24 years, he has estimated a need of Rs 1.2 crore. He can reach this goal by starting an SIP of Rs 8,000 in an equity fund and Rs 2,000 in the gold bond scheme.

How to invest for goals

* Investment for this goal will be for one year only.

Annual return assumed to be 12% for equity. Inflation assumed to be 7%.

Finally, for retirement, he will need a sum of Rs 5.6 crore in 28 years. To meet this goal, he can assign his equity fund and EPF corpuses. Besides these, he will have to start an SIP of Rs 15,000 in a diversified equity mutual fund for the specified period.

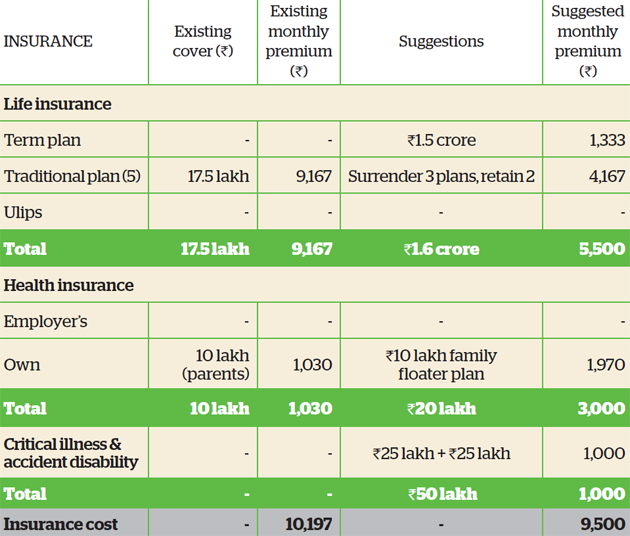

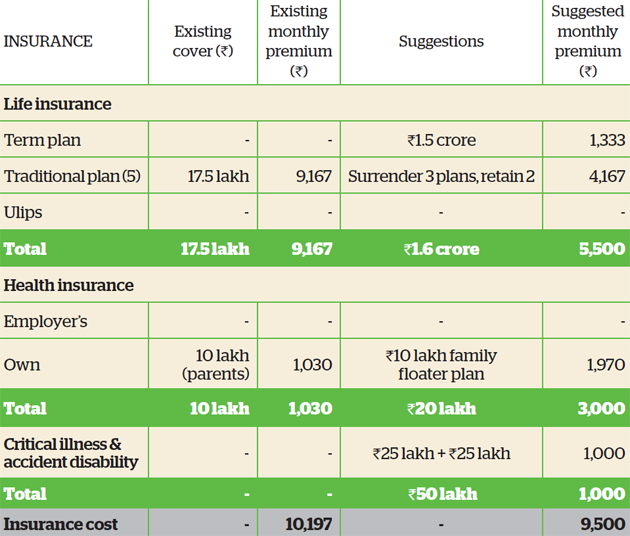

For life insurance, Kumar has five traditional plans worth Rs 17.5 lakh, and for which he is paying a monthly premium of Rs 9,167. Maalde suggests he surrender three of these plans and retain two, and also buy a term plan worth Rs 1.5 crore for 30 years. This will cost him about Rs 1,333 a month.

He has also bought a health plan of Rs 10 lakh for his parents. Maalde suggests he retain this and purchase a Rs 10 lakh family floater plan for himself, his wife and daughter at a cost of Rs 1,970 a month. Kumar is also advised to buy a Rs 25 lakh critical illness plan as well as a Rs 25 lakh accident disability plan for himself at a premium of Rs 1,000 a month.

Insurance portfolio

Premiums are indicative and could vary for different insurers.

Financial plan by Pankaaj Maalde, Certified Financial Planner.

Write to us for expert advice

Looking for a professional to analyse your investment portfolio? Write to us at etwealth@timesgroup.com with ‘Family Finances’ as the subject. Our experts will study your portfolio and offer objective advice on where and how much you need to invest to reach your goals.

Portfolio

Cash flow

Kumar can start by building an emergency corpus of Rs 3 lakh, which is equal to six months’ expenses. This can be done by using his cash holding (Rs 20,000), liquid fund corpus (Rs 39,000) and the post office scheme corpus (Rs 1 lakh), and investing the amount in an ultra short-term fund. For the remaining amount, he can save Rs 13,000 for a year to reach the goal.

Next, he wants to save Rs 1.5 crore for his child’s education in 17 years. To reach this goal, he will have to start an SIP of Rs 25,000 in an equity fund. For the child’s wedding in 24 years, he has estimated a need of Rs 1.2 crore. He can reach this goal by starting an SIP of Rs 8,000 in an equity fund and Rs 2,000 in the gold bond scheme.

How to invest for goals

* Investment for this goal will be for one year only.

Annual return assumed to be 12% for equity. Inflation assumed to be 7%.

Finally, for retirement, he will need a sum of Rs 5.6 crore in 28 years. To meet this goal, he can assign his equity fund and EPF corpuses. Besides these, he will have to start an SIP of Rs 15,000 in a diversified equity mutual fund for the specified period.

For life insurance, Kumar has five traditional plans worth Rs 17.5 lakh, and for which he is paying a monthly premium of Rs 9,167. Maalde suggests he surrender three of these plans and retain two, and also buy a term plan worth Rs 1.5 crore for 30 years. This will cost him about Rs 1,333 a month.

He has also bought a health plan of Rs 10 lakh for his parents. Maalde suggests he retain this and purchase a Rs 10 lakh family floater plan for himself, his wife and daughter at a cost of Rs 1,970 a month. Kumar is also advised to buy a Rs 25 lakh critical illness plan as well as a Rs 25 lakh accident disability plan for himself at a premium of Rs 1,000 a month.

Insurance portfolio

Premiums are indicative and could vary for different insurers.

Financial plan by Pankaaj Maalde, Certified Financial Planner.

Write to us for expert advice

Looking for a professional to analyse your investment portfolio? Write to us at etwealth@timesgroup.com with ‘Family Finances’ as the subject. Our experts will study your portfolio and offer objective advice on where and how much you need to invest to reach your goals.