How PF Auto-Transfer Works Through Form 11

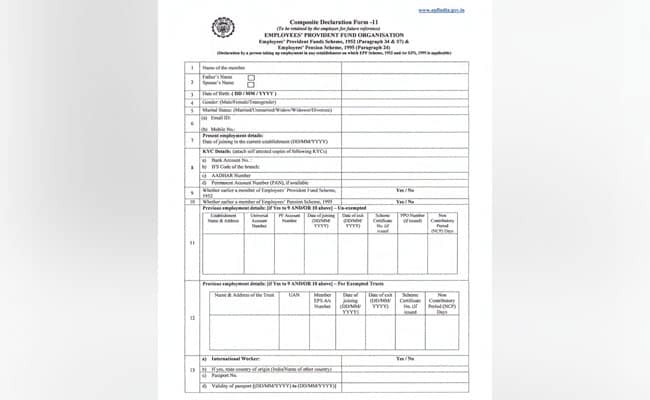

1) In Form 11, the new joinee has to fill in personal details and other details like UAN (Universal Account Number) and previous provident fund number.

2) UAN is a unique number assigned to an employee. It acts as an umbrella for the multiple Member Ids allotted to an individual by different establishments. The idea is to link multiple Member Identification Numbers (Member Id) allotted to a single member under single Universal Account Number. Universal Account Number (UAN) is allotted by Employees' Fund Organization (EPFO)and disseminated through the employers.

3) The employer then enters the information as given in Form 11 in the employer's portal.

3) The data is then validated with the information available against the UAN.

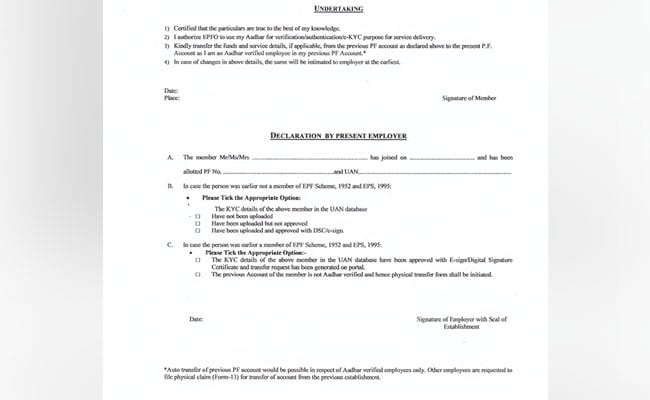

4) In case, the UAN is Aadhaar seeded and verified, the declaration by the employer of transfer request made by the employee in Form-11 will trigger an auto-transfer process which will transfer the accumulations against his previous provident fund account (PF ID) to the new provident fund account. Form No. 13 is not required to be submitted in such cases.

5) An SMS informing the subscriber about the proposed auto-transfer will be sent on his/her registered mobile number.

6) Auto transfer will be completed only after the member does not request to stop the proposed auto-transfer (either online, or through employer or at the nearest EPFO office) within 10 days of the SMS, and the first contribution by the present employer is deposited and reconciled.

7) On transfer of the account, the new employee will be communicated by SMS on his mobile number seeded against the UAN and by e-mail, if registered.

Composite Declaration Form 11 issued by EPFO for auto-transfer of PF money

Auto transfer of previous PF account would be possible in respect of Aaadhar verified employees only. In case the earlier UAN was not seeded with Aadhaar or UAN was Aadhaar seeded but not verified, the member needs to apply for transfer in Form-13 as the existing procedure for physical transfer would be followed.