Bharat Financial-IndusInd spread throws up cool trading opportunity

, ETMarkets.com|

Updated: Nov 08, 2017, 03.26 PM IST

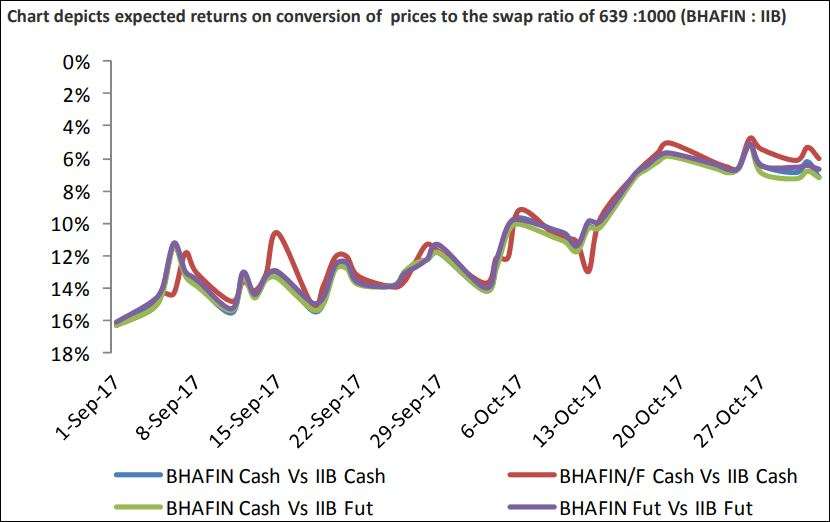

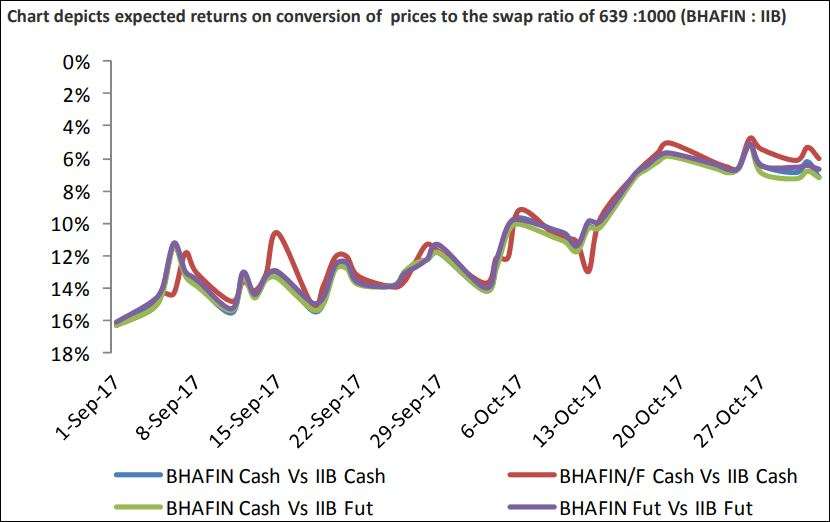

NEW DELHI: The prevailing spread in stock prices of IndusInd Bank and Bharat Financial Inclusion – which recently got board approvals for a merger – offers a lucrative trading opportunity for traders.

The swap ratio set for the merger at 639 shares of IndusInd Bank for every 1,000 shares of Bharat Financial Inclusion, and the prevailing stock prices of the two scrips suggest shares of Bharat Financial Inclusion are trading at an 8 per cent discount to the swap ratio.

At Tuesday’s close, 639 shares of IndusInd Bank were worth Rs 10.5 lakh, while 1,000 shares of Bharat Financial counted for Rs 9.85 lakh. It means Bharat Financial shareholders holding shares worth Rs 9.95 lakh (at prevailing price) would get shares worth Rs 10.5 lakh (8 per cent higher) on completion of the merger.

While the lenders are expecting the merger process to take around six to nine months, Edelweiss Securities expect the process to complete in 6-7 months going by track record of previous mergers in the BFSI sector.

The brokerage said long-only holders of IndusInd Bank in cash segment can shift to Bharat Financial to capture this residual spread of 8 per cent in the runup to deal completion. It noted that IndusInd Bank has a history of offering dividends during June-July, with dividend yield of 35 bps, which could be a yield enhancement opportunity.

“Dilution in IIB from merger and subsequent warrants allotment to foreign promoters along with additional buying by FPIs might as well propel IIB close to foreign ownership caution limits. This appears all the more probable, as the deal completion is still two quarters away. Additional buying by foreign holders will lend more conviction to our expectations,” the brokerage said.

This appears all the more probable as the deal completion is still two quarters away; additional buying by foreign holders will lend more conviction to this expectation, Edelweiss said.

At the end of September quarter, IndusInd Bank had 69.38 per cent foreign ownership while it has approval for a foreign ownership limit of 74 per cent. FIIs are restricted in Bharat Financial Inclusion.

Here's what F&O traders can do:

The swap ratio set for the merger at 639 shares of IndusInd Bank for every 1,000 shares of Bharat Financial Inclusion, and the prevailing stock prices of the two scrips suggest shares of Bharat Financial Inclusion are trading at an 8 per cent discount to the swap ratio.

At Tuesday’s close, 639 shares of IndusInd Bank were worth Rs 10.5 lakh, while 1,000 shares of Bharat Financial counted for Rs 9.85 lakh. It means Bharat Financial shareholders holding shares worth Rs 9.95 lakh (at prevailing price) would get shares worth Rs 10.5 lakh (8 per cent higher) on completion of the merger.

While the lenders are expecting the merger process to take around six to nine months, Edelweiss Securities expect the process to complete in 6-7 months going by track record of previous mergers in the BFSI sector.

The brokerage said long-only holders of IndusInd Bank in cash segment can shift to Bharat Financial to capture this residual spread of 8 per cent in the runup to deal completion. It noted that IndusInd Bank has a history of offering dividends during June-July, with dividend yield of 35 bps, which could be a yield enhancement opportunity.

“Dilution in IIB from merger and subsequent warrants allotment to foreign promoters along with additional buying by FPIs might as well propel IIB close to foreign ownership caution limits. This appears all the more probable, as the deal completion is still two quarters away. Additional buying by foreign holders will lend more conviction to our expectations,” the brokerage said.

This appears all the more probable as the deal completion is still two quarters away; additional buying by foreign holders will lend more conviction to this expectation, Edelweiss said.

At the end of September quarter, IndusInd Bank had 69.38 per cent foreign ownership while it has approval for a foreign ownership limit of 74 per cent. FIIs are restricted in Bharat Financial Inclusion.

Here's what F&O traders can do: