There are about 33 crore PAN cards, while Aadhaar has been issued to about 115 crore people. The government made the PAN-Aadhaar linking mandatory for filing ITR and obtaining PAN from July 1, 2017. The Supreme Court had in June upheld the validity of an Income Tax Act provision making Aadhaar mandatory for allotment of PAN cards and ITR filing, but had put a partial stay on its implementation till a Constitution bench addressed the issue of right to privacy.

How to link Aadhaar card with PAN

Aadhaar - the 12-digit personal identification number by the Unique Identification Authority of India (UIDAI) to residents - can be linked with PAN - a 10-digit alphanumeric number allotted by the Income Tax Department to a person, firm or entity - through multiple ways. Aadhaar-PAN linking can be done through SMS, online and while applying for a PAN.

How To Link Aadhaar card with PAN through SMS

For all taxpayers whose name given in the Aadhaar card and PAN card are identical, a simple SMS-based facility is provided to achieve the linking. Such assessees need to send an SMS to 567678 or 56161 in the format: UIDPAN<12-digit Aadhaar><10-digit PAN>

For example: UIDPAN 111122223333 AAAPA9999Q

However, in case of assessees whose names given in the Aadhaar and PAN cards have a "minor mismatch", according to the Income Tax Department, the linking can be achieved using an online facility.

How to link Aadhaar card with PAN via income tax website

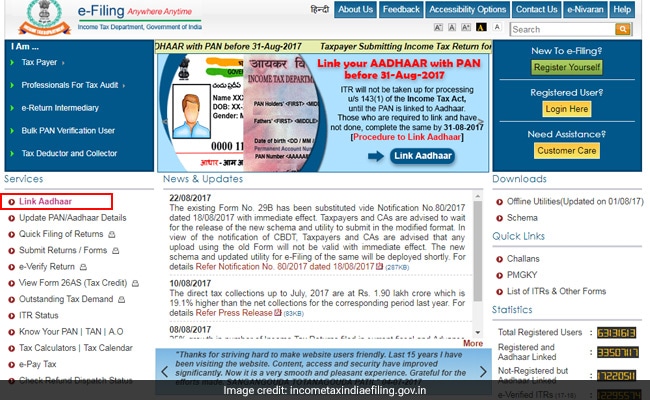

A facility available on the Income Tax Department's e-filing website - incometaxindiaefiling.gov.in - enables assessees to link the two identities. Individuals with identical names given on Aadhaar and PAN as well as those with a minor mismatch can both use this facility to link their Aadhaar with PAN.

The taxman has outlined steps to carry out this task through its website:

Once on the income tax e-filing website, click on the 'Link Aadhaar' option on the left hand side.

Enter your PAN, Aadhaar and name given on the Aadhaar Card. The name detail to be filled in this step is case sensitive.

Click on 'Link Aadhaar' button to proceed.

An OTP or one-time-password will be sent to the mobile number registered with Aadhaar.

Seed Aadhaar in PAN application

Aadhaar can also be seeded into the PAN database by quoting the biometrics-based identity number in the PAN application form - for allotment of a new PAN or for reprint of PAN card, the taxman has said.

Completely different names on Aadhaar, PAN

In such cases, first a correction should be made on the Aadhaar or PAN, as required. Once this is done, the user can proceed by any of the methods explained above.

"In case where Aadhaar name is completely different from name in PAN database then the linkage may fall and the PAN holder has to change the name in either Aadhaar or in PAN database or visit personally to designated PAN application centre of NSDL eGov or UTIITSL for Biometric Aadhaar authentication," the taxman has said.