Restaurants

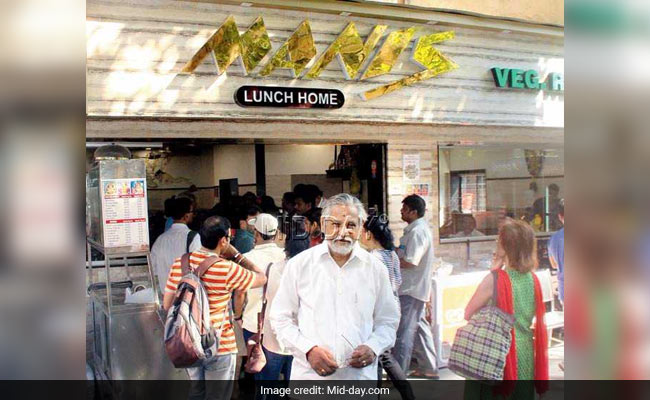

According to Cafe Madras owner Devavrat Kamath too cash payments have gained prominence once more. "We got Paytm within 48 hours after demonetisation as well as a card-swiping machine," he said, adding that the latter took a fair bit of struggle to obtain.

Cafe Madras at King's Circle faced a tough time procuring a card-swiping machine after demonetisation.

K S Narayanswamy, owner of Mani's Lunch Home in Chembur.

Banks

Digital transactions, notably mobile and merchant transactions, have grown significantly, and mobile banking/wallet volumes are double of last year and sustaining the post-demonetisation peaks, according to Ritesh Raj Saxena, head, Savings, Digital & Payments Business, IndusInd Bank.

Chaotic scenes outside ATMs are a thing of the past. File pic

He pointed out that the benefits for the banking industry had been multifold. "On the consumer side, going from cash to digital has helped to reduce banking transaction costs, with over 90 per cent of the overall transaction value getting fulfilled digitally. On the merchant side, introduction of New Age digital payment services, viz. QR, UPI and Aadhaar Pay, after demonetisation, has helped to improve the economics for banks in terms of bringing in more merchants, thereby opening up a virtuous cycle of financial inclusion fueled by digitally-enabled commerce," said Saxena.

Payments Council of India

Chairman Navin Surya said: "The growth rate of the digital payments industry, which was earlier in the range of 20-50 per cent, has accelerated post demonetisation to 40-70 per cent."

Pointing out that demonetisation was just 'one of the milestones' in our country's cashless journey and not the final destination, he added: "It conveyed a strong psychological message to our countrymen that cash was not welcome and its digitisation was inevitable. However, for further accelerating this growth and moving towards a 'less cash economy', both the government and regulators need to continue with the initiatives that they have taken since the announcement... critical steps can drive our current industry growth of 10 per cent transactions to 50 per cent over the next five years."

NCR Corporation Pvt Ltd, ATM manufacturer

As per Navroze Dastur, MD, NCR, the first seven months after demonetisation were a huge challenge. "Nearly 86 per cent of the currency had been sucked out of the system, and the government had not remonetised its equivalent amount; a year on, this has changed," he said.

MD of NCR Navroze Dastur

However, Dastur pointed out, we are currently at the same cash levels as we were before demonetisation. "We saw a major spurt in digital transactions during the demonetisation period, but after the currency has been remonetised, there is a clear drop in digital transactions, with cash transactions having gained prominence once again."

Hospitals

Here, digital transactions have increased since demonetisation. Dr Rajendra P Patankar, chief operating officer, Nanavati Super Speciality Hospital, said: "Before demonetisation, around 50 per cent of the transactions were digital; the number has now surged to 80 per cent. Most patients prefer paying digitally, even smaller amounts. This has made the system quicker."

Hospitals, including Nanavati, have seen a rise in digital transactions

Dr Parag R Rindani, associate vice president of Wockhardt Hospitals, shared the sentiment. "Most transactions now are made with plastic money. To encourage digital transactions further, we also started NeFT service."

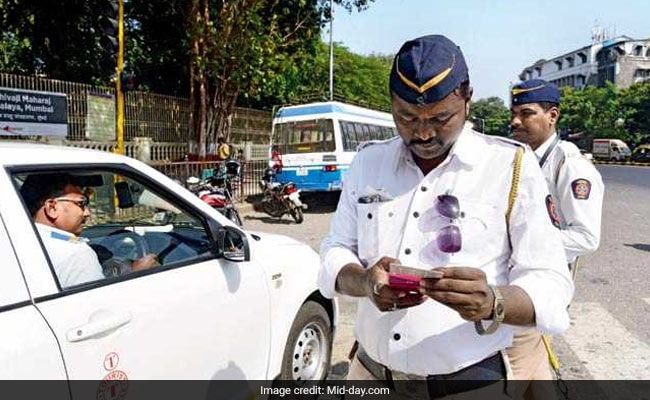

Traffic and e-challan glitches

But it's definitely not been all sunshine and roses, with niggling, careless and lazy errors slowing the entire system down.

Glitches in e-challan app and card machines given to traffic cops need to be addressed

And this wasn't even the end of it. When the reporter opened his e-challan app to pay the fine through it, the main screen displayed a pending offence and a fine amount, but a click to go to the next page to make the payment showed no record of any fine.

---------------------------------------------------------------------------------------------------------------------------------------

70%

Maximum growth recorded by digital payments industry after Nov 8, 2016

50%

Maximum growth of digital payments industry before demonetisation

50

Percentage digital transactions can rise to over the next five years

10%

Overall digital transactions currently

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)