How To Access This New EPFO Facility For Linking UAN With Aadhaar

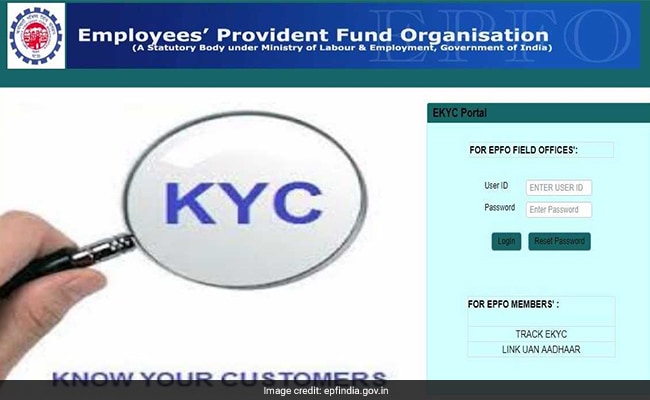

For linking UAN with Aadhaar, visit EPFO's website www.epfindia.gov.in. This facility is available at the Online Services section on the EPFO website. Then select the "eKYC Portal" link.

On the next page, the user can proceed by clicking on the 'Link UAN Aadhaar' link.

(Using this facility, EPFO members can online link their respective UAN with Aadhaar)

For using this facility, the EFPO subscriber will have to provide his/her UAN. "An OTP will be sent to his/her mobile linked with UAN. After OTP verification, the member will have to provide his/her Aadhaar Number. Another OTP will be sent to his/her mobile/email linked with Aadhaar. After OTP verification, if UAN details are matched with Aadhaar details, then UAN will be linked with Aadhaar," EPFO says.

Benefits of Linking UAN With Aadhaar

The EPFO runs three schemes - Employees Provident Fund Scheme 1952, Employees Pension Scheme 1995 and Employees Deposit Linked Insurance Scheme 1976. EPFO receives 1 crore claims every year including those pertaining to EPF withdrawal, pension fixation and insurance.EPFO in a recent tweet highlighted the benefits of seeding your EFP account with Aadhaar number:

Submit claims directly to EPFO without employers' attestation: EPFO members can complete the whole process online without interacting with the employer. The claim submitted by the member would flow in a soft form to the EPFO database, where it will be processed and the member's bank account will be credited.Individuals can submit claims directly to EPFO without employers.There are many Benefits of Aadhaar backed UAN. pic.twitter.com/4VnNZ7b5s4

— EPF INDIA (@socialepfo) August 25, 2017

Receive monthly updates on the mobile number registered with your UAN

Download e-passbook and check your passbook balance and other details: A subscriber can also check PF balance through a missed call and EPFO's app.

File/update nomination form online

Edit personal details

Link multiple EPF accounts allotted over the years