HDFC Standard Life fit for long-term investors with high risk appetite

, ET Bureau|

Updated: Nov 03, 2017, 09.02 AM IST

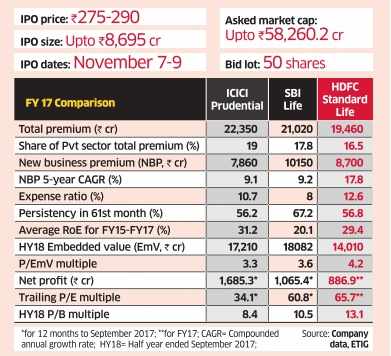

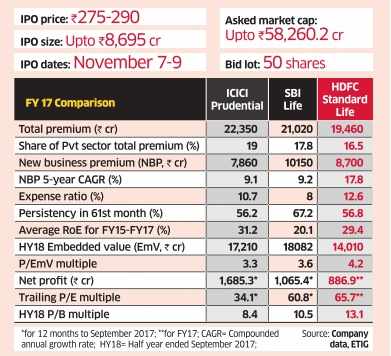

HDFC Standard Life plans to raise upto Rs 8,695 crore from the primary market to offer liquidity to promoters. The IPO is aggressively priced compared with the listed peers including ICICI Prudential Life Insurance and SBI Life Insurance.But, a more balanced product mix with relatively higher proportion of pure protection products and lower reliance on products linked to various funds along with faster growth of new business premium may still attract long-term investors.

BUSINESS AND FINANCIALS

HDFC Standard Life is the country's third-largest private sector life insurance company with 16.5 per cent share of total private sector premiums in FY17.Based on the new business premium (NBP), it ranked second with a market share of 17.2 per cent. Its margin on the value of new business (VNB margin) was 22 per cent in FY17 compared with 10-19 per cent for some of the peers.

The company's business mix looks more balanced with pure protection products such as term insurance and annuities forming 26 per cent of NBP.For peers, the proportion in under 5 per cent. A higher proportion of such products reduces exposure to market volatility. The company's total income doubled to Rs 30,554.4 crore between FY13 and FY17. Net profit too increased by similar magnitude to Rs 886.9 crore. Its dividend as a percentage of net profit increased to 29.8 per cent in FY17 from 21.3 per cent in FY15.

VALUATION AND RECOMMENDATION

The embedded value (EmV) of a life insurance company tends to capture the longterm profitability of the existing business.

Based on this parameter, the IPO is valued at 4.2 times the EmV at the end of September 2017, which is steeper compared with the multiple of 3.3 for ICICI Pru and 3.6 for SBI Life. The IPO is expensive even on the conventional valuation parameters including price earnings (PE) and price-book (PB) multiples. HDFC Standard Life has been growing new business faster with better mix, which may partially justify the premium valuation. Given these factors, the issue is more suitable for investors with long-term horizon and an appetite to endure short-term stock volatility.

BUSINESS AND FINANCIALS

HDFC Standard Life is the country's third-largest private sector life insurance company with 16.5 per cent share of total private sector premiums in FY17.Based on the new business premium (NBP), it ranked second with a market share of 17.2 per cent. Its margin on the value of new business (VNB margin) was 22 per cent in FY17 compared with 10-19 per cent for some of the peers.

The company's business mix looks more balanced with pure protection products such as term insurance and annuities forming 26 per cent of NBP.For peers, the proportion in under 5 per cent. A higher proportion of such products reduces exposure to market volatility. The company's total income doubled to Rs 30,554.4 crore between FY13 and FY17. Net profit too increased by similar magnitude to Rs 886.9 crore. Its dividend as a percentage of net profit increased to 29.8 per cent in FY17 from 21.3 per cent in FY15.

VALUATION AND RECOMMENDATION

The embedded value (EmV) of a life insurance company tends to capture the longterm profitability of the existing business.

Based on this parameter, the IPO is valued at 4.2 times the EmV at the end of September 2017, which is steeper compared with the multiple of 3.3 for ICICI Pru and 3.6 for SBI Life. The IPO is expensive even on the conventional valuation parameters including price earnings (PE) and price-book (PB) multiples. HDFC Standard Life has been growing new business faster with better mix, which may partially justify the premium valuation. Given these factors, the issue is more suitable for investors with long-term horizon and an appetite to endure short-term stock volatility.