Spelling more trouble for the government battling hard to bring a slowing economy back on a high growth trajectory, global oil prices on Monday breached the psychological mark of $60 a barrel. The rate jumped on anticipation that the Opec-led production cut, due for expiry next March, would be extended.

Brent crude oil futures, the international benchmark for oil prices, opened above $60 a barrel and gained further during the day to reach $ 60.63, close to the highest level since July 2015 and almost 36 per cent higher than 2017 lows recorded in June.

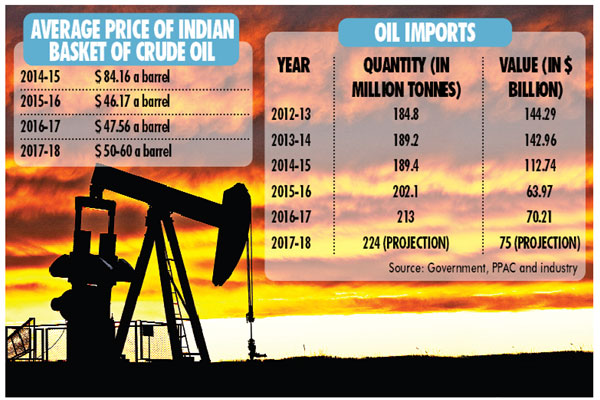

The international crude oil price of the Indian basket, a derived basket comprising sour grade (Oman and Dubai average) and sweet grade (Brent dated) of crude oil processed in Indian refineries, has also moved up consistently over the past week, reaching $56.92 a barrel on Friday.

Higher oil prices could mean more problems for India, which imports more than 80 per cent of its crude requirements. As per government estimates, India’s import bill could rise by 23 per cent from $70 billion in FY17 if average crude price for FY18 settles around $55 a barrel and rupee-dollar exchange rate is around Rs 65 or more in the remaining six months of the current fiscal.

Moreover, continued higher prices in the balance period of the financial year could force the government to further cut excise duty on petrol and diesel, thereby sacrificing revenue. It could also increase government’s oil subsidy and again load a portion of subsidies on state-owned oil companies.

“Unlike in the past, the current spike in global oil prices could sustain for a longer period as there seems to be the real issue of low inventory levels in various parts of the globe. This is pulling up demand for oil and thereby pushing up prices. If $60 is breached for a longer duration, the next resistance level this time could be $70,” said a prominent oil sector expert, who refused to get quoted saying he needed to study the oil data further.

What has triggered the fresh round of price rise is an indication given by the Organization of the Petroleum Exporting Countries (Opec) plus Russia and nine other producers that they may hold back about 1.8 million barrels per day (bpd) of production cut beyond March 2018. Moreover, US shale oil that has been a balancing factor in the past to check oil price rise is subdued due to rising growth in US and lower inventory levels.

Though rising exports from Iraq has kept a lid on prices to some extent, the prospect further trouble in the region due to continuing tensionsbetween Iraqi government forces and Kurdish forces could keep oil prices steady. A Citi bank outlook for the oil sector over the next five years has projected crude prices to be range-bound between $40-$60 a barrel between now and 2022.

It has, however, cautioned the prices could spike over $70 a barrel if recently restored production from African region falls.

“In the past two years global oil price fall has come to the advantage of the government that has made huge savings on the oil with import bill almost halving. This also allowed the government to raise excise duty on petrol and diesel frequently and helped it mobilise in excess of Rs 1.4 lakh crore. But all these gains could vanish if crude remains over $60 in balance period of FY18. With lower tax buoyancy, any reduction in duty could hurt government’s fisc,” said BK Chaturvedi, former member (energy), erstwhile Planning Commission.

The consistent fall in global oil prices for the past two years nearly halved India’s oil import bill to $64 billion in FY16 even though the country imported higher 202.1 million tonnes of crude oil in the fiscal year. This compared to import of 189.4 million tonnes of crude oil for $112.7 billion in the previous FY15.

“We have survived $100 or more crude prices a few years ago and we can surely absorb some spike in price now. A 10-20 per cent increase in oil and gas price would not have much impact on the economy and government finances. The oil market is now different from what it was few years ago and the prices look range-bound up to $ 60 for next couple of years. Besides, today we are in a condition that forex is not a critical element of economy,” said Kirit Parikh, energy sector expert and chairman, Integrated Research and Action for Development (IRADe). The prospects of higher oil prices may not only increase import bill (and CAD), but together with lower tax collections, this could hurt fiscal deficit target of the government for FY18. The deficit target for current year has been kept at 3.2 per cent of GDP and breaching this target is already on cards on expected stimulus package from the government.

But higher oil prices could spell good times for state-owned upstream companies such as ONGC and Oil India and private explorers Cairn and Reliance Industries as they could maximise their revenue by having higher margin on sale of crude. For the government, however, rise in oil import bill is not the only worry. If oil prices remain high, they would have to succumb to popular pressure to cut excise duty on petrol and diesel to prevent any further spike in its retail rates even as it adversely impacts its fisc. Petrol and diesel prices have increased by Rs 7 and Rs 5 per litre respectively in last two months fuelling the risk of inflationary pressure gripping the economy.

Also firm oil market could also disturb governments budgeted oil subsidy bill with increase in subsidy requirements for LPG cylinders and kerosene. The upstream subsidy sharing mechanism may also make a come back disturbing earnings of ONGC and OIL.