Mahindra Logistics IPO to open on October 31: 10 things you should know

Mahindra Logistics, the subsidiary of Mahindra & Mahindra, is scheduled to open its initial public offering on October 31, with a price band of Rs 425-429 per share.

Moneycontrol News

Mahindra Logistics, the subsidiary of Mahindra & Mahindra, is scheduled to open its initial public offering on October 31, with a price band of Rs 425-429 per share.

The offer will close for subscription on November 2, 2017.

The book running lead managers to the issue are Kotak Mahindra Capital Company and Axis Capital.

Equity shares are proposed to be listed on BSE and NSE.

Here are 10 things one should know before investing in Mahindra Logistics IPO:-

Company Profile

Mahindra Logistics, the 3rd party logistics (3PL) solutions provider, is a part of the Mahindra Partners Division of the Mahindra Group.

It operates in two distinct business segments - supply chain management (SCM) and corporate people transport solutions (PTS).

Through its SCM business, the company offers customised and end-to-end logistics solutions and services including transportation and distribution, warehousing, in-factory logistics and value added services to clients. It has a large network of over 1,000 business partners providing it vehicles, warehouses and the other assets and services for the SCM business.

Certain key clients for the SCM business include Volkswagen India, Vodafone India, Thermax, JSW Steel, Ashok Leyland, Siemens, Bosch, BMW India, 3M India, and Mercedes-Benz India.

Through its PTS business, the company provides technology-enabled people transportation solutions and services across India to over 100 domestic and multinational companies operating in the IT, ITeS, business process outsourcing, financial services, consulting and manufacturing industries. Its key clients in India for PTS business include Tech Mahindra, AXISCADES Engineering Technologies and ANZ Support Services India.

Its subsidiary, 2X2 Logistics provides logistics and transportation services to original equipment manufacturers (OEMs) to carry finished automobiles from manufacturing locations to stockyards or directly to distributors through specially designed vehicles. Its other subsidiary, Lords provides international freight forwarding services for exports and imports, customs brokerage operations, project cargo services and charters.

About the Public Issue

The initial public offering of up to 1,93,32,346 equity shares comprises of an offer for sale of up to 96,66,173 shares by promoter Mahindra & Mahindra; up to 92,71,180 shares by Normandy Holdings; and up to 3,94,993 shares by Kedaara Capital Alternative Investment Fund – Kedaara Capital AIF 1.

The offer, which constitutes 27.17 percent of post-offer paid-up equity share capital, includes a reservation of up to 1,25,000 shares for subscription by eligible employees who will get shares at a discount of Rs 42 per equity share on the offer price.

Bids can be made for a minimum of 34 equity shares and in multiples of 34 shares thereafter.

Objects of the Issue

It is an offer for sale issue; hence the company will not receive any proceeds from the IPO.

Strengths

> Mahindra Logistics operates business primarily on basis of an 'asset-light' business mode which allows flexibility and scalability in operations and high capital efficiency.

> Technology is an integral to its business and operations. Hence, it provide customised and technology driven logistics solutions.

> Its integrated, end-to-end logistics services focus on creating solutions that address requirements of clients across SCM and PTS businesses. Entities within the Mahindra Group together constituted largest client group and contributed 53.96 percent, 63.24 percent and 70.14 percent to total revenue from operations in FY17, FY16 and FY15, respectively.

> It has presence across diverse industry verticals with long-standing client relationships.

> The company has an experienced management team with strong domain expertise.

Financials

Its SCM and PTS businesses contributed 89.89 percent and 10.11 percent, respectively, to the total revenue from operations in the three month period ended June 30, 2017 and 88.94 percent and 11.06 percent, respectively, to the total revenue from operations in FY17.

As of March 2017, its long-term borrowings were Rs 26.09 crore and surplus funds were Rs 141.22 crore (including cash and cash equivalents of Rs 50.17 crore).

Promoter

The promoter of the company is Mahindra & Mahindra which holds 5,14,78,330 equity shares, representing 73.19 percent of paid-up equity share capital of company.

Shareholders

Here are top 10 shareholders of the company:-

Management

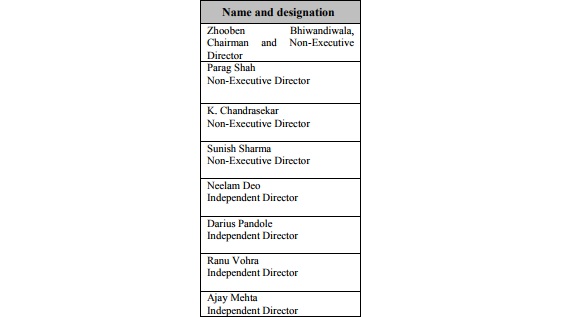

Board of Directors

Management Organisation Structure

Dividend Policy

Mahindra Logistics has not declared any dividend during the last five fiscals.

Risks and Concerns

Here are some risks and concerns highlighted by brokerage houses:-

> Company depends significantly on clients in automotive industry and is highly dependent on performance of automotive industry. A loss of or a significant decrease in business from clients in auto industry could adversely affect business and profitability.

> MLL depends on a limited number of clients, which exposes to a high risk of client concentration.

> MLL's business and operations depend significantly on their parent and promoter, Mahindra & Mahindra and the other Mahindra Group entities.

> MLL operates in a highly fragmented and competitive industry and increased competition may lead to a reduction in revenues, reduced profit margins or a loss of market share.

> Company’s business is highly dependent on technology and any disruption or failure of technology systems may affect their operations.

> The company may not be able to manage the growth of their business effectively or continue to grow their business at a rate similar to what they have experienced in the past.

Image Source: RHP