Reliance Nippon Life Asset Management IPO to open on Wednesday: 10 things you should know

Reliance Nippon Life Asset Management is set to open its initial public offer for subscription on October 25, with a price band of Rs 247-252 per share.

Moneycontrol News

Reliance Nippon Life Asset Management is set to open its initial public offer for subscription on October 25, with a price band of Rs 247-252 per share.

JM Financial Institutional Securities, CLSA India, Nomura Financial Advisory and Securities (India) and Axis Capital are the global co-ordinators and book running lead managers to the issue.

Edelweiss Financial Services, IIFL Holdings, SBI Capital Markets and Yes Securities (India) are the book running lead managers to the offer. Karvy Computershare is the Registrar to the issue.

The company is going to list its equity shares on the National Stock Exchange of India and BSE.

Here are 10 things you should know before subscribing the issue:-

Company Profile

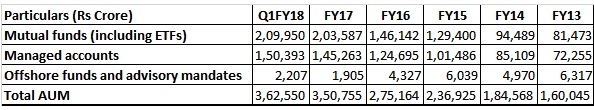

Reliance Nippon Life Asset Management (RNLAM), promoted by Anil Dhirubhai Ambani Group-led Reliance Capital, is involved in managing mutual funds (including exchange traded funds); managed accounts, including portfolio management services, alternative investment funds (AIFs) and pension funds; and offshore funds and advisory mandates.

Its total asset under management (AUM) stood at Rs 3,62,550 crore as of June 30, 2017.

RNLAM started its mutual fund operations in 1995 as the asset manager for Reliance Mutual Fund, managed quarterly average AUM of Rs 2,22,964 crore and 7.01 million investor folios, as of June 2017. The company managed 55 open ended mutual fund schemes including 16 ETFs and 174 closed ended schemes for Reliance Mutual Fund at the end of June quarter.

Issue Details

The initial public offering of up to 6.12 crore equity shares will close on October 27, 2017.

The offer consists of a fresh issue of up to 2,44,80,000 equity shares and an offer for sale of up to 3,67,20,000 equity shares by promoters - Reliance Capital and Nippon Life Insurance Company.

The issue will constitute 10 percent of the post-offer paid-up equity share capital of the company.

Investor can bid for minimum 59 equity shares and in multiples of 59 shares thereafter.

Objects of the Issue

The net proceeds from fresh issue would be utilised for:-

> Setting up new branches and relocating certain existing branches (Rs 38.31 crore);> Upgrading the IT system (Rs 40.65 crore);

> Advertising, marketing and brand building activities (Rs 72.09 crore);

> Lending to subsidiary (Reliance AIF) for investment as continuing interest in the new AIF schemes managed by Reliance AIF (Rs 125 crore);

> Investing towards continuing interest in new mutual fund schemes managed by the company (Rs 100 crore);

> Funding inorganic growth and other strategic initiatives (Rs 165 crore); and

> Meeting expenses towards general corporate purposes.

Company will not receive any proceeds from the offer for sale.

Strengths

> RNLAM was the third largest asset management company, in terms of mutual fund quarterly average AUM (QAAUM) with a market share of 11.4 percent, as of June 2017, according to ICRA. The company believes that its strong relationships with distributors and investors; and strong support from promoters, Reliance Capital and Nippon Life, will drive growth.

> It has a strong presence across India, have set up subsidiaries in Singapore and Mauritius and a representative office in Dubai. It has a pan-India network of 171 branches and approximately 58,000 distributors as of June 30, 2017.

> The company believes that it offers a comprehensive suite of products ( across mutual funds and ETFs, managed accounts and offshore funds andadvisory mandates) catering to requirements of investors with varied risk profiles and time-horizons.

> RNLAM regularly monitors current processes and endeavours to benchmark them against competitors and incorporate industry best practices in operations. It believes that this focus on processes has contributed significantly to the growth.

> Superior customer service is an integral part of its value proposition to investors. It believes that innovation, an easy and simple on-boarding process, efficient service delivery and robust grievance redressal processes are the key elements of this service value proposition.

> RNLAM said its operations are conducted by a well-qualified management team that has significant experience in all aspects of business.

Financials

RNAM reported 21.1 percent CAGR increase in total operating revenue to Rs 1,307.5 crore over FY13-17. Investment management fees, which contributed around 97 percent to the topline, increased by 21.1 percent CAGR.

While, portfolio management fees, which contributed 3 percent to the topline, increased by 19.1 percent CAGR over the same period. Total Operating expenditure increased at a relatively lower pace of 17.9 percent CAGR as compared to topline, thereby leading to a 27.9 percent CAGRrise in consolidated EBITDA over FY13-17 to Rs 470.83 crore in FY17.

EBITDA margin improved from 28.9 percent in FY13 to 36 percent in FY17. PAT increased by 15 percent CAGR over FY13-17 to Rs 402.76 crore in FY17.

Promoters

Reliance Capital and Nippon Life Insurance Company are two promoters of the company.

Shareholding Details

Top shareholders of the company as of October 11, 2017:-

Management

Here is the details of the constitution of Board:-

Key Management Personnel:-

Dividend Policy

The dividends declared by the company on equity shares in each of fiscal years 2013, 2014, 2015, 2016 and 2017 are given below:-

Risks and Concerns

Here are some risks and concerns highlighted by brokerages houses:-

> Subdued economic activities;

> Inability to attract new investors and fall in AUM;

> Retaining investment professionals and personnel remains key risk;

> Underperformance of investment products to impact profitability

> Unfavorable AUM mix leading to lower management fees;

> Unfavorable regulatory limits on management fees;

> Inability to launch new mutual fund and AIF schemes;

> Competition could reduce market share or margins;

> Acquisition targets have not been identified;

> The AMC depends on third-party distribution channels and other intermediaries, and problems with these distribution channels and intermediaries could adversely affect its business and financial performance;

> Cap on mutual fund expenses.