IndusInd-Bharat Fin merger to result in long-term synergies

, ET Bureau|

Updated: Oct 16, 2017, 08.57 AM IST

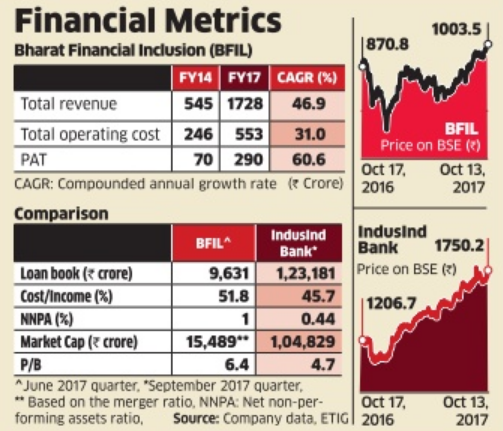

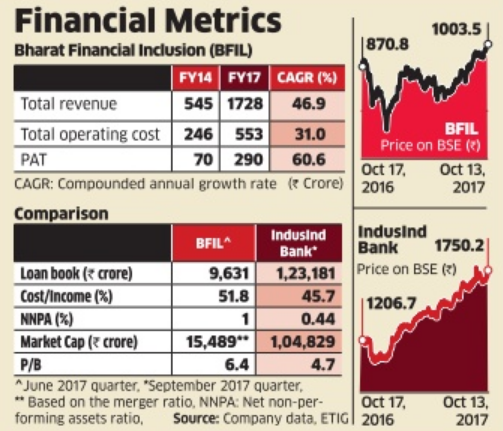

The share swap ratio looks favourable to the shareholders of Bharat Financial Inclusion (BFIL). Besides a premium over the current stock price, the merger is expected to improving return ratios by rationalising the cost structure of the microfinance company.

For IndusInd Bank shareholders, however, it appears to be an expensive deal in the short term and a lot will depend upon how well the bank is able to take advantage of the merger synergies in the long-term.

According to the swap ratio announced on Saturday, for every 1,000 shares of BFIL, its shareholders will receive 639 shares of IndusInd Bank. This results in a premium of 11.4 per cent over BFIL's stock price of Rs 1,003.5 on Friday.

Over the past four years, BFIL has significantly pruned operating costs. Its cost-income ratio fell to 50 per cent in FY17 from 74.5 per cent in FY14. Since IndusInd Bank operates at a cost-income ratio of 46-47 per cent, the micro-finance segment will likely report a further drop in the ratio after the merger.

This may in turn spruce up the return on equity (RoE), which fell sharply to 3.9 per cent in FY17 compared with 16.7 per cent three years ago.

On the other hand, IndusInd's shareholders need to bear with an apparently expensive merger deal. In addition, higher volatility in the micro-finance segment and relatively lower credit quality will be a challenge -the net nonperforming asset ratio was 2.7 per cent for BFIL in FY17, while IndusInd Bank has maintained the ratio below 0.5 per cent.

The swap ratio implies BFIL's price-book (PB) ratio to be 6.4.IndusInd Bank, with 10 times bigger loan book, has PB of 4.7.Some of the other finance companies currently trade at a lower PB between three and five.

Considering a long-term horizon, the valuation signifies the premium paid by the bank to increase foothold in the micro lending segment which has a high growth potential. After the merger, it will have access to over 2.9 lakh centres of BFIL, largely in rural areas. Also, the bank's exposure to micro-finance segment will improve to over 9 per cent from the current 2 per cent of the loan book.

For IndusInd Bank shareholders, however, it appears to be an expensive deal in the short term and a lot will depend upon how well the bank is able to take advantage of the merger synergies in the long-term.

According to the swap ratio announced on Saturday, for every 1,000 shares of BFIL, its shareholders will receive 639 shares of IndusInd Bank. This results in a premium of 11.4 per cent over BFIL's stock price of Rs 1,003.5 on Friday.

Over the past four years, BFIL has significantly pruned operating costs. Its cost-income ratio fell to 50 per cent in FY17 from 74.5 per cent in FY14. Since IndusInd Bank operates at a cost-income ratio of 46-47 per cent, the micro-finance segment will likely report a further drop in the ratio after the merger.

This may in turn spruce up the return on equity (RoE), which fell sharply to 3.9 per cent in FY17 compared with 16.7 per cent three years ago.

On the other hand, IndusInd's shareholders need to bear with an apparently expensive merger deal. In addition, higher volatility in the micro-finance segment and relatively lower credit quality will be a challenge -the net nonperforming asset ratio was 2.7 per cent for BFIL in FY17, while IndusInd Bank has maintained the ratio below 0.5 per cent.

The swap ratio implies BFIL's price-book (PB) ratio to be 6.4.IndusInd Bank, with 10 times bigger loan book, has PB of 4.7.Some of the other finance companies currently trade at a lower PB between three and five.

Considering a long-term horizon, the valuation signifies the premium paid by the bank to increase foothold in the micro lending segment which has a high growth potential. After the merger, it will have access to over 2.9 lakh centres of BFIL, largely in rural areas. Also, the bank's exposure to micro-finance segment will improve to over 9 per cent from the current 2 per cent of the loan book.