IndusInd robust show may fuel stock rally

, ET Bureau|

Updated: Oct 13, 2017, 09.01 AM IST

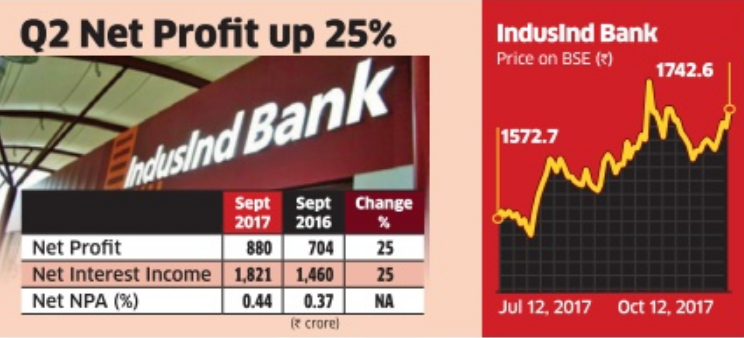

IndusInd Bank reported a 25 per cent year-on-year rise in net profit for the quarter ended September, led by growth in interest as well as non-interest income.

Net profit rose to Rs 880 crore or Rs 14.54 per share from Rs 704 crore or Rs 11.69 per share last year. Following are a few key takeaways from the bank's results.

Momentum Continues:

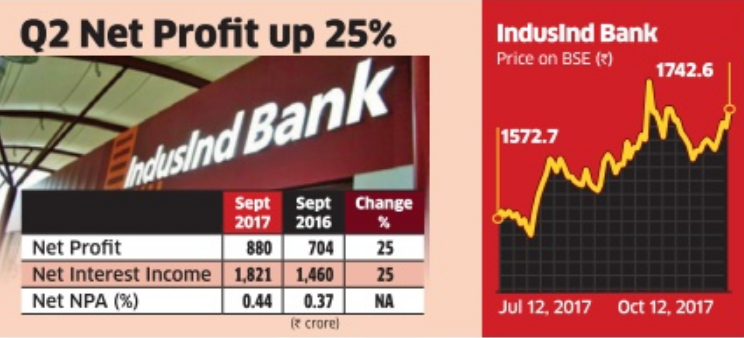

IndusInd has been a consistent performer on bank street for the last nine years and the results on Thursday were a reiteration of the fact. The bank's credit growth has been higher than the system and at 24 per cent year-on-year, growth in the second quarter is more than three times the abysmal 6.8 per cent reported by the banking industry. The bank's stock has risen 43 per cent in the last one year and this momentum is likely to sustain.

Asset Quality:

A big reason for IndusInd's top notch valuation is its pristine asset quality. At 0.44 per cent, the bank's net non-performing assets are one of the low est in the industry. Moreover, the bank has also not been hit by the 40 companies so far sent by the RBI to the NCLT because it had exposure to only nine of those companies. In the current quarter, the bank provided Rs 36 crore as higher provisions for these accounts, a very small amount for a bank of Rs 2.64 lakh crore balance sheet.

Commercial Vehicle uptick:

IndusInd Bank's consumer finance book is made up of a large chunk of vehicle loans, a big part of which is made of commercial vehicles (CVs).IndusInd disbursed a record Rs 2,300 crore in September, of which 50 per cent was from CVs, which could be an early indicator of an economic revival, said CEO Romesh Sobti. He pointed to the higher auto sales, CV uptick and firming up of freight rates as early signs that growth is likely on the uptrend.

Bharat Financial:

Last month, IndusInd said it had entered into exclusive talks with micro finance company Bharat Financial for a possible acquisition. It looks like the bank may announce a share swap deal after a board meeting on Saturday. In a notice to the exchanges, the banks said it will also issue warrants to promoters, which could be to ensure that promoter holding does not fall below the 15 per cent mark.

Net profit rose to Rs 880 crore or Rs 14.54 per share from Rs 704 crore or Rs 11.69 per share last year. Following are a few key takeaways from the bank's results.

Momentum Continues:

IndusInd has been a consistent performer on bank street for the last nine years and the results on Thursday were a reiteration of the fact. The bank's credit growth has been higher than the system and at 24 per cent year-on-year, growth in the second quarter is more than three times the abysmal 6.8 per cent reported by the banking industry. The bank's stock has risen 43 per cent in the last one year and this momentum is likely to sustain.

Asset Quality:

A big reason for IndusInd's top notch valuation is its pristine asset quality. At 0.44 per cent, the bank's net non-performing assets are one of the low est in the industry. Moreover, the bank has also not been hit by the 40 companies so far sent by the RBI to the NCLT because it had exposure to only nine of those companies. In the current quarter, the bank provided Rs 36 crore as higher provisions for these accounts, a very small amount for a bank of Rs 2.64 lakh crore balance sheet.

Commercial Vehicle uptick:

IndusInd Bank's consumer finance book is made up of a large chunk of vehicle loans, a big part of which is made of commercial vehicles (CVs).IndusInd disbursed a record Rs 2,300 crore in September, of which 50 per cent was from CVs, which could be an early indicator of an economic revival, said CEO Romesh Sobti. He pointed to the higher auto sales, CV uptick and firming up of freight rates as early signs that growth is likely on the uptrend.

Bharat Financial:

Last month, IndusInd said it had entered into exclusive talks with micro finance company Bharat Financial for a possible acquisition. It looks like the bank may announce a share swap deal after a board meeting on Saturday. In a notice to the exchanges, the banks said it will also issue warrants to promoters, which could be to ensure that promoter holding does not fall below the 15 per cent mark.