Consolidation has come back to the Indian telecom sector. The country’s largest telecom operator Bharti Airtel on Thursday acquired Tata’s loss-making and highly leveraged wireless mobile business, Tata Teleservices, in a by and large cash free, debt-free deal concluded after a short negotiation.

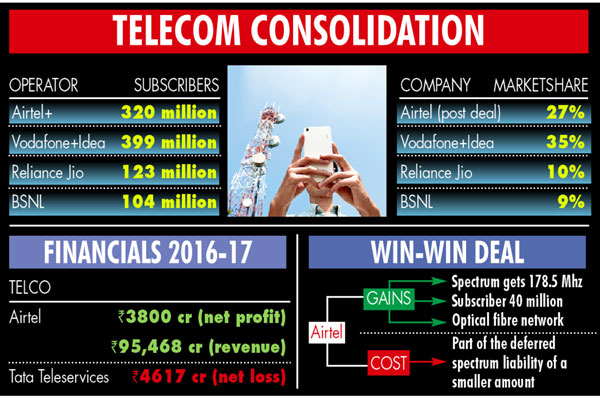

The deal — a win-win for both the entities — straightaway offers four crore customers and 178.5 Mhz of highly valuable 3G and 4G spectrum to the Sunil Mittal company in addition to offering it the right to use Tata’s well-laid fibre optic.

It will also help Bharti increase its market share in wireless segment by 3 per cent. For Tatas, the sale allows it to move ahead on the road to exit the bleeding telecom operations completely while focusing on automobile, IT and steel businesses. Under the terms of the deal, Bharti Airtel has entered into an agreement to merge the consumer mobile businesses of the seriously ailing Tata Teleservices and its Maharashtra arms into Bharti Airtel, subject to regulatory approvals.

It excludes the Tata Group’s stake in tower firm Viom Networks.

Tatas will explore the combination of its enterprise business with Tata Communications and retain fixed line and broadband business with Tata Sky.

For Airtel, the acquisition of Tata Tele’s consumer mobile operations would largely be cash free, but it will have to take a part of Tata’s Rs 10,000 crore spectrum liability. That apart, there is benefits galore for Airtel in this deal. Tata Tele’s near 180 MHz of spectrum across high capacity 800, 1,800, 2,100 Mhz (3G, 4G) bands in 19 populous circles will add value to the company’s 4G network for expansion and offer more data to the customers at a time when Airtel’s archrival Reliance Jio is stifling competition with unlimited data and free voice plans.

“The acquisition of additional spectrum made an attractive business proposition. It will further strengthen our already solid portfolio and create substantial long term value for our shareholders, given the significant synergies,” Sunil Bharti Mittal, chairman, Bharti Airtel, said.

Bharti will also be signing an indefeasible Rights of Use (IRU) agreement with Tata Teleservices for access to its fibre optic backbone, which will again add to its data prowess.

Of the acquired spectrum bands, 71.3 MHz is liberalised and the 800 Mhz band along with the fibre network is a big bonanza for Airtel. “We believe today’s agreement is the best and most optimal solution for the Tata Group and its stakeholders. Finding the right home for our longstanding customers and our employees has been the priority for us. We have evaluated multiple options and are pleased to have this agreement with Bharti,” N Chandrasekaran, chairman, Tata Sons, said.

Through this deal, Bharti Airtel will further strengthen its position as the numero one operator in the country in terms of number subscribers, revenue market share and spectrum portfolio with an aim to take on the might of Reliance Jio with yet another acquisition.

Airtel is pushing further consolidation in the industry that is largely left with four big players now. With the latest merger, Airtel continues to lead the pack with its recent acquisitions of India operations of Norwegian company Telenor, 4G broadband spectrum of Tikona Networks and now the consumer business of Tata Teleservices Limited (TTSL) and Tata Teleservices (Maharashtra) Limited (TTML).

The upcoming Vodafone and Idea merger, however, will overtake Airtel in terms of market share and subscriber base.

With this merger, Bharti’s total subscriber base will cross Rs 320 million, but will still fall short of the Vodafone and Idea combine, whose subscriber base is pegged at 390 million. At number three will be Reliance Jio followed by state operator BSNL. India’s incumbent telecom operators, along with Reliance Jio Infocomm, may corner 90 per cent of market share by revenue, according to a note by brokerage firm CLSA.

Ironically, it was Sunil Mittal who had complained of consolidation causing lesser competition in the industry and had warned at the recent India Economic Summit that competition is going down and there are only three players now.

An industry source said, “The deal belongs to Airtel. Most importantly it will bolster Airtel’s already strong spectrum foot-print with the addition of 178.5 MHz spectrum in the 850, 1800 & 2100 MHz bands, which will be very useful for Airtel ‘s 4G service for both capacity and coverage.” The merger of TTSL’s customers and revenue base will further strengthen Bharti Airtel’s revenue market share (RMS), Airtel said.

Suffering on account of Jio’s free and cheap service onslaught, Airtel had posted a weak first quarter (April-June) result with a 75 per cent drop in net profit to Rs 367 crore. The average revenue per user of Airtel had slipped on a quarter-on-quarter basis to Rs 154 per month. The total revenue of the company had slipped 14 per cent Y-o-Y to Rs 21,958 crore during the quarter under review.

Tata Teleservices is not a listed entity, while it’s Maharashtra arm is listed. The telecom company in one of its worst phases had seen its net worth eroded by over Rs 11, 000 crore at the end of financial year ended March 2017. The company had announced a loss of Rs 4,617 crore for FY17, compared to a loss of Rs 2,023 crore in FY16 while, the company’s debt stood at Rs 28,766 crore in FY17. Because of the price war in telecom spurred by the entry of Reliance Jio, the Tata group company’s turnover declined to Rs 9,419 crore in FY17 from Rs 10,588 crore in FY16. It was on a continuous slide on the subscriber front.

Bharti Airtel will now serve Tata’s customers while offering them the added benefits of its innovative product portfolio, access to superior voice & data services, mobile banking, VAS and domestic/ international roaming facilities.

Tata consumer mobile business (CMB’s) operations and services will continue as normal until the completion of the transaction. Apart from spectrum and subscribers, the other advantage Airtel gets is this transaction will also provide it with an indefeasible right to use (IRU) for part of the existing fibre network of Tata supplementing its own fibre network. The 5,000 employees of Tata will be demerged on the lines of the two businesses -- CMB and EFL (Enterprise and Fixed Line and Broadband) post an optimal manpower planning.

There are more changes on the anvil within the Tata company with the management in initial stages of exploring combination of its enterprise business with Tata Communications and its retail fixed line and broadband business with Tata Sky. Any such transaction will be subject to respective boards and other requisite approvals.

Tata and Bharti Airtel will work together to further explore other mutual areas of cooperation that will be value accretive for both the Groups, believes the company. The Bharti Board, which met on Thursday afternoon, has approved this transaction.

Goldman Sachs (India) Securities Private Limited is financial advisor to Tata.

Airtel with operations in 17 countries across Asia and Africa ranks amongst the top three mobile service providers globally in terms of subscribers.

In India, the company’s product offerings include 2G, 3G and 4G wireless services, mobile commerce, fixed line services, high speed home broadband, DTH and enterprise services, including national & international long distance services to carriers.