State Bank of India (SBI) Fixed Deposit Rates:

SBI revised interest rates on retail domestic term deposits (below Rs 1 crore) with effect from October 1, 2017, according to its website.The revised interest rates are as under:

| Tenors | Revised For Public w.e.f. 01.10.2017 (%) | Revised for Senior Citizens w.e.f. 01.10.2017 (%) |

| 7 days to 45 days | 5.5 | 6 |

| 46 days to 179 days | 6.5 | 7 |

| 180 days to 210 days | 6.5 | 7 |

| 211 days to less than 1 year | 6.5 | 7 |

| 1 year | 6.5 | 7 |

| Above 1 year to 455 days | 6.5 | 7 |

| 456 days to less than 2 years | 6.5 | 7 |

| 2 years to less than 3 years | 6.25 | 6.75 |

| 3 years to less than 5 years | 6.25 | 6.75 |

| 5 years and up to 10 years | 6.25 | 6.75 |

How to open SBI Fixed deposit online:

1) Login to your SBI online banking facility using your login id and password.

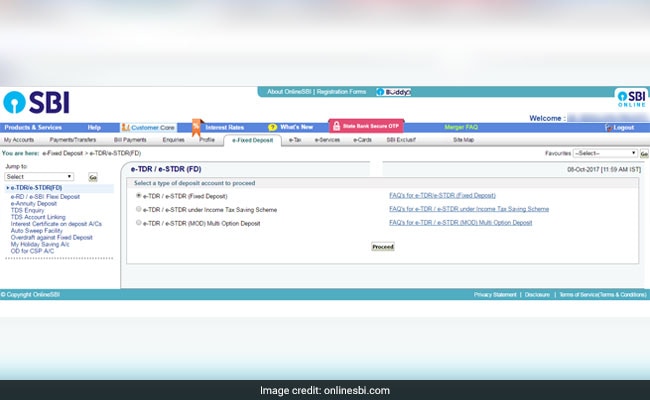

2) On the home page, select e-fixed deposit tab on the top menu.

SBI E-fixed deposits: A screen grab from SBI's online banking page

3) Once you select the e-fixed deposit, you will see three options i.e. fixed deposits, fixed deposits under income tax savings scheme and multi option deposits. If you want to open normal fixed deposit, then select the first option and click on "proceed" button.

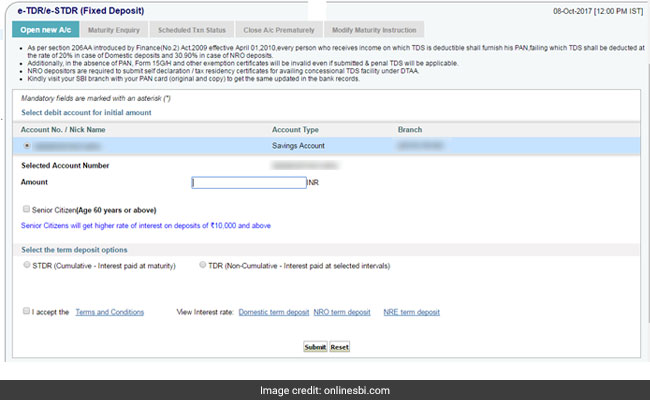

4) If you have multiple bank account numbers linked to your online banking, select the account from which you want the FD amount to be debited. Then fill the amount for which you want to create an FD. If you are a senior citizen, then select the "senior citizen" option. Senior citizens get higher interest on some maturities compared to others.

5) Below the "senior citizen" option, select the term deposit option. If you want your quarterly interest to be reinvested and paid along with principal at the time of maturity, then select "STDR" option. If you want your interest to be paid quarterly, then select "TDR" option.

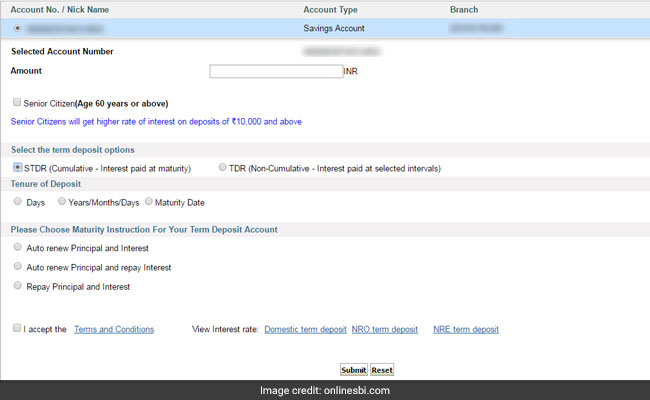

6) Once you click on the "STDR" option, it will ask you to fill the tenure of deposit. If you want to fix the maturity of your FD in number of days, then select "days". If you have a fixed date in your mind for your FD to mature, then select the "maturity date option", otherwise select the "years/months/days" option where you can give the maturity in no of years plus months and days like four year, two months and 15 days.

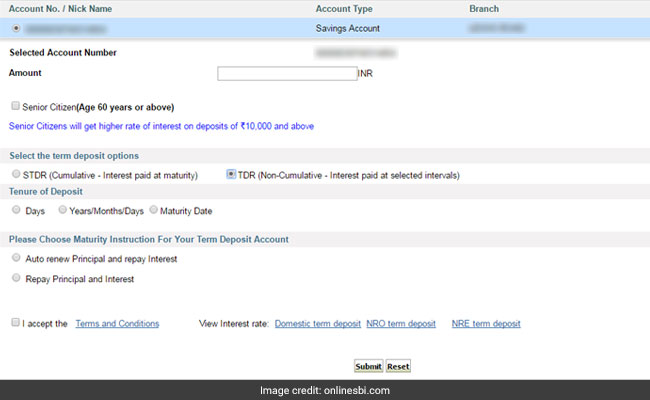

7) After you select the tenure, you have to select your maturity options from three available options - auto renew principal and interest, auto renew principal and repay interest, repay principal and interest.

8) If you select any of the first two maturity options - auto renew principal and interest , auto renew principal and repay interest - then you will also have to give the tenure for which you want your FD to be renewed after maturity.

9) Now read the terms and conditions and accept them to create the e-fixed deposit.

10) Once you accept and click "submit", your fixed deposit will be created and you will get a confirmation for the same. Please record the transaction number for any future reference.