China is said to curb stock-market rally by selling banks

Bloomberg|

Updated: Oct 10, 2017, 12.51 PM IST

Chinese state-backed funds intervened to limit gains in the nation’s stock market on Monday, part of the government’s effort to restrain market swings before a key leadership reshuffle this month, according to people familiar with the matter.

The funds sold shares of large-cap companies, including banks and China United Network Communications Ltd., said the people, who asked not to be identified because the information is private. Before Monday, the funds had been buying stocks to support the market after S&P Global Ratings cut China’s sovereign credit grade, the people said. Their share purchases on Sept. 22 and the following week included Unicom and other large-cap companies.

The moves to cap both gains and losses reflect Chinese leaders’ focus on stability in the run-up to a twice-a-decade Communist Party congress. While the country’s stocks entered the global spotlight as they swung from boom to bust in 2015, government intervention has since helped reduce volatility in the $7.7 trillion market to the lowest level since the early 1990s. State funds have been known to increase their presence during important political events.

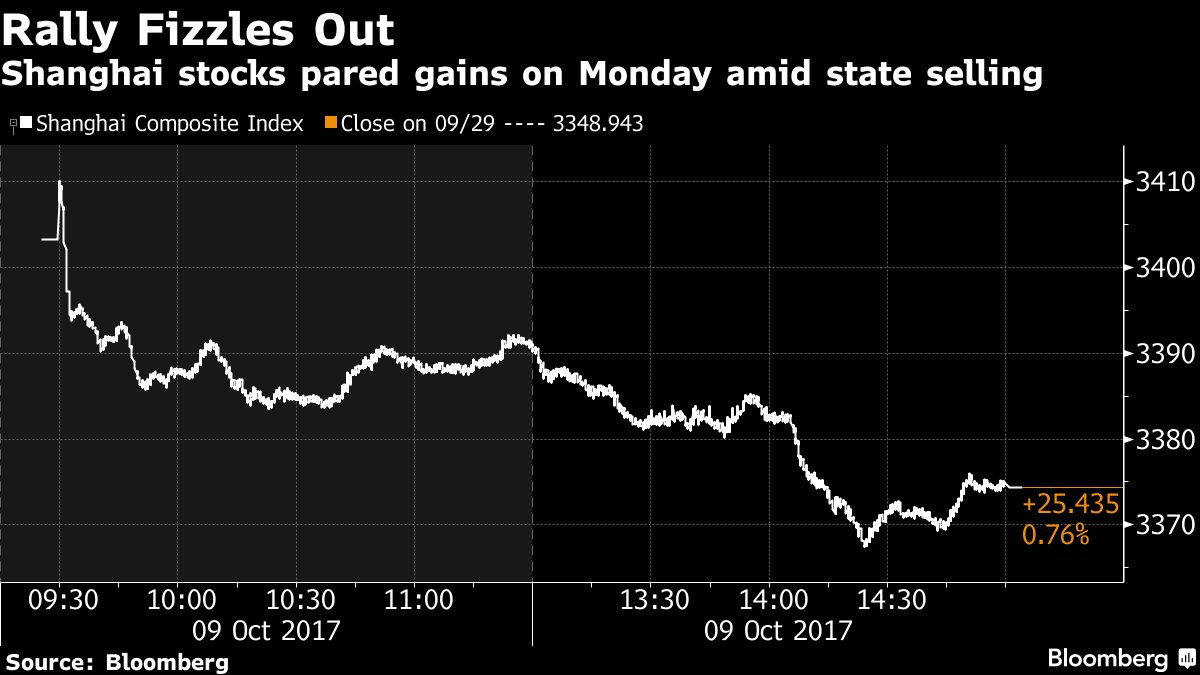

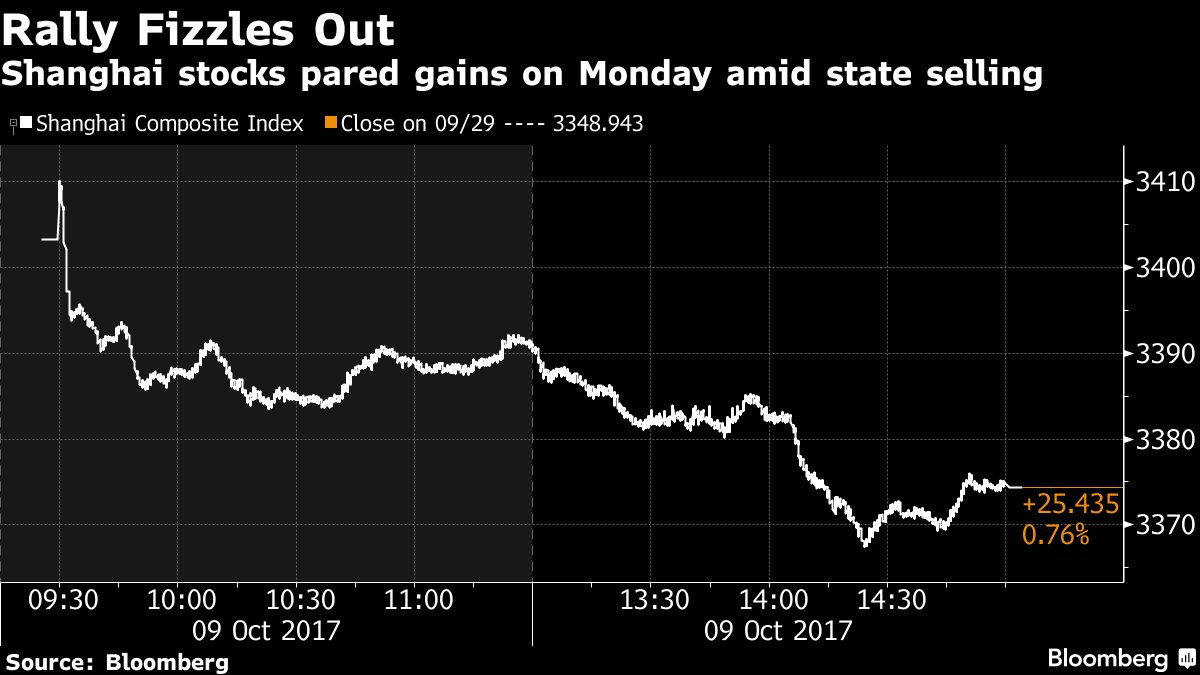

After touching the highest intraday level since January 2016 on Monday, the Shanghai Composite Index erased half its gain by the close. Industrial & Commercial Bank of China Ltd. pared its advance to 1.7 per cent from 5.5 per cent, while Unicom dropped the most in a week.

The China Securities Regulatory Commission didn’t immediately respond to a faxed request for comment. The Shanghai Composite slipped 0.1 per cent at 1:42 p.m. local time on Tuesday.

News of state selling could help curb gains in large-cap Chinese stocks, said Ken Chen, a Shanghai-based analyst at KGI Securities. But he added that China’s big companies may remain a “major investment theme” if the country eases monetary policy. The stock market’s early rally on Monday was sparked by a central bank announcement that it will cut lenders’ reserve ratios from next year, a move that promises to support bank earnings and boost small businesses.

If history is any guide, the government is unlikely to allow a major equity rally any time soon. After state-backed funds were said to sell bank shares in August 2016, the Shanghai Composite slipped 1.8 per cent over the following two weeks.

The funds sold shares of large-cap companies, including banks and China United Network Communications Ltd., said the people, who asked not to be identified because the information is private. Before Monday, the funds had been buying stocks to support the market after S&P Global Ratings cut China’s sovereign credit grade, the people said. Their share purchases on Sept. 22 and the following week included Unicom and other large-cap companies.

The moves to cap both gains and losses reflect Chinese leaders’ focus on stability in the run-up to a twice-a-decade Communist Party congress. While the country’s stocks entered the global spotlight as they swung from boom to bust in 2015, government intervention has since helped reduce volatility in the $7.7 trillion market to the lowest level since the early 1990s. State funds have been known to increase their presence during important political events.

After touching the highest intraday level since January 2016 on Monday, the Shanghai Composite Index erased half its gain by the close. Industrial & Commercial Bank of China Ltd. pared its advance to 1.7 per cent from 5.5 per cent, while Unicom dropped the most in a week.

The China Securities Regulatory Commission didn’t immediately respond to a faxed request for comment. The Shanghai Composite slipped 0.1 per cent at 1:42 p.m. local time on Tuesday.

News of state selling could help curb gains in large-cap Chinese stocks, said Ken Chen, a Shanghai-based analyst at KGI Securities. But he added that China’s big companies may remain a “major investment theme” if the country eases monetary policy. The stock market’s early rally on Monday was sparked by a central bank announcement that it will cut lenders’ reserve ratios from next year, a move that promises to support bank earnings and boost small businesses.

If history is any guide, the government is unlikely to allow a major equity rally any time soon. After state-backed funds were said to sell bank shares in August 2016, the Shanghai Composite slipped 1.8 per cent over the following two weeks.