How PF Auto Transfer Works Through Form 11

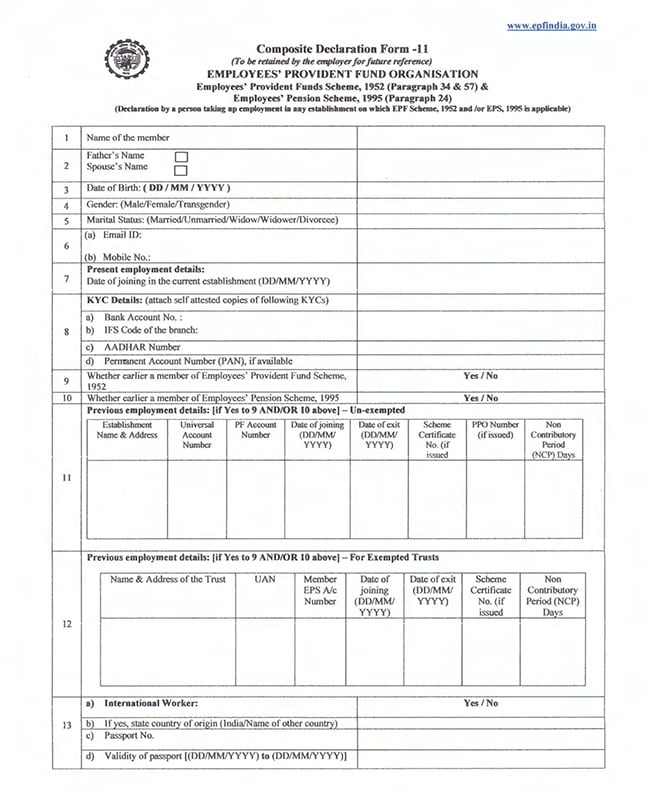

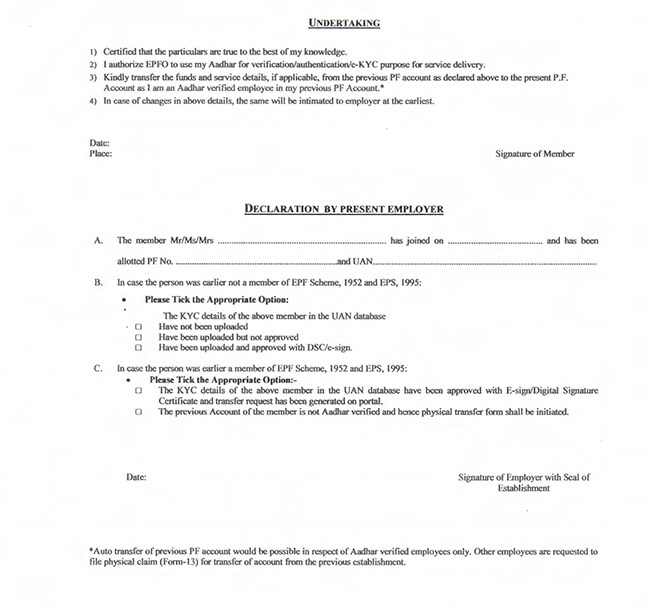

1) After joining a new organization, the new employee has to fill and submit details through the new Composite Declaration Form 11, wherein the joinee has to fill personal details and other details about previous employment. The new joined has to also fill in UAN (Universal Account Number) and previous provident fund number.

2) The employer enters the information as given in Form 11 in the employer's portal.

3) The data is then validated with the information available against the UAN and in case of any discrepancy, the employer has to verify/update the information provided.

4) In case, the earlier UAN was Aadhaar seeded and verified, the declaration by the employer of transfer request made by the employee in Form-11 will trigger an auto-transfer process which will transfer the accumulations against his previous provident fund account (PF ID) to the new provident fund account. Form No. 13 is not required to be submitted in such cases.

5) An SMS informing the subscriber about the proposed auto-transfer will be sent on his registered mobile number.

6) Auto transfer will be completed only after the member does not request to stop the proposed auto-transfer (either online, or through employer or at the nearest EPFO office) within 10 days of the SMS, and the first contribution by the present employer is deposited and reconciled.

7) On transfer of the account, the new employee will be communicated by SMS on his mobile number seeded against the UAN and by e-mail, if registered.

8) Auto transfer of previous PF account would be possible in respect of Aadhar verified employees only. In case the earlier UAN was not seeded with Aadhaar or UAN was Aadhaar seeded but not verified, the member needs to apply for transfer in Form-13 as the existing procedure for physical transfer would be followed.

(Composite Declaration Form 11 issued by EPFO)

Meanwhile, retirement fund body EPFO said it has asked its field offices to take action against erring 700 PF trusts that have not filed online returns. The Central Provident Fund Commissioner after a review found that more than 700 exempted establishments (private PF trusts) did not file online returns, the EPFO said in a statement.