19:58 (IST)

GST Council meeting ends. Finance Minister Arun Jaitley may speak shortly.

19:58 (IST)

GST Council meeting ends. Finance Minister Arun Jaitley may speak shortly.

20:04 (IST)

Impact of GST on trade, transition discussed: Jaitley

"Impact of GST on trade, transition issues were discussed today. Exports were a main concern of the small-scale sector," says Finance Minister Arun Jaitley.

20:01 (IST)

Finance Minister Arun Jaitley addresses media.

19:47 (IST)

Big-ticket rate revisions not discussed

Jammu and Kashmir Haseeb Drabu told CNBC TV18 not a lot of big-ticket rate revisions at this GST Council meeting were discussed.

19:44 (IST)

GST on works contracts reduced to 5%

Jammu and Kashmir Haseeb Drabu told CNBC TV18 that GST on works contracts for government reduced to 5 percent from 12 percent.

19:42 (IST)

#CNBCTV18Exclusive | Haseeb Drabu J&K FM says there's a possibility that #GST Council may look at other modalities instead of e-wallet

— CNBC-TV18 (@CNBCTV18Live) October 6, 2017

19:41 (IST)

#CNBCTV18Exclusive | Haseeb Drabu J&K FM says focus was on small traders & exporters & on reducing compliance distress pic.twitter.com/jMO0po4pDF

— CNBC-TV18 (@CNBCTV18Live) October 6, 2017

19:40 (IST)

What we know so far:

• GST Council to allow quarterly filing of returns for businesses with annual turnover of less than Rs 1 crore.

• Relief for jewellers as no need to furnish PAN card on jewellery purchase of more than Rs 50,000.

• GST rate on handicrafts may be cut from 12% to 5%.

• GST Council decides to roll-out e-way billing from April.

• A few daily-use items to get cheaper. Some daily use items removed from 28 percent tax slab.

• In principle, GST Council has revised the rate of air-conditioned restaurants to 12 percent. A group of ministers has been formed to devise the mechanism. The GoM will submit its report in 10 days.

19:37 (IST)

Meanwhile, Ludhiana industrialists protest against GST

A group of industrialists in this Punjab city representing small industries on Friday protested against the new indirect tax GST.

They demanded the withdrawal of Goods and Services Tax.

Jaswinder Singh, president of Janata Nagar Small Industrial Association, who was leading the protest said that the wrong economic policies of the government have destroyed the financial structure of the country.

Trade and industry have become the worst victim of wrong economic policies, he added.

PTI

Compliance burden for small firms to ease

Reports suggest that SMEs with annual turn over up to Rs 1.5 crore have been allowed to file returns on a quarterly basis now, instead of monthly. This is a good move that will ease the compliance burden for small industrial units. Small industrial units need to be given special care since these entities lack the clout and financial muscle enjoyed by large corporations.

19:29 (IST)

GST Council took few crucial decisions in the meeting today,council member @MauvinGodinho speaks to CNBC-TV18 highlighting key decisions pic.twitter.com/hWiCc3FJpI

— CNBC-TV18 News (@CNBCTV18News) October 6, 2017

19:27 (IST)

SMEs earning up to Rs 1.5 crore annually to file quarterly returns

SMEs with an annual turnover of up to Rs 1.5 crore allowed to file quarterly returns, reports CNBC TV18.

19:24 (IST)

Next GST Council meet to be held on 9 and 10 November in Guwahati.

19:22 (IST)

#GSTCouncilMeet that started at 10.30 am, still underway.Union Finance Minister Arun Jaitley expected to brief media after the meeting ends.

— ANI (@ANI) October 6, 2017

19:19 (IST)

Bills in AC restaurants to become cheaper

AC restaurant tax rate revised to 12 percent from 28 percent GST Council member Mauvin Godinho tells CNBC TV18.

19:16 (IST)

Six months wait for e-Wallet facility to come up for exporters

e-Wallet for exporters will come into play in six months, CNBC TV18 reports.

19:14 (IST)

Gas stoves get cheaper

According to the CNBC TV18, GST rate for some items has been reduced from 28 percent. GST rate on gas stove and consumer articles have been brought out of the 28 percent bracket.

19:03 (IST)

GST Council to examine key rate cut issues in restaurants

19:00 (IST)

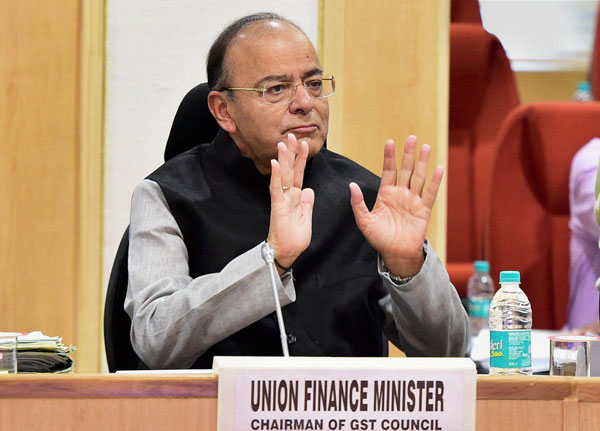

Union Finance Minister Arun Jaitley at the 22nd meeting of the Goods and Services Tax Council, in New Delhi on Friday. PTI

18:56 (IST)

JUST IN -- #GST council decides to roll out E-way billing from April: CNBC sources

— News18 (@CNNnews18) October 6, 2017

LIVE UPDATES: https://t.co/3aNVqUKErqpic.twitter.com/2J2UnaF5iy

18:55 (IST)

Finance Minister Arun Jaitley will brief the media at 7 pm.

By removing PAN requirement for gold purchase, isn't the govt taking a U-turn?

If initial reports are anything to go by, from now on the government need not be informed on the purchase of jewellery for over Rs 50,000. PAN card is no longer mandatory for such purchases. Prima facie, this decision is surprising since the very idea of making PAN mandatory for high-value gold purchases was to check the flow of illegal cash. By removing this restriction, isn't the government now taking a U-turn from this objective?

18:46 (IST)

GST Meet helps markets go for a bull run on Friday; hits two-week high

Domestic bourses saw their their first weekly rise in three weeks as the Sensex on Friday soared over 222 points to end at an over two-week high of 31,814.22 and the Nifty closed near 10,000-level on across-the-spectrum buying led by metal stocks ahead of the GST Council meet outcome.

Expectations built up among investors on ground that today's GST Council meeting may provide some relief to exporters and small and medium enterprises in terms of faster refunds and compliance.

Positive global cues tracking another record close on Wall Street on account of buoyant US data and hopes for tax reform too helped the domestic rally.

PTI

18:36 (IST)

Ahead of state Gujarat polls, government offers relief for jewellers

The government need not be informed on the purchase of jewellery for over Rs 50,000. PAN card no longer mandatory for such purchases, reports CNBC Awaaz.

18:30 (IST)

The threshold for composition scheme in GST hiked from Rs 75 lakh to Rs 1 crore: Sources.

PTI

18:27 (IST)

Handicraft to get cheaper, reports moneycontrol.com

Quoting sources moneycontrol.com reported that the GST rate on some handicraft items may be cut to 5 percent from 12 percent.

18:19 (IST)

Haryana Finance Minister Capt Abhimanyu and J & K Chief Minister Haseeb Drabu at the 22nd meeting of the Goods and Services Tax (GST) council, in New Delhi on Friday. PTI

18:06 (IST)

World Bank says GST will have positive impact

World Bank president Jim Yong Kim said that the Goods and Services Tax is going to have a hugely positive impact on the Indian economy.

"There's been a deceleration in the first quarter, but we think that's mostly due to temporary disruptions in preparation for the GST, which by the way is going to have a hugely positive impact on the economy," Kim told a group of reporters during a conference call ahead of the annual meeting of the International Monetary Fund and the World Bank in Washington.

17:59 (IST)

Union Finance Minister Arun Jaitley, Minister for State for Finance Shiv Pratap Shukla and Revenue Secretary Hasmukh Adhia at the 22nd meeting of the Goods and Services Tax (GST) council, in New Delhi on Friday. PTI

17:55 (IST)

Composition scheme threshold to go up?

According to moneycontrol.com, Telangana finance minister says that composition scheme threshold likely to be raised to Rs 1 crore to 1.5 crore; expect full consensus on it.

17:53 (IST)

Goa chief minister Manohar Parrikar, Puducherry chief minister V Narayanasami, Bihar deputy chief minister Sushil Kumar Modi, Delhi deputy chief minister Manish Sisodia at the 22nd meeting of the Goods and Services Tax (GST) council, in New Delhi on Friday. PTI

17:48 (IST)

Composition scheme limit hiked?

Sources say GST Council has decided to raise composition scheme limit to Rs 1 crore from Rs 75 lakh, reports CNBC-TV18’s Shereen Bhan

17:44 (IST)

17:36 (IST)

No discussion on cutting tax rates?

A Financial Express report said: "The GST Council, in its 22nd meeting today in New Delhi, has apparently skipped the discussion on cutting tax rates on the remaining 60 of the 100 items under review, and has instead chosen to focus on straightening out administrative and procedural issues to make the implementation of the tax reform simpler for business owners."

Political consensus for GST a big success

The political consensus generated for the passage of GST Bill was a major success of the Narendra Modi the government to push the reform agenda. GST has been stuck in Parliament for more than a decade. But, with small companies increasingly feeling the heat of GST rollout, this political consensus is on a shaky ground now. Opposition parties have escalated the attack on the government citing the hardship faced by small entrepreneurs in the GST regime. If necessary adjustments are not made to ease this pain, the government will have to prepare for tougher days ahead.

17:16 (IST)

#GSTcouncil discussed issues faced by small traders, requested quarterly filing of returns for small businesses: AP Fin Min Y.Ramakrishnudu

— ANI (@ANI) October 6, 2017

17:15 (IST)

Chairing 22nd meeting of the #GST Council in New Delhi, Oct. 6, 2017 pic.twitter.com/bE00APAQ5q

— Arun Jaitley (@arunjaitley) October 6, 2017

17:04 (IST)

.@GST_Council mulls move back to pre-GST regime benefits for exporters, learns @ShereenBhan#CNBCTV18Exclusivepic.twitter.com/hYeLDIjE4j

— CNBC-TV18 News (@CNBCTV18News) October 6, 2017

Hiccups inevitable for GST in the short-term

Short-term hiccups are inevitable during the implementation of GST. But, the government must work on models to help small and medium companies operate smoothly during the transition period. Prime Minister Narendra Modi shouldn’t let the opposition demonetise the GST giving an excuse of a faulty rollout. As the World Bank has said, despite the temporary pain, GST is certain to have a positive impact on the economy in the long-term. The immediate task for the government is to cushion small industrial units from the transition pain by addressing inefficiencies in the implementation while taking political consensus ahead.

Comparing GST with other economic steps of the Modi government is wrong

It is wrong to compare the GST with Modi’s other economic moves such as demonetisation. This is a much-needed, long-awaited tax reform while note ban was a risky adventure, that later turned out to be a misadventure for the economy. Unlike this, GST is a progressive step India has taken to elevate the economy to the next orbit of development.

16:46 (IST)

Cheaper restaurants, cab services

According to moneycontrol.com, restaurants, cab services are among the 60 items for which rates are likely to come down.

16:42 (IST)

Council unanimous on increasing composition threshold on turnover of Rs.1 crore: Etela Rajender, Telangana Fin Min #GSTCouncilMeetpic.twitter.com/0tL7T0P5Dw

— ANI (@ANI) October 6, 2017

The all-powerful GST Council is meeting on Friday amid rising clamour for changes in the new tax regime that has inflicted considerable pain on the small and medium enterprises.

The 22nd meeting of the council comes soon after Prime Minister Narendra Modi, BJP president Amit Shah and Finance Minister Arun Jaitley held an emergency meeting on Thursday, where the topic of discussion was reportedly the state of the economy and the ways to affect a course correction.

Small and medium-sized enterprises, crucial to Modi’s plans to create millions of more jobs, have been hurt by a massive tax overhaul launched in July that added layers of extra bureaucracy for firms and hit exports.

Finance Minister Arun Jaitley is now chairing the meeting of the council. Officials with knowledge of the meeting and industry bodies told Reuters that they expected the government to simplify the filing of tax returns under GST to ease the burden on smaller businesses.

Many companies also want the government to increase the size of turnover imposed before they must start filing returns. Ajay Sahai, head of the Federation of Indian Export Organisation, told the news agency that he expected the government to allow its 25,000 small and medium-sized members to file tax returns quarterly.

However, it is not only the MSMEs that will get a hand-holding. Read here about the four key steps the GST Council is likely to take on Friday.

Published Date: Oct 06, 2017 07:21 pm | Updated Date: Oct 06, 2017 07:58 pm

GST Council meets today: From support for MSMEs to tax rate cuts; how govt plans to ease the pain

Narendra Modi meets Arun Jaitley, Amit Shah: Govt may be mulling measures to ease traders' GST worries

Narendra Modi to address BJP national executive meet today: Slow economic growth, Assembly polls atop agenda