Don’t jump over market bounce; dollar sending out warning signs

, ETMarkets.com|

Updated: Oct 06, 2017, 10.57 AM IST

NEW DELHI: The greenback is in the green again!

US President Donald Trump’s proposed tax concessions, rising chances of a December rate hike by the US central bank and its balance sheet trimming have reversed a falling trend in the US dollar, which some analysts say may cause pain in emerging markets.

Indian investors have a good reason to worry. Should the latest rally in the dollar index continue, it would most likely halt the latest rebound in domestic equities and end the bull run that pushed the domestic benchmarks to new highs this year.

The dollar index, which tracks the US currency against a basket of six top global currencies, was back at 93. India’s rupee is down about 200 paise from its July high to quote at 65.3 to the dollar on Friday.

A falling rupee is positive for many of the Sensex and Nifty constituents, as they generate good shares of their earnings abroad.

But weakness in the local currency can threaten domestic macro-economics, as costlier imports can throw India’s already high current account deficit out of control.

Foreign portfolio investors, traditionally a major driver of Indian equities, find it unattractive when the rupee weakens, as cross-currency maths eats into their return on equities.

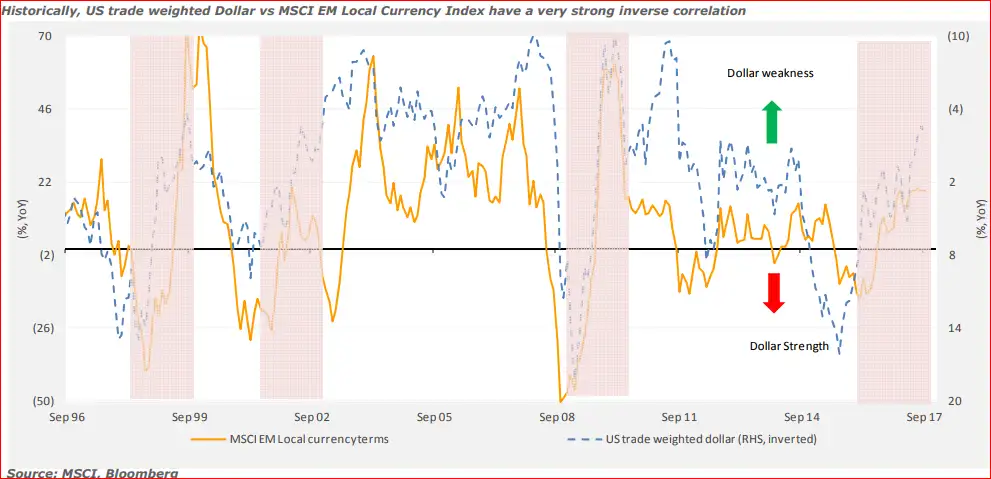

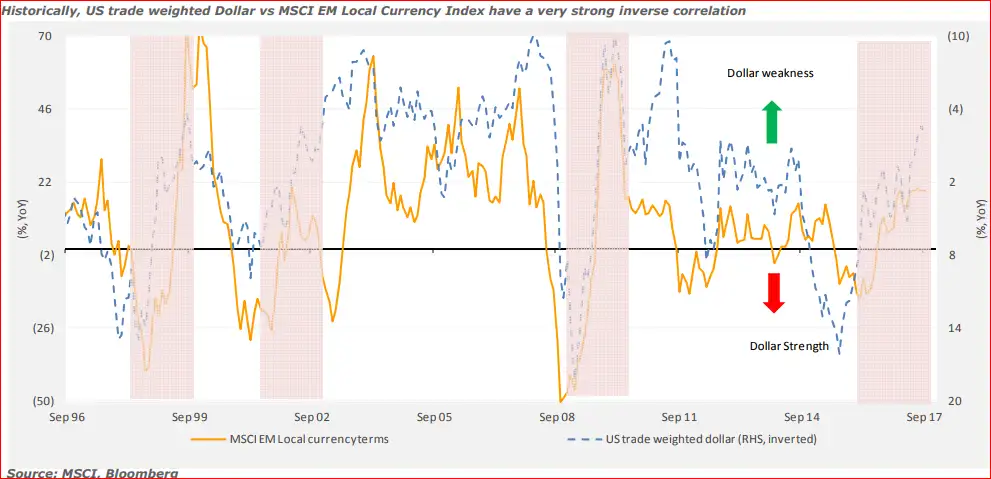

A persistent weakness in the greenback over the past 1.5 years has been a key driver of the rally in emerging markets’ (EM) stocks.

Historically, dollar movements have had a strong influence on emerging market assets, says Mumbai-based Edelweiss Securities. Of late, the greenback has started strengthening again owing to a relatively more hawkish Fed and expectations of tax cuts by the Trump administration. If this strength persists, it could weigh on EM equities, the brokerage noted.

A rise in dollar index weighs on EM currencies. After a strong show for most of last year and first quarter of this, the rupee weakened quite a bit the second quarter.

Kotak Institutional Equities said the economic recovery in the US and progress on taxation reforms may result in the US Fed unwinding its balance sheet and raising interest rates faster than the market’s current expectations, which could influence the rupee movement.

Emerging markets have often performed poorly at times of strong appreciation in the US dollar, the brokerage said.

Emerging market equities are considered risky assets. Whenever optimism over the US economy has pushed the dollar index higher, overseas funds have shifted money from emerging markets to dollar-denominated assets.

The correlation between the dollar index and EM equities has not been that pronounced when the former has risen due to weakness in other currencies, such as the pound and the euro due to weakness in their dominant economies.

Rich valuation of Indian stocks does not permit much room for further deterioration in India’s macroeconomic parameters and earnings disappointments, said Kotak Equities

Any further weakness in the rupee may be crucial for India Inc’s earnings estimates for FY2018E and FY2019E, it said, as the currency equation matters to bottom line performance of companies whose businesses are linked to global commodity prices, or IT and pharmaceutical firms that have fair shares of their businesses abroad.

US President Donald Trump’s proposed tax concessions, rising chances of a December rate hike by the US central bank and its balance sheet trimming have reversed a falling trend in the US dollar, which some analysts say may cause pain in emerging markets.

Indian investors have a good reason to worry. Should the latest rally in the dollar index continue, it would most likely halt the latest rebound in domestic equities and end the bull run that pushed the domestic benchmarks to new highs this year.

The dollar index, which tracks the US currency against a basket of six top global currencies, was back at 93. India’s rupee is down about 200 paise from its July high to quote at 65.3 to the dollar on Friday.

A falling rupee is positive for many of the Sensex and Nifty constituents, as they generate good shares of their earnings abroad.

But weakness in the local currency can threaten domestic macro-economics, as costlier imports can throw India’s already high current account deficit out of control.

Foreign portfolio investors, traditionally a major driver of Indian equities, find it unattractive when the rupee weakens, as cross-currency maths eats into their return on equities.

A persistent weakness in the greenback over the past 1.5 years has been a key driver of the rally in emerging markets’ (EM) stocks.

Historically, dollar movements have had a strong influence on emerging market assets, says Mumbai-based Edelweiss Securities. Of late, the greenback has started strengthening again owing to a relatively more hawkish Fed and expectations of tax cuts by the Trump administration. If this strength persists, it could weigh on EM equities, the brokerage noted.

A rise in dollar index weighs on EM currencies. After a strong show for most of last year and first quarter of this, the rupee weakened quite a bit the second quarter.

Kotak Institutional Equities said the economic recovery in the US and progress on taxation reforms may result in the US Fed unwinding its balance sheet and raising interest rates faster than the market’s current expectations, which could influence the rupee movement.

Emerging markets have often performed poorly at times of strong appreciation in the US dollar, the brokerage said.

Emerging market equities are considered risky assets. Whenever optimism over the US economy has pushed the dollar index higher, overseas funds have shifted money from emerging markets to dollar-denominated assets.

The correlation between the dollar index and EM equities has not been that pronounced when the former has risen due to weakness in other currencies, such as the pound and the euro due to weakness in their dominant economies.

Rich valuation of Indian stocks does not permit much room for further deterioration in India’s macroeconomic parameters and earnings disappointments, said Kotak Equities

Any further weakness in the rupee may be crucial for India Inc’s earnings estimates for FY2018E and FY2019E, it said, as the currency equation matters to bottom line performance of companies whose businesses are linked to global commodity prices, or IT and pharmaceutical firms that have fair shares of their businesses abroad.