Why consumer is king for banks

, ET Bureau|

Oct 05, 2017, 12.58 AM IST

Sumit Bali, who heads the personal assets vertical at Kotak Mahindra Bank (KMB), is mindful of the changing preferences of online shoppers. Weeks before the onset of the festival season, Bali and his team chalk out strategies to garner more ‘card spends’ on major ecommerce sites.

“Earlier, people used their credit cards to buy fuel only; a little later, they started buying apparel. Now, they use cards to shop online,” says Bali.

KMB’s ‘small business, personal loan and credit cards’ advances have grown over 24% since last year, to Rs 18,277 crore in the first quarter of this fiscal. This portfolio accounts for nearly 10% of its assets. KMB has over 10 lakh credit card holders.

“Our cards business is doing well. We run several offers for ecommerce buyers; we give them adequate limits, allow easy EMI conversion and float loyalty programmes,” Bali adds.

Bali has little choice but to entice shoppers to buy more using Kotak cards. He is running a nimble-footed race against most private banks — and now, even some public sector banks — to capture a larger share of retail business. And credit card is a hot lap in the race, that has just begun, with the starter pistol being fired just a couple of years back.

Outstanding credit on cards has surged over 71%, from Rs 33,115 crore in July 2015 to Rs 56,775 crore in July 2017.

The current trend to encourage more credit card usage is in direct contrast to what retail bankers did in 2010 (in the aftermath of the global financial crisis).

Back then, none of them wanted “to do a lot of credit cards” as they had burnt their fingers on account of higher card payment defaults and even ‘loss assets.’ Credit card users alone cannot be blamed for this, as banks had also lent without proper care or diligence, giving rise to massive indebtedness among retail borrowers. Job losses and salary cuts pursuant to the global economic meltdown had caused further stress in retail books.

But these are matters of the past, and bankers, in their own words, have learnt well and become much wiser. Call it audacity or being simply opportunistic in business, banks are more focused on creating retail assets now. Perhaps it is their bad experience lending to corporates that has forced banks to turn retail.

To make a dent, banks started expanding their credit card portfolios two years ago. Simultaneously, they became more amenable to disbursing loans for homes, auto, personal, small business, gold, against property and for education.

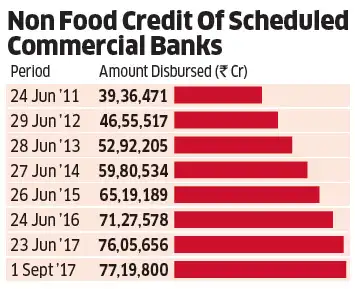

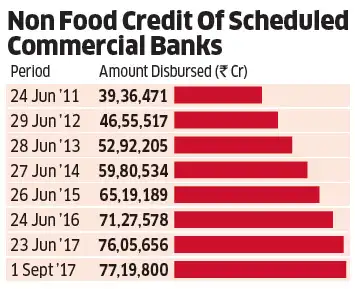

Retail loans have grown 37% since mid-2015, to Rs 16.65 lakh crore currently. And from the troughs of 2010, retail loan books have almost trebled (see graph below) .

“Retail credit has been the only area driving business growth for private banks,” says Siddharth Purohit, senior banking analyst at Angel Broking. “In the absence of a pick-up in credit demand from corporates, retail will continue to be the area of focus for banks.”

“Retail credit has been the only area driving business growth for private banks,” says Siddharth Purohit, senior banking analyst at Angel Broking. “In the absence of a pick-up in credit demand from corporates, retail will continue to be the area of focus for banks.”

“PSU banks have not managed to expand their retail lending books because they’re still dependent on large-ticket loans; these banks do not even have enough products around retail lending,” he adds.

What started as a simple business strategy became a business imperative when bank coffers brimmed over with retail deposits in the months that followed demonetisation. With not much of corporate capex happening, banks are forced to loosen their purse strings in favour of small borrowers. This, in a way, sets the tone for the return of retail lending.

LOWER DELINQUENCY RATES

From a bank’s perspective, times have never been better to focus on retail customers. They are flush with cash to lend, interest rates have fallen to levels that make sales pitches effective and easy, manufacturers are willing to sell wares at deep discounts and consumers are showing more willingness to buy. That apart, retail ‘delinquency rates’ are currently trending at historical lows across most lending products.

A loan is termed to be delinquent when no repayment (EMI — principal or interest payment) is made for 90 days. A Transunion-Cibil study, done exclusively for ET, reveals that delinquency rates in credit cards has dropped from 6% in the second quarter of 2010 to 1.5% in the first quarter of this fiscal.

In personal loans (which are mostly unsecured in nature), default rates have fallen from 2.7% in 2010’s second quarter to 0.7% now. Delinquency rates in housing loans (including loans against property, or LAP) and auto loan portfolios also hover at a little over 1%.

“Banks are now lending in a more responsible manner,” says Harshala Chandorkar, COO of Transunion-Cibil, a leading credit information bureau.

“The sourcing has been good for most banks. Earlier, they would lend without really looking at the quality of borrowers. Now, they’re more careful. This has lowered instances of overleveraging, too,” Chandorkar affirms.

Higher delinquency rates prompted banks to shrink their retail lending operations in 2010. It took a long time for banks to get back to lending generously to retail customers. By 2012, the more adventurous among banks started secured lending — mostly LAP with very low loan-to-value (LTV). So, for a mortgaged property worth Rs 10 lakh, the bank would only lend Rs 5 lakh, the LTV, in this case, being 50%. By 2012, gold loans started gaining a larger share in retail books of most banks.

Buoyed by the success of these two products, banks started taking interest in expanding their unsecured loan basket. It started with consumer durables loans, then credit cards in 2014-15, vehicle loans and then personal loans.

All this while lenders focused on growing their housing loan book, which is regarded stable, and accounts for over half of all retail loans across banks. “The emergence of credit bureaus has helped us immensely,” says Arvind Kapil, country head, home, mortgage and unsecured loans, HDFC Bank. “We get much ‘intel’ about the borrower before every loan we disburse… This is a marked departure from what we did in 2007-08.”

These days, bankers like Kapil rely a lot on credit bureau data before deciding the creditworthiness of borrowers. They run risk predictive models and artificial intelligence (AI) tools to ascertain financial habits and behaviour of prospective borrowers. “Ten years ago, we had a lot of data, but we couldn’t do a lot of analysis or draw correlation patterns. Now, we process data extensively to get meaningful inputs. This is helping us lend more efficiently,” says Kapil.

Increased levels of digitisation have also helped to banks to reach out retail customers more seamlessly. Large private banks such as HDFC, Axis, ICICI and Kotak Mahindra have capabilities to disburse retail loans in less than 24 hours. Some have also shifted loan products online, which enables customers to get loans even on Sundays and other non-working days.

“Delinquency rates (on retail loans) have also fallen because customers are aware of the importance of maintaining a high credit score – and the applicability of it in various spheres,” points out Kapil.

BUSINESS OF RETAIL LENDING

Most private banks have expanded retail assets to nearly 45% of total advances. Apart from home loans, banks have been able to grow their auto, personal, LAP, small business finance and credit card portfolios by a good measure. Their target customer base is mostly the salaried class and self-employed professionals.

For most banks, the move to retail assets started as a risk-mitigation gambit. Take, for instance, Axis Bank, which hit the road to “retailisation” in 2010. “Our focus was to granulise balance sheet and limit risk, both on the assets and liabilities side,” explains Rajiv Anand, executive director (retail banking), Axis Bank. “Our focus is to do incremental disbursements to existing customers, source through internal channels and also acquire new customers. Retail loan book is more of a contained risk; it’s a well-diversified book with a lot of heterogeneous borrowers. Besides, these are small ticket loans.”

Axis Bank, like many other banks, has a data team looking into the credit profile of customers. With data-enabled intelligent inputs, banks are no longer harping on collaterals for every loan disbursed. Cash flow-based lending is catching up among modern-day banks.

“We’re able to underwrite loans better now. We’re more open to taking higher levels of unsecured risk, thanks to our predictive models,” Anand adds. Most banks have built unsecured loan books in the range of 9–13% of their retail advances.

The retail strategy is working well for most banks, with ample growth potential in the coming days. Bankers rattle out streams of macro-data to support this premise. Total credit to household in India is just about 10%, vis-à-vis 16% in Russia, 40% in China, 24% in Brazil and 79% in the US. Housing loan penetration in India is just about 3%.

“Retail lending is bound to grow even more in a growing economy,” believes Kapil of HFDC Bank.

Analysts tracking banks are not worried about the stupendous rise in retail loans. But they are conscious of “negative macros” such as a probable economic slowdown, job losses and diminishing value of assets (which could affect bank collaterals).

“A time will come when leverage could increase in specific buckets — and we’re conscious of that. But now there’re no signs of excessive leverage,” says Anand of Axis. “Retail risk has been benign for some time now but we’ll be careful.”

Bali of KMB insists on keeping a tight lending policy to stay out of default trouble. “As long as you don’t get adventurous, you will not run into trouble with the retail book.”

“Earlier, people used their credit cards to buy fuel only; a little later, they started buying apparel. Now, they use cards to shop online,” says Bali.

KMB’s ‘small business, personal loan and credit cards’ advances have grown over 24% since last year, to Rs 18,277 crore in the first quarter of this fiscal. This portfolio accounts for nearly 10% of its assets. KMB has over 10 lakh credit card holders.

“Our cards business is doing well. We run several offers for ecommerce buyers; we give them adequate limits, allow easy EMI conversion and float loyalty programmes,” Bali adds.

Bali has little choice but to entice shoppers to buy more using Kotak cards. He is running a nimble-footed race against most private banks — and now, even some public sector banks — to capture a larger share of retail business. And credit card is a hot lap in the race, that has just begun, with the starter pistol being fired just a couple of years back.

Outstanding credit on cards has surged over 71%, from Rs 33,115 crore in July 2015 to Rs 56,775 crore in July 2017.

The current trend to encourage more credit card usage is in direct contrast to what retail bankers did in 2010 (in the aftermath of the global financial crisis).

Back then, none of them wanted “to do a lot of credit cards” as they had burnt their fingers on account of higher card payment defaults and even ‘loss assets.’ Credit card users alone cannot be blamed for this, as banks had also lent without proper care or diligence, giving rise to massive indebtedness among retail borrowers. Job losses and salary cuts pursuant to the global economic meltdown had caused further stress in retail books.

But these are matters of the past, and bankers, in their own words, have learnt well and become much wiser. Call it audacity or being simply opportunistic in business, banks are more focused on creating retail assets now. Perhaps it is their bad experience lending to corporates that has forced banks to turn retail.

To make a dent, banks started expanding their credit card portfolios two years ago. Simultaneously, they became more amenable to disbursing loans for homes, auto, personal, small business, gold, against property and for education.

Retail loans have grown 37% since mid-2015, to Rs 16.65 lakh crore currently. And from the troughs of 2010, retail loan books have almost trebled (see graph below) .

“Retail credit has been the only area driving business growth for private banks,” says Siddharth Purohit, senior banking analyst at Angel Broking. “In the absence of a pick-up in credit demand from corporates, retail will continue to be the area of focus for banks.”

“Retail credit has been the only area driving business growth for private banks,” says Siddharth Purohit, senior banking analyst at Angel Broking. “In the absence of a pick-up in credit demand from corporates, retail will continue to be the area of focus for banks.” “PSU banks have not managed to expand their retail lending books because they’re still dependent on large-ticket loans; these banks do not even have enough products around retail lending,” he adds.

What started as a simple business strategy became a business imperative when bank coffers brimmed over with retail deposits in the months that followed demonetisation. With not much of corporate capex happening, banks are forced to loosen their purse strings in favour of small borrowers. This, in a way, sets the tone for the return of retail lending.

LOWER DELINQUENCY RATES

From a bank’s perspective, times have never been better to focus on retail customers. They are flush with cash to lend, interest rates have fallen to levels that make sales pitches effective and easy, manufacturers are willing to sell wares at deep discounts and consumers are showing more willingness to buy. That apart, retail ‘delinquency rates’ are currently trending at historical lows across most lending products.

A loan is termed to be delinquent when no repayment (EMI — principal or interest payment) is made for 90 days. A Transunion-Cibil study, done exclusively for ET, reveals that delinquency rates in credit cards has dropped from 6% in the second quarter of 2010 to 1.5% in the first quarter of this fiscal.

In personal loans (which are mostly unsecured in nature), default rates have fallen from 2.7% in 2010’s second quarter to 0.7% now. Delinquency rates in housing loans (including loans against property, or LAP) and auto loan portfolios also hover at a little over 1%.

“Banks are now lending in a more responsible manner,” says Harshala Chandorkar, COO of Transunion-Cibil, a leading credit information bureau.

“The sourcing has been good for most banks. Earlier, they would lend without really looking at the quality of borrowers. Now, they’re more careful. This has lowered instances of overleveraging, too,” Chandorkar affirms.

Higher delinquency rates prompted banks to shrink their retail lending operations in 2010. It took a long time for banks to get back to lending generously to retail customers. By 2012, the more adventurous among banks started secured lending — mostly LAP with very low loan-to-value (LTV). So, for a mortgaged property worth Rs 10 lakh, the bank would only lend Rs 5 lakh, the LTV, in this case, being 50%. By 2012, gold loans started gaining a larger share in retail books of most banks.

Buoyed by the success of these two products, banks started taking interest in expanding their unsecured loan basket. It started with consumer durables loans, then credit cards in 2014-15, vehicle loans and then personal loans.

All this while lenders focused on growing their housing loan book, which is regarded stable, and accounts for over half of all retail loans across banks. “The emergence of credit bureaus has helped us immensely,” says Arvind Kapil, country head, home, mortgage and unsecured loans, HDFC Bank. “We get much ‘intel’ about the borrower before every loan we disburse… This is a marked departure from what we did in 2007-08.”

These days, bankers like Kapil rely a lot on credit bureau data before deciding the creditworthiness of borrowers. They run risk predictive models and artificial intelligence (AI) tools to ascertain financial habits and behaviour of prospective borrowers. “Ten years ago, we had a lot of data, but we couldn’t do a lot of analysis or draw correlation patterns. Now, we process data extensively to get meaningful inputs. This is helping us lend more efficiently,” says Kapil.

Increased levels of digitisation have also helped to banks to reach out retail customers more seamlessly. Large private banks such as HDFC, Axis, ICICI and Kotak Mahindra have capabilities to disburse retail loans in less than 24 hours. Some have also shifted loan products online, which enables customers to get loans even on Sundays and other non-working days.

“Delinquency rates (on retail loans) have also fallen because customers are aware of the importance of maintaining a high credit score – and the applicability of it in various spheres,” points out Kapil.

BUSINESS OF RETAIL LENDING

Most private banks have expanded retail assets to nearly 45% of total advances. Apart from home loans, banks have been able to grow their auto, personal, LAP, small business finance and credit card portfolios by a good measure. Their target customer base is mostly the salaried class and self-employed professionals.

For most banks, the move to retail assets started as a risk-mitigation gambit. Take, for instance, Axis Bank, which hit the road to “retailisation” in 2010. “Our focus was to granulise balance sheet and limit risk, both on the assets and liabilities side,” explains Rajiv Anand, executive director (retail banking), Axis Bank. “Our focus is to do incremental disbursements to existing customers, source through internal channels and also acquire new customers. Retail loan book is more of a contained risk; it’s a well-diversified book with a lot of heterogeneous borrowers. Besides, these are small ticket loans.”

Axis Bank, like many other banks, has a data team looking into the credit profile of customers. With data-enabled intelligent inputs, banks are no longer harping on collaterals for every loan disbursed. Cash flow-based lending is catching up among modern-day banks.

“We’re able to underwrite loans better now. We’re more open to taking higher levels of unsecured risk, thanks to our predictive models,” Anand adds. Most banks have built unsecured loan books in the range of 9–13% of their retail advances.

The retail strategy is working well for most banks, with ample growth potential in the coming days. Bankers rattle out streams of macro-data to support this premise. Total credit to household in India is just about 10%, vis-à-vis 16% in Russia, 40% in China, 24% in Brazil and 79% in the US. Housing loan penetration in India is just about 3%.

“Retail lending is bound to grow even more in a growing economy,” believes Kapil of HFDC Bank.

Analysts tracking banks are not worried about the stupendous rise in retail loans. But they are conscious of “negative macros” such as a probable economic slowdown, job losses and diminishing value of assets (which could affect bank collaterals).

“A time will come when leverage could increase in specific buckets — and we’re conscious of that. But now there’re no signs of excessive leverage,” says Anand of Axis. “Retail risk has been benign for some time now but we’ll be careful.”

Bali of KMB insists on keeping a tight lending policy to stay out of default trouble. “As long as you don’t get adventurous, you will not run into trouble with the retail book.”