1:00 PM

Buzzing stock

Dr Reddy's (DRL) gained nearly 3% to Rs 2,223 after Aurigene Discovery Technologies, a wholly-owned subsidiary of the DRL and a specialised biotechnology company announced plans to initiate a Phase II trials of its CA-170 program, a PDL1-VISTA inhibitor to be conducted at sites in India.

CA-170 is an oral small molecule targeting the immune checkpoints PDL1 and VISTA.

12:47 PM

Reliance Securities on India Cements

ICL drives over 80% of its total sales from Southern and Western markets, where realizations still appear to be firm despite seasonal overhang. We believe that improving operating synergies and strong realization environment in Western markets will continue to pay off with improvement in profitability. We believe that with the recent group restructuring, ICL is likely to harness RMC business and Trinetra’s cement division in a better way.

Further, possible reduction in interest cost with loan repayment / refinancing / rating upgrade and likely demand improvement in Southern markets augur well for ICL in the long-term. We maintain our fundamental BUY rating on the stock with a Target Price of Rs 225.

12:32 PM

Buzzing stock

Tata Power hit a four month high of Rs 86.70, up 7% on BSE in intra-day trade after the rating agency CARE Ratings reaffirmed its ratings assigned to the company's long-term debt instruments at 'CARE AA; Stable'.

READ MORE

12:15 PM

SBI Life to launch India's first billion dollar IPO since CIL in 2010

SBI Life Insurance, a joint venture between State Bank of India (SBI) and BNP Paribas Cardif, will come out with its initial public offering on September 20. The issue, which is an offer for sale by the two promoters, will be priced in the band of Rs 685-700 per share.

READ DETAILS HERE 12:01 PM

Rane Group companies rally up to 18%

Rane (Madras) (up 18% at Rs 580), Rane Engine Valve (17% at Rs 679), Rane Brake Lining (14% at Rs 1,350) and Rane Holdings (12% at Rs 2,019) were up more than 10% on BSE in intra-day trade.

READ MORE11:44 AM

Capacit'e Infra IPO opens today: Should you subscribe?

Capacit'e Infraprojects IPO intends to use the net proceeds for funding working capital requirements, purchase of capital assets and general corporate purposes. The IPO (price band: Rs 245 – 250) opened for subscription today and will close on September 15.

READ MORE DETAILS

11:34 AM

Edelweiss Securities on CPI inflation

In ensuing months, we expect CPI to rise further, largely led by base effects in food CPI and the statistical impact of HRA allowances. We foresee inflation moving towards 4% in the next couple of months and 4.5% by the year end. This implies FY18 inflation will range from 3.5-4.0%, within RBI’s comfort zone. This certainly opens room for further rate cuts. Our base case is another 25bps cut in FY18, but we strongly believe that more is warranted.

11:19 AM

Edelweiss on Future Lifestyle Fashion

We expect 12% SSSG in Central in FY18 aided by recovery in urban consumption and better execution. On account of sharpened focus on power brands and closing of loss making stores (Planet Sports) we revise up target multiple to 16x (from 15x) FY19E EV/EBITDA and arrive at revised target price of Rs 464 (Rs 416). We maintain ‘BUY/SO’. At CMP, the stock is trading at 13.7x FY19E EV/EBITDA

11:17 AM

Nomura on broadcast industry

India’s broadcasting industry has had a tough period post demonetisation and GST implementation, but turnaround began from August and we expect healthy double-digit growth to resume for leading players as we head into the festive season from September. We also note the last phase of digitisation (especially in South India) will drive subscription revenues. We maintain Buy on Zee TV with a target price of Rs 654. We initiate on SUN TV with a Buy rating and target price of Rs 985

11:16 AM

Emkay Global on Suzlon Energy

Reiterate BUY with Rs 26 target price. Catalysts from PPA agreements in Andhra Pradesh and Karnataka. SUEL stock declined 20% from its May peak, as investors were worried that the company would fall short of its FY17 volume of 1.5GW this year

11:01 AM Broader markets continue to outperform

At 11:00 am, the BSE Midcap and the BSE Smallcap indices were up 0.4% each, outperforming the frontline indices.

10:59 AM Markets check

At 11:00 am, the Sensex was trading at 32,227, up 68 points, while the broader Nifty50 was ruling at 10,106, up 13 points.

10:45 AM

RIL hits new high

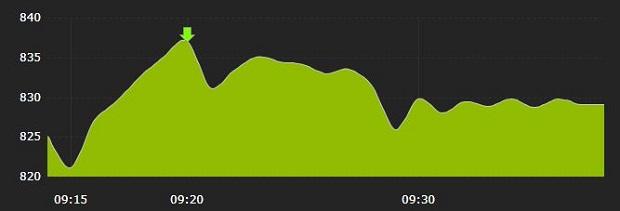

Reliance Industries (RIL) hits a new high of Rs 845, up 2.6%, extending its Tuesday’s nearly 1% gain on BSE. The stock surpassed its previous high of Rs 832.70 touched on September 7, 2017 in intra-day trade.

CLICK HERE FOR FULL REPORT

10:31 AM

Surge in investors buying protection against market fall

The share of investors buying protection against a correction in the equity markets has seen the largest monthly increase in 14 months, says a survey of Bank of America Merrill Lynch (BofA-ML) survey of global fund managers. In September, there was a nine percentage point increase in equity hedging and only a net 24 per cent of those polled hadn’t bought protection against a fall in the equity markets.

READ MORE

10:15 AM

Buzzing stock

Tata Chemicals rose nearly 2% to Rs 646 after the Tata Global Beverages proposed to sell up to 1,05,00,000 equity shares of face value of Rs 10/- each of Tata Chemicals to Tata Sons.

10:00 AM

HDFC MF to join IPO bandwagon

HDFC Mutual Fund, the country’s second-largest money manager, has joined the list of probable asset management companies (AMCs) waiting to go public.

The AMC has begun preliminary discussions to list itself on the bourses but is yet to arrive at a time frame or appoint merchant bankers for the share sale, said two people familiar with the matter.

READ FULL REPORT9:50 AM

More upgrades for Tata Steel after pension deal

With the much-awaited Tata Steel UK pension scheme resolution getting cleared, investor sentiment has got a boost. For the company, which is working hard to make its European operations more profitable, resolving the British Steel Pension Scheme (BSPS) was critical for de-risking its future liabilities.

CLICK HERE FOR FULL ANALYSIS

9:42 AM Buzzing stock

Capital First rose over 2% to Rs 839 after the Reserve Bank has allowed foreign investors to hold up to 50% equity holding in financial services firm Capital First. READ MORE

9:30 AM Nifty Bank snaps four-day long rally

Source: NSE

9:25 AM Broader markets outperform

Broader markets outperformed with the BSE Midcap and the BSE Smallcap indices extending gains by up to 0.3%.

9:24 AM Sensex heatmap at open

Source: BSE

9:18 AM Markets at open

At 9:18 am, the S&P BSE Sensex was trading at 32,150, down 8 points, while the broader Nifty50 was at 10,088, down 5 points.

9:15 AM Stocks in news

ONGC, Oil India, Jet Airways, ITC, Phoenix Mills, Capital First, Dr Reddy's, GMR etc

9:10 AM Gold prices

Gold prices held steady on Wednesday as the dollar remained firm, with safe-haven demand for the metal buoyed after US President Donald Trump’s latest comments on tensions over North Korea.

Spot gold was nearly unchanged at $1,330.85 an ounce, while US gold futures for December delivery were flat at $1,335.00 an ounce.

9:08 AM

Pre-open trade

The Nifty50 index held above 10,100 in pre-open trade. The S&P BSE Sensex was trading at 32,163, up 5 points, while the broader Nifty50 was at 10,100, up 7 points.

9:08 AM

Macroeconomic data

The data on the Index of Industrial Production (IIP) and consumer price index (CPI)-based inflation, released on Tuesday, were more bad news for the Narendra Modi government, after growth of gross domestic product (GDP) crashed to its lowest in its tenure last week.

CLICK HERE FOR DETAILS 9:05 AM

Nifty outlook and technical calls by HDFC Securities

Nifty has surpassed the crucial resistance of 9,988, and is all set to register a new all-time high above 10,137. Despite lot of uncertainty, charts indicated the dominance of bulls over bears in the last one month and it seems to be getting right so far. Earlier resistance of 9,988 is expected to interchange its role as a support going forward for Nifty.

9:02 AM

Today's picks

9:00 AM

Technical calls

8:57 AM Oil prices

Oil prices were mixed, but largely held on to gains in the previous session after OPEC said it expected higher demand for its crude next year.

US West Texas Intermediate (WTI) was trading up 6 cents, or 0.1% at $48.29 a barrel after rising 0.3% on Tuesday.

International benchmark Brent crude was down 7 cents, or 0.1% at $54.20 a barrel, having settled up 0.8% in the previous session.

8:54 AM Wall Street on Tuesday

The major Wall Street indices hit record closing highs with financial stocks leading the charge, but gains were stunted by a decline in Apple Inc shares after it unveiled its latest line of iPhones.

The S&P 500, Dow Jones industrials and Nasdaq Composite clocked record closes, with investors drawn to riskier assets as concerns about US tensions with North Korea eased and the financial impact from Hurricane Irma appeared less severe than was feared last week.

The Dow Jones Industrial Average rose 61.49 points, or 0.28% to 22,118.86, the S&P 500 gained 8.37 points, or 0.34% to 2,496.48 and the Nasdaq Composite added 22.018 points, or 0.34% to 6,454.28.

8:52 AM Asian markets

Asian shares inched up to a 10-year high. MSCI's broadest index of Asia-Pacific shares outside Japan was slightly higher in early trade, while Japan's Nikkei stock index added 0.4% to a one-month high, getting a tailwind from a weaker yen. China's Shanghai Composite remained little changed, while Hong Kong's Hang Seng bucked the trend to lose 0.4%.

CLICK HERE FOR FULL STORY

8:50 AM

Singapore Nifty

At 8:45 am, SGX Nifty, Nifty futures being traded on Singapore Stock Exchange was trading at 10,099, up 9 points or 0.09%.

8:49 AM Good Morning!

Welcome to Business Standard's market liveblog.

First Published: Wed, September 13 2017. 12:55 IST