With competition getting hotter in the affordable housing finance sector, private lender Axis Bank will waive 12 equated monthly installments (EMIs) on regular repayments of loans of up to Rs 30 lakh under the new scheme Shubh Aarambh Home Loans.

The lender has introduced Shubh Aarambh Home Loans, in which 12 EMIs are waived — four EMIs each after the fourth, eighth and 12th year — from the date of the first disbursement. The waiver will be in the form of reduction in tenure.

The loans can be used to purchase an under-construction/ready/resale house, self-construction, and a plot plus construction.

Customers also have the option to transfer existing home loans to Axis Bank without additional cost, according to Rajiv Anand, executive director, retail banking.

Earlier, the bank had floated Asha home loan for low-income groups. Thirty-five thousand families have availed of the scheme.

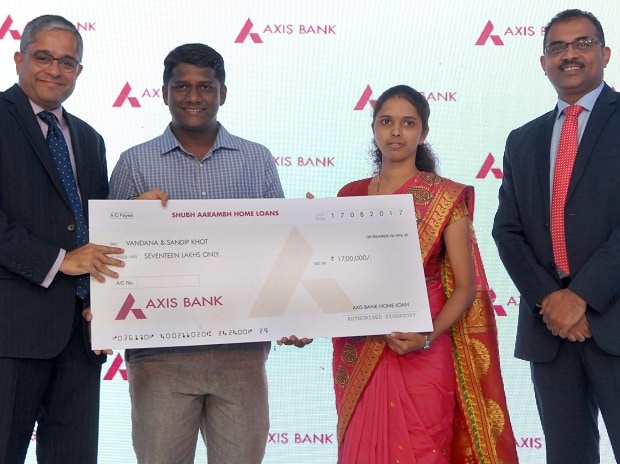

Representative Image

Icra, in a note on mortgage finance for FY17, had said owing to the increase in supply and better affordability on the part of borrowers, the traditional lenders were increasing their focus on this segment.

Affordable housing is likely to continue to grow at a faster pace than industry. Credit growth for affordable housing over the medium- to long-term is likely to be high at around 30 per cent, which could increase mortgage penetration levels to 13-15 per cent by March 2022, according to the Icra report.

‘Infrastructure’ status for affordable housing projects, given in the Union Budget, will improve access to funding from avenues like insurance and pension funds and boost supply.