The country’s largest bank—State Bank of India (SBI) — cut interest rate on savings deposits up to Rs 1 crore by 50 basis points (bps) to 3.5 per cent per annum with immediate effect, setting the stage for other banks to follow suit.

Deposits of over Rs 1 crore will continue to earn four per cent interest per annum, SBI said in a statement.

This is the first rate revision in savings deposit rate by SBI after the Reserve Bank of India (RBI) deregulated savings bank deposit interest rate on October 25, 2011.

The rate cut in savings accounts also comes two days ahead of the RBI’s monetary policy review on August 2.

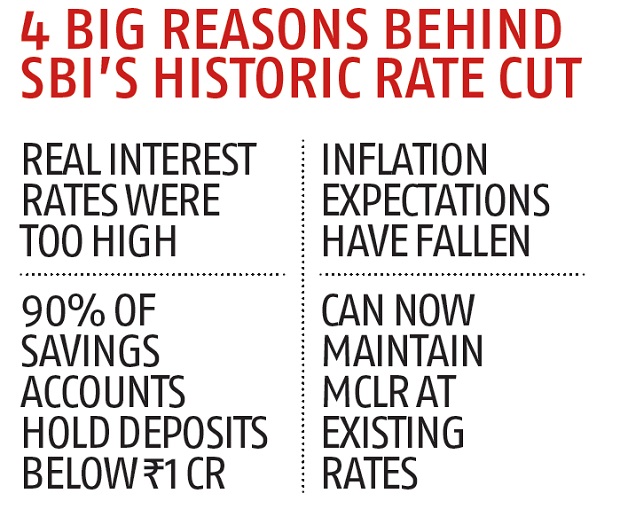

Giving the rationale for the decision, Rajnish Kumar, managing director (national banking group), ABI, said low inflation and high real interest rate weighed on the bank to decide on the cut.

Source: Bloomberg

With 90 per cent of its savings deposits falling under the Rs 1-crore bracket, the bank will end up lowering its annual interest bill by Rs 4,230 crore on its latest savings deposit base of Rs 9.4 lakh crore.

For the current financial year (FY18), this works out to a saving of Rs 2,820 crore for SBI, considering four months have elapsed.

The stock market cheered the bank’s decision, as SBI shares closed 4.5 per cent higher at Rs 312 per share on the BSE on Monday.

SBI said it had cut the MCLR or lending rate by 90 bps in January 2017. It did so, on the strength of huge inflows of money into current account and savings deposits, a low-cost liability base after the government demonetised old Rs 500 and Rs 1,000 notes in November 2016.

Of the deposits garnered during the currency purge, about 40 per cent continue to remain with the bank as low-cost funds.

Analysts said the bank has taken this step to protect its net interest margin when income from loans is low due to tepid demand for advances. The surplus liquidity in the system offers room to tweak rates further.

An SBI executive said, “We encourage depositors to switch to fixed deposits, which are less volatile in terms of rates and can benefit from our strong reach, distribution and franchise network.” The reduction in rates was also necessary, as it was difficult to maintain MCLR at current levels, the official added.

Asked if the bank would revise both its lending and savings rate if RBI were to cut the key repo rate, an SBI executive said: “The situation is always dynamic and asset liability committee (ALCO) always takes into account the competitive situation in the market. We also have to consider that credit growth is muted.”

“The interest rates are showing a softening bias. The bank’s ALCO is scheduled to meet in the last week of August,” Kumar added.

Two top executives of private sector banks, which offer higher rates on savings deposits, said SBI’s decision would set the trend for the banking industry to lower rates. “Other public and private sector banks are expected to follow suit,” said an analyst with a domestic brokerage.