SI Reporter |

4:04 PM

3:58 PM Sectoral performance

3:55 PM Weekly Sensex gainers and losers

3:49 PM Top Sensex gainers and losers

3:47 PM RIL ended at Rs 1,586, up 3.76%. The stock hit in intraday high of Rs 1,592, up 4% on the BSE.

3:42 PM The market breadth, indicating the overall health of the market, remained negative. On BSE, 1,423 shares declined and 1,256 shares rose. A total of 139 shares were unchanged.

3:40 PM In the broader market, BSE Midcap and the BSE Smallcap indices ended little changed. For the week, BSE Midcap settled flat, while BSE Smallcap added 0.5%.

3:37 PM MARKETS@CLOSE

The Sensex settled at 32,028, up 124 points, while the broader Nifty50 ended at 9,915, up 41 points. For the week, both indices closed flat.

3:26 PM Oil update

Oil prices edged higher on a weaker dollar and diplomatic tensions in the Gulf, but Brent held below the $50 per barrel level that was breached for the first time in six weeks on Thursday. Benchmark Brent crude futures were up 24 cents at $49.54 a barrel, while US West Texas Intermediate (WTI) crude futures traded at 47.09 a barrel, up 17 cents.

3:21 PM Nifty IT (up 2%) continues to lead among sectoral indices. Wipro, HCL Tech, TCS and Infosys gain the most, up between 2% and 6%.

3:14 PM Sterlite Technologies WAS UP 8% AFTER hitting a new high of Rs 248, up 20% on the National Stock Exchange (NSE), extending its two-session long rally of over 30% after the company said it reported its highest ever quarterly revenues driven by strong order book and export sales in June quarter (Q1FY18). CLICK HERE FOR FULL REPORT

3:10 PM At 3:10 pm, volatility index VIX was down nearly 2% to 11 mark.

3:09 PM Top Sensex gainers and losers

2:49 PM Markets recover after RIL (up 4%) extends gains; Sensex up over 100 points, Nifty back above 9,900

2:35 PM

2:13 PM

2:02 PM European markets open mixed

FTSE 100 added 0.2%, while CAC 40 and Euro STOXX 50 were trading flat with positive bias.

1:50 PM

1:33 PM The market breadth, indicating the overall health of the market, turned negative in the noon trade. On BSE, 1,481 shares declined and 1,041 shares rose. A total of 132 shares were unchanged.

1:26 PM Cable stocks fell after Jio announces Jio phone TV-cable, which is priced at Rs 309/month. Dish TV tumbled over 6%, Hathway Cable & Datacom slipped 3%, Sun TV Netwrok shed 3.8% and Siti Network fell 1.3%.

1:10 PM All sectoral indices except Nifty IT were trading in red

1:06 PM Top gainers and losers on BSE Sensex

12:46 PM RIL announces 1:1 bonus issue in its 40th AGM; launches Jio Phone. The last time RIL gave a bonus was in 2009. READ ABOUT IT HERE

12:36 PM Shares of telecom services provider Idea Cellular (down 7% to Rs 88.40) and Bharti Airtel (down 4% at Rs 404) have dipped up to 6% on BSE in intra-day trade after Reliance Jio, a telecom subsidiary of Reliance Industries (RIL), launched a feature phone. Click here for full report

12:19 PM Dish TV fell over 5% after Jio announces Jio phone cable TV, which is priced at Rs 309/month for the big screen.

12:18 PM

12:16 PM

12:14 PM

12:04 PM At 12:00 noon, RIL was trading 2% higher at Rs 1,562. It hit an intraday high of Rs 1,587 on the BSE

12:02 PM Mukesh Ambani: The main aim is for feature phone users to migrate to Jio Phone

12:01 PM Mukesh Ambani: Jio Phone will be availabe for testing from August 15 and pre-booking starts from August 24.

12:00 PM Markets pare morning gains: At 12:00 pm, the S&P BSE Sensex was trading at 31,965, up 60 points while the broader Nifty50 index was ruling at 9,890, up 17 points.

In broader markets, the BSE Midcap and BSE Smallcap indices gained 0.2% each

11:59 AM Idea falls over 4% after Reliance Jio launches Jio Phone for free

11:58 AM Mukesh Ambani: To avoid potential misuse of the Jio Phone, the comapny will collect a fully refundable deposit of Rs 1,500, which will be refunded after 3 years

11:55 AM Mukesh Ambani: The Jio Phone will available to all Indians for free

11:55 AM Jio effect: Bharti Airtel slips over 3% in intraday trade

11:49 AM Mukesh Ambani: Putting an end to unaffordable data in India. Dhan Dhana Dhan plan will be available on Jio Phone at Rs 153/month

11:48 AM Mukesh Ambani: Voice calls will always be free on the JIO PHONE

11:46 AM Jio effect: Idea Cellular falls over 2%

11:43 AM Jio phone fulfills PM Narendra Modi's Digital India and Make in India wishes

11:37 AM Mukesh Ambani: Jio Phone is 100% 4G LTE phone

11:34 AM Mukesh Ambani introduces the intelligent feature smartphone - JIO PHONE

11:33 AM Mukesh Ambani: India's 4G coverage is more than India's 2G coverage due to Jio

11:31 AM Mukesh Ambani: Aim to have 10,000 offices in every city/town in India

11:30 AM Mukesh Ambani: Jio will cover 99% of India's population in the coming months

11:29 AM Mukesh Ambani: Shareholder money has doubled every 2.5 years over the last 40 years.

11:24 AM Mukesh Ambani: Jio has over 125 million subscribers, as of today

11:23 AM Mukesh Ambani: India on its way to becoming number 1 in broadband connections in the coming months

11:23 AM

11:22 AM Mukesh Ambani: India has overtaken US and China in mobile data usage

11:22 AM Mukesh Ambani: In just 6 mnths of Jio's launch, the data usage in India went from 20 cr GB per month to 120 cr GB per month

11:21 AM Bharti Airtel, Idea Cellular shed 2% each after the Reliance AGM kicked off. At 11:20 am, Bharti Airtel was at Rs 411, while the Idea quoted at Rs 92. Reliance Communications was trading flat at Rs 24.

11:20 AM Mukesh Ambani: Jio had grown faster than Whatsapp, Facebook and Skype

11:20 AM Mukesh Ambani: Had 3,500 employees in 1977; now we employ 2,50,000 people

11:19 AM BSE Telecom index falls 0.8% with Bharti Airtel, Idea Cellular dragging, down 2% each

11:18 AM Mukesh Ambani: In less than 170 days, over 100 million customers added to Jio network

11:18 AM Mukesh Ambani: Jio added 7 customers per second every single day

11:17 AM Mukesh Ambani on Reliance Jio: Jio has broken many world record in just 10 months

11:15 AM Mukesh Ambani: Rs 1000 cr investment in RIL shares in 1977 have turned to be Rs 16.7 lk crore today

11:14 AM Mukesh Ambani: Market cap has grown at a CAGR Of 32% in the last 40 years

11:11 AM Mukesh Ambani at RIL AGM: Turnover has grown to over Rs 3.3 lakh crore, up 4700 times in 40 years

11:07 AM Bharti Airtel, Idea Cellular falls 2% ahead of 40th RIL AGM. RIL up over 3%

10:42 AM

10:18 AM Views on Wipro Buyback:

10:12 AM Market Check

9:36 AM Nifty IT index gained 1.8% in today's trade led mainly by Wipro (up 7%). HCL Tech, Tech Mahindra, Infosys also gained between 1-2.5%

9:32 AM At 9:32 am, the S&P BSE Sensex was trading at 31,965, up 60 points while the broader Nifty50 was ruling at 9,890, up 17 points.

In broader markets, the BSE Midcap and BSE Smallcap indices were trading in line with the frontline indices, were up 0.3% each.

9:27 AM In spotlight: Wipro

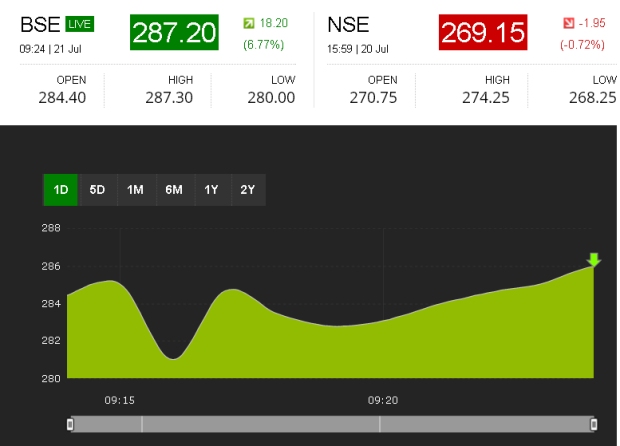

9:24 AM Reliance Industries in focus post strong Q1

9:20 AM Top gainers and losers on BSE Sensex

9:16 AM

9:11 AM Wipro ADR closed 5.7% higher by 5.7% at $5.75 on buyback plan

9:08 AM Derivative strategy on Engineers India by HDFC Securities:

9:07 AM

9:07 AM Technical calls by Prabhudas Lilladher:

9:05 AM Pre-open trade: Markets open higher in pre open trade with Sensex gaining 100 points and Nifty firmly above 9,900

9:04 AM A December Fed rate hike certainly looks less likely based on the June data. As for the Fed’s seeming commitment to balance sheet contraction, there is clearly an institutional desire on the part of the American central bank to commence this process well before the potential change in Fed leadership. Still, if the Fed does start such contraction, it is taking a big risk, given its deflation obsession, since balance sheet contraction is another form of monetary tightening, says CLSA's Christopher Wood in his weekly note, GREED & fear

9:02 AM Wipro announces buyback offer of Rs 11,000 crore

9:02 AM Sebi might cut listing time to 3 days from IPO, against 6 days at present CLICK HERE FOR THE FULL STORY

9:00 AM RIL to be in focus on above-estimate results

9:00 AM

8:59 AM

8:58 AM

8:50 AM

8:49 AM Asian Markets

8:48 AM Wall Street

8:48 AM SGX Nifty

The Nifty50 futures on the Singapore Stock Exchange were trading 5 points higher at 9,901 indicating a flat opening for the domestic market.