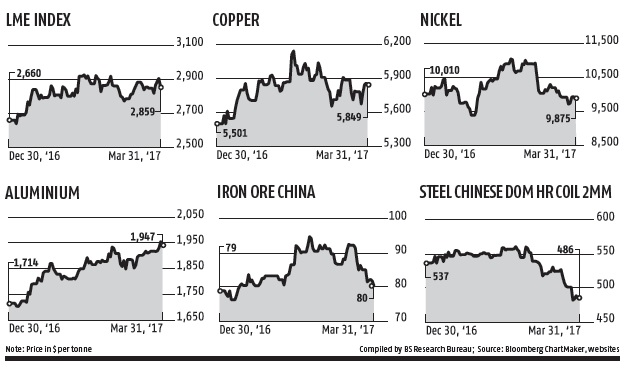

Metals, ferrous and non-ferrous have seen a correction in the last one month. All are down from their peaks seen in the early part of the year, except some like coking coal, aluminium, and tin.

Why metals corrected

In January, when Donald Trump took over as US President, most metals recovered sharply on funds going long, following his promise to spend $1 trillion on infrastructure development. Of late, fund managers have sold metals and booked profits on Trump not being able to push legislation and on recent geo-political tensions leading to growth worries — which is good for safe-haven metals like gold and silver; negative for industrial metals.

Is this a trend reversal?

Fall in prices of most industrial commodities in last few months is not a trend reversal. As T Gnanasekar, director, CommTrendz Research and Fund Management, said, “When geo-political tensions soften and when US President sees some Bills getting through, industrial metals will rise again as the Chinese economy has been doing well, and Trump has already said he favours low interest rates and weaker dollar. All are good signs of metals recovering.”

Steel and its key inputs

Prices of steel and its key input iron ore have seen a sharp fall in a month’s time. However, China has begun clamping down on excess steel capacities and prices of coking coal, key input in steel, have almost doubled in a month on reports of damage by a cyclone in Australia. Amid high prices of coking coal, steel prices cannot remain low for long.