Tata Steel UK plans $663 million payout to settle pension dues

MUMBAI: Tata Steel is planning to write a cheque of £520 million ($663 million) to its UK pensioners as a one-time settlement under a rarely used scheme, called the Regulated Apportionment Arrangement (RAA), said multiple sources aware of the development.

The company is finalising terms with British regulators to clear all pension liabilities, a move that would ring fence the business, derisk it and help in future consolidation. The development follows the slow progress of Tatas’ talks with the UK government post Brexit.

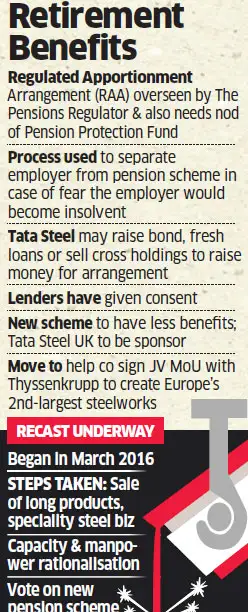

RAA is overseen by The Pensions Regulator (TPR) in the UK and also needs the approval of the Pension Protection Fund.

The process is used to separate an employer from its pension scheme in circumstances where the employer would otherwise become insolvent. The Tatas have been arguing that they need to detach UK operations from British Steel Pension Scheme (BSPS) failing which the group will cease support, making the operations go bankrupt.

The process is used to separate an employer from its pension scheme in circumstances where the employer would otherwise become insolvent. The Tatas have been arguing that they need to detach UK operations from British Steel Pension Scheme (BSPS) failing which the group will cease support, making the operations go bankrupt.

As Tata Steel UK is not insolvent, it can only detach itself from BSPS with the approval of TPR and trustees of the scheme. This process is called Regulated Apportionment Arrangement.

As per rules, the Pension Protection Fund or members of the amended British Steel Pension Scheme can take a minority stake of 10-33% in Tata Steel UK if it turns around sharply. The regulatory step — called an ‘Anti-Embarrassment Equity Stake’ — seeks to safeguard pensioners’ interests.

The quantum of holding is yet to be finalised but it will be a minority stake dilution. Tata Steel India last month reached out to its consortium of over 30 Indian and global lenders to waive the covenants attached to its loans and is believed to have received their consent.

The banks have security over the shares of both Tata Steel UK and Tata Steel Netherlands — the two entities that own the European operations — as well as the assets of Tata Steel UK. As per the covenants, if Tata Steel invests fresh equity into the business, the lenders have a charge on that and their approval becomes mandatory.

“In this case, Tata Steel is infusing cash to clear pension liabilities without paying the banks. Hence, the need for their consent,” explained an official in the know. On Monday, the company informed the stock exchanges that its board will meet on April 20 to discuss a fund-raising proposal.

Sources said the company could look to raise up to $1billion.

NEW TERMS

“RAA needs to ensure the pension scheme receives a fair outcome superior to what it would otherwise get in case of an insolvency,” said the official quoted above.

Members of the amended BSPS will enjoy reduced benefits as compared with the original one and thus the plan is likely to have a sizeable surplus and lesser risk. Tata Steel UK has agreed to sponsor the new BSPS, said officials in the know. Also, the new plan may not be acceptable to all, which would further reduce the risk.

BSPS is a large scheme with over 130,000 members and assets and liabilities of £15 billion. In contrast, Tata Steel UK has less than 10,000 members. Though the scheme is well-funded compared with other private sector pension schemes in Europe, it still poses a massive financial risk to Tata Steel UK given the reduced profitability and cash flow of the operations.

There was no response from Tata Steel spokespersons to ET’s detailed questionnaire at the time of going to press.

MERGER AHEAD

The new scheme will also boost discussions with Thyssenkrupp over the proposed merger of Tata Steel’s European business with the German conglomerate to create Europe’s second-largest steelworks after ArcelorMittal. The move is facing opposition from German unions like IG Metall, which have described it as ‘high-risk’ amid fears it would lead to thousands of job losses and plant closures.

Tata Group watchers say it is still not clear how Tata Steel will raise the funds. Tata Steel India will have to raise the money and pass it on as shareholder loan.

Analysts feel Tata Steel could either raise a bond or fresh debt or sell its cross holdings in Tata Group companies such as Tata Motors and Tata Power, where it currently holds 2.90% and 1.45%, respectively.

At current prices, the stakes could fetch Tata Steel Rs 4,087.75 crore ($630 million). It is unlikely to raise fresh equity.

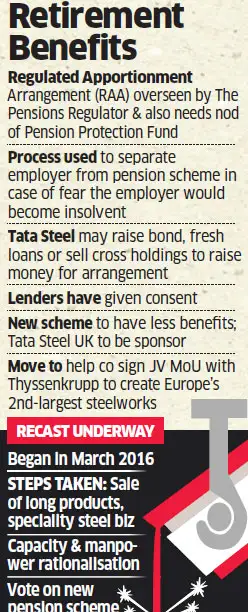

“The key remains resolution of the pension issue pertaining to the company’s UK operations and the potential JV with ThyssenKrupp,” wrote Ashish Jain and Mukund Sarawogi, analysts at Morgan Stanley, after the company sold its speciality steels business to Liberty House Group in February.

Tatas have been in talks with the UK government to see if changes can be made to the regulatory framework to allow BSPS trustees to make reductions to pension benefits without the consent of each individual member. But the discussions that began in June 2016 did not advance post the Brexit vote.

In March, Tata Steel UK had said it will close BSPS from March 31 and employees will get a new contributory scheme for retirement savings. Nearly 10,000 workers had voted to move to a less-generous scheme in return for job safety and Tatas’ promise of investments.

The company is finalising terms with British regulators to clear all pension liabilities, a move that would ring fence the business, derisk it and help in future consolidation. The development follows the slow progress of Tatas’ talks with the UK government post Brexit.

RAA is overseen by The Pensions Regulator (TPR) in the UK and also needs the approval of the Pension Protection Fund.

The process is used to separate an employer from its pension scheme in circumstances where the employer would otherwise become insolvent. The Tatas have been arguing that they need to detach UK operations from British Steel Pension Scheme (BSPS) failing which the group will cease support, making the operations go bankrupt.

The process is used to separate an employer from its pension scheme in circumstances where the employer would otherwise become insolvent. The Tatas have been arguing that they need to detach UK operations from British Steel Pension Scheme (BSPS) failing which the group will cease support, making the operations go bankrupt. As Tata Steel UK is not insolvent, it can only detach itself from BSPS with the approval of TPR and trustees of the scheme. This process is called Regulated Apportionment Arrangement.

As per rules, the Pension Protection Fund or members of the amended British Steel Pension Scheme can take a minority stake of 10-33% in Tata Steel UK if it turns around sharply. The regulatory step — called an ‘Anti-Embarrassment Equity Stake’ — seeks to safeguard pensioners’ interests.

The quantum of holding is yet to be finalised but it will be a minority stake dilution. Tata Steel India last month reached out to its consortium of over 30 Indian and global lenders to waive the covenants attached to its loans and is believed to have received their consent.

The banks have security over the shares of both Tata Steel UK and Tata Steel Netherlands — the two entities that own the European operations — as well as the assets of Tata Steel UK. As per the covenants, if Tata Steel invests fresh equity into the business, the lenders have a charge on that and their approval becomes mandatory.

“In this case, Tata Steel is infusing cash to clear pension liabilities without paying the banks. Hence, the need for their consent,” explained an official in the know. On Monday, the company informed the stock exchanges that its board will meet on April 20 to discuss a fund-raising proposal.

Sources said the company could look to raise up to $1billion.

NEW TERMS

“RAA needs to ensure the pension scheme receives a fair outcome superior to what it would otherwise get in case of an insolvency,” said the official quoted above.

Members of the amended BSPS will enjoy reduced benefits as compared with the original one and thus the plan is likely to have a sizeable surplus and lesser risk. Tata Steel UK has agreed to sponsor the new BSPS, said officials in the know. Also, the new plan may not be acceptable to all, which would further reduce the risk.

BSPS is a large scheme with over 130,000 members and assets and liabilities of £15 billion. In contrast, Tata Steel UK has less than 10,000 members. Though the scheme is well-funded compared with other private sector pension schemes in Europe, it still poses a massive financial risk to Tata Steel UK given the reduced profitability and cash flow of the operations.

There was no response from Tata Steel spokespersons to ET’s detailed questionnaire at the time of going to press.

MERGER AHEAD

The new scheme will also boost discussions with Thyssenkrupp over the proposed merger of Tata Steel’s European business with the German conglomerate to create Europe’s second-largest steelworks after ArcelorMittal. The move is facing opposition from German unions like IG Metall, which have described it as ‘high-risk’ amid fears it would lead to thousands of job losses and plant closures.

Tata Group watchers say it is still not clear how Tata Steel will raise the funds. Tata Steel India will have to raise the money and pass it on as shareholder loan.

Analysts feel Tata Steel could either raise a bond or fresh debt or sell its cross holdings in Tata Group companies such as Tata Motors and Tata Power, where it currently holds 2.90% and 1.45%, respectively.

At current prices, the stakes could fetch Tata Steel Rs 4,087.75 crore ($630 million). It is unlikely to raise fresh equity.

“The key remains resolution of the pension issue pertaining to the company’s UK operations and the potential JV with ThyssenKrupp,” wrote Ashish Jain and Mukund Sarawogi, analysts at Morgan Stanley, after the company sold its speciality steels business to Liberty House Group in February.

Tatas have been in talks with the UK government to see if changes can be made to the regulatory framework to allow BSPS trustees to make reductions to pension benefits without the consent of each individual member. But the discussions that began in June 2016 did not advance post the Brexit vote.

In March, Tata Steel UK had said it will close BSPS from March 31 and employees will get a new contributory scheme for retirement savings. Nearly 10,000 workers had voted to move to a less-generous scheme in return for job safety and Tatas’ promise of investments.