Yellow metal’s shining start to 2017 suggests rally coming to an end soon

By David Fickling

Gold has got off to a great start in 2017, climbing 8.9 per cent and even erasing its post-US election slump with a leap to $1,251 an ounce Thursday.

That sounds good for precious metal bulls. But haven't we seen this picture before?

A bright outlook for gold in the first quarter has become as predictable a sign of spring as flowering snowdrops and awakening groundhogs. But over the past four years, the rally held throughout the year only once, in 2016. That suggests this year's boomlet may already be nearing its end.

Gold in 2017 +8.9%

Gold shows a pronounced seasonality, driven largely by the period from early November to mid-February when Diwali, Christmas and Lunar New Year stoke jewelry demand in India, the US and China, which collectively account for more than two-thirds of the world's consumption of gold trinkets.

Averaging out the past seven years of data from the World Gold Council, a clear picture emerges: Jewelry buyers weight their purchases heavily toward the last quarter, with ETFs and funds trimming their positions at the same time to match the rising demand.

Consumer buying then drops off, but the rest of the market keeps surfing the price wave to push demand about 25 metric tons above its 1,103-ton average quarterly run rate in the three months through March. By the start of April, buying looks weak in almost all sectors of the market, pushing total purchases about 23 tons below average.

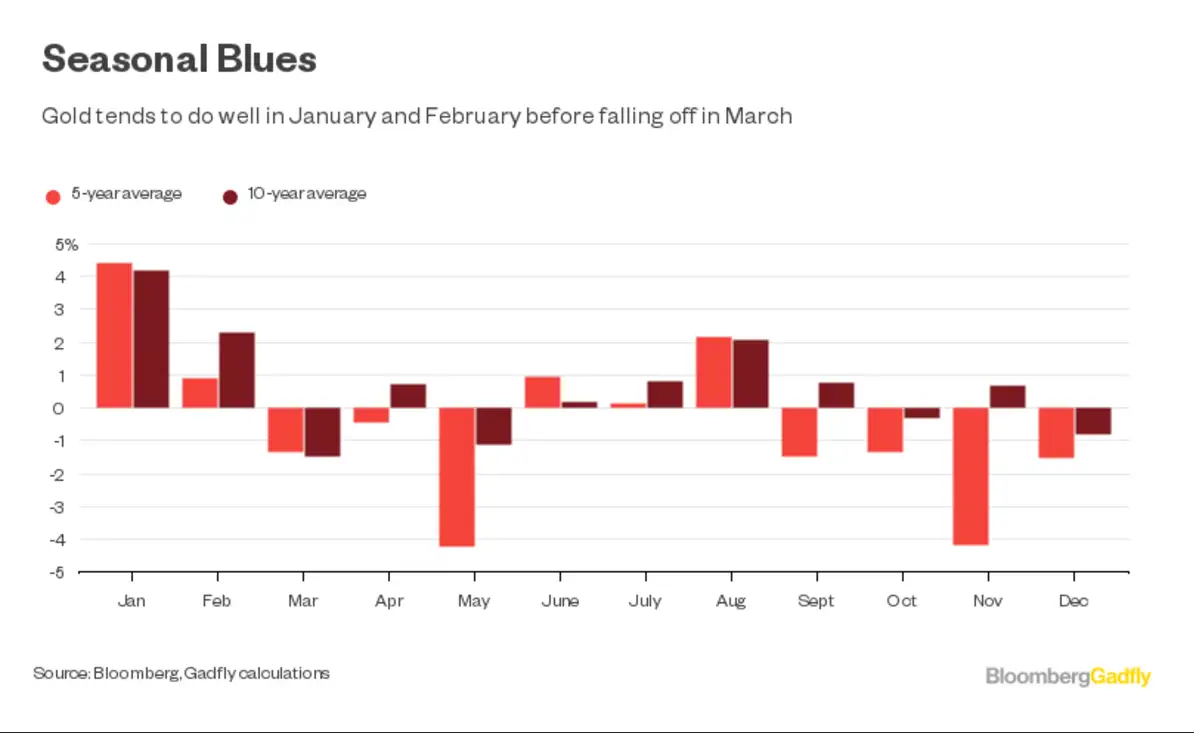

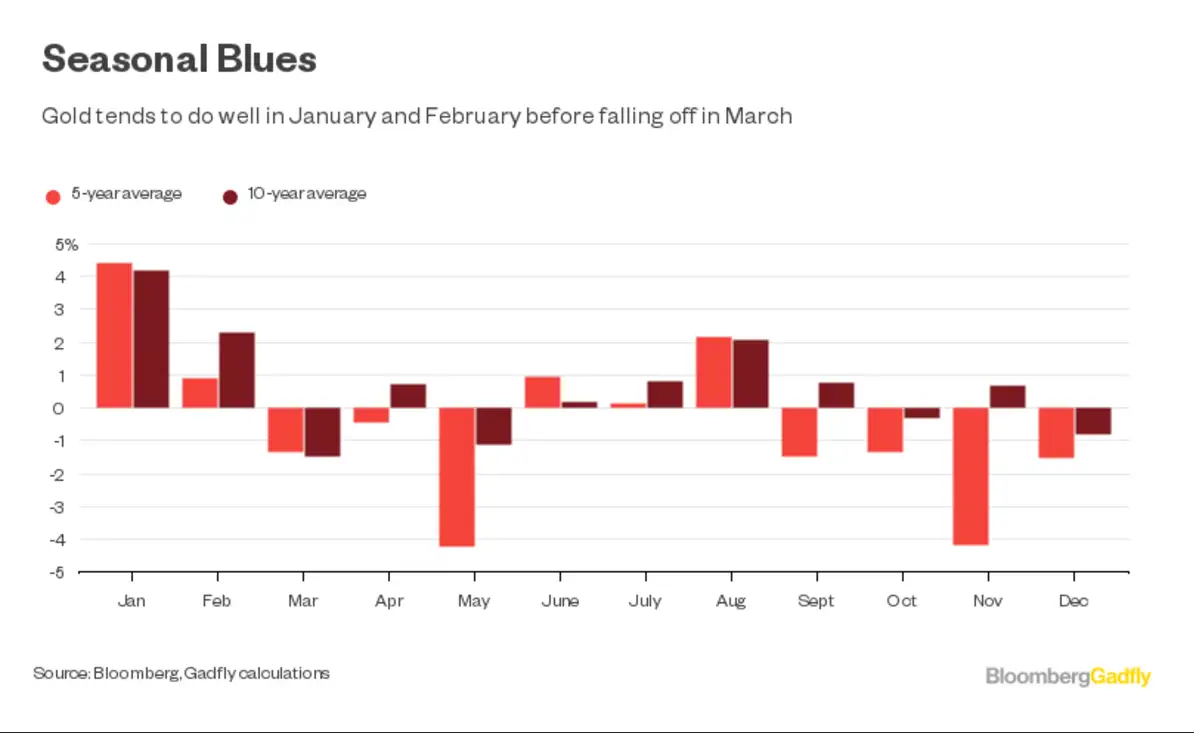

The second-quarter blues will start kicking in well before the end of March. Buying at the start of January and selling a month later would have produced an average 4.2 per cent return over the past 10 years. February trades yielded 2.3 per cent, but the 1.5 per cent average drop in March kicks off a fallow season that lasts until things pick up again in August.

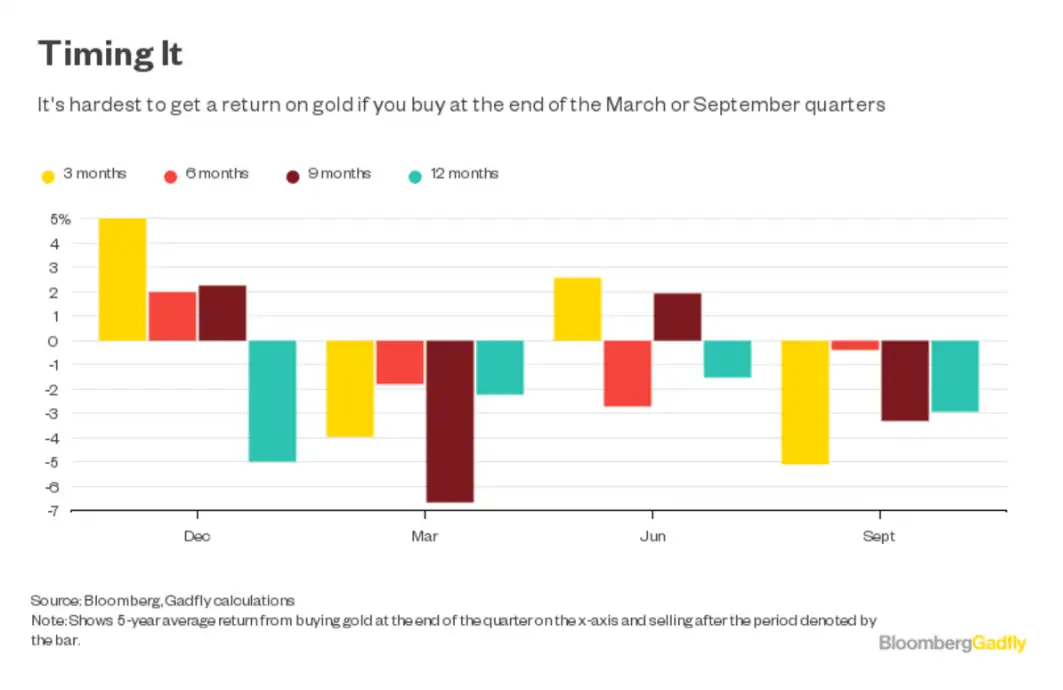

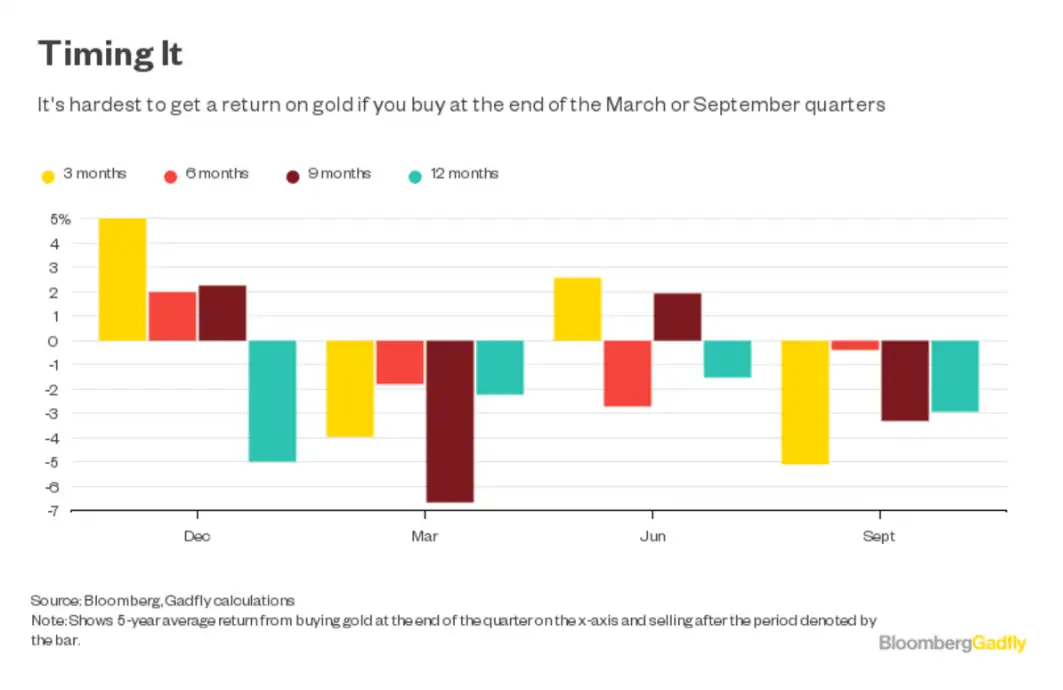

Holding for longer doesn't work so well, either. The weakness between March and June tends to dig a hole under investment positions that can be difficult to climb out of without taking a loss.

For investors who went long gold at the back end of last year, congratulations: You've had a good couple of months. Those tempted to join them should bear in mind that the prospect of three rate hikes this year from the US Federal Reserve hasn't gone away, and the odds of an increase at its May meeting are above 50 per cent.

Equity investors have long done inexplicably well by the seemingly dumb formula of "sell in May and go away." Their counterparts in the gold market might not want to wait so long.

Gold has got off to a great start in 2017, climbing 8.9 per cent and even erasing its post-US election slump with a leap to $1,251 an ounce Thursday.

That sounds good for precious metal bulls. But haven't we seen this picture before?

A bright outlook for gold in the first quarter has become as predictable a sign of spring as flowering snowdrops and awakening groundhogs. But over the past four years, the rally held throughout the year only once, in 2016. That suggests this year's boomlet may already be nearing its end.

Gold in 2017 +8.9%

Gold shows a pronounced seasonality, driven largely by the period from early November to mid-February when Diwali, Christmas and Lunar New Year stoke jewelry demand in India, the US and China, which collectively account for more than two-thirds of the world's consumption of gold trinkets.

Averaging out the past seven years of data from the World Gold Council, a clear picture emerges: Jewelry buyers weight their purchases heavily toward the last quarter, with ETFs and funds trimming their positions at the same time to match the rising demand.

Consumer buying then drops off, but the rest of the market keeps surfing the price wave to push demand about 25 metric tons above its 1,103-ton average quarterly run rate in the three months through March. By the start of April, buying looks weak in almost all sectors of the market, pushing total purchases about 23 tons below average.

The second-quarter blues will start kicking in well before the end of March. Buying at the start of January and selling a month later would have produced an average 4.2 per cent return over the past 10 years. February trades yielded 2.3 per cent, but the 1.5 per cent average drop in March kicks off a fallow season that lasts until things pick up again in August.

Holding for longer doesn't work so well, either. The weakness between March and June tends to dig a hole under investment positions that can be difficult to climb out of without taking a loss.

For investors who went long gold at the back end of last year, congratulations: You've had a good couple of months. Those tempted to join them should bear in mind that the prospect of three rate hikes this year from the US Federal Reserve hasn't gone away, and the odds of an increase at its May meeting are above 50 per cent.

Equity investors have long done inexplicably well by the seemingly dumb formula of "sell in May and go away." Their counterparts in the gold market might not want to wait so long.