A week back Samsung initiated the registration process for early access to its mobile payment service Samsung Pay in India. And this week, the service has been officially launched for the users who registered for early access program to use Samsung Pay services.

India saw a huge spike in digital payment services post demonetisation drive, which took place on November 8. Since then, a lot many players have entered the arena and are offering digital payment services in different ways. The latest in the arena is Samsung Pay, which took the lead and launched its mobile payment services in India before Apple’s Apple Pay and Google’s Android Pay.

While there is no dearth of e-wallet services and digital payment apps in India, what is it that makes Samsung Pay different from other existing services? Let’s take a look:

What is Samsung Pay

The Samsung Pay is a secure and easy to use mobile payment service available exclusively on select Samsung Galaxy smartphones -- Samsung Galaxy Note5, Samsung Galaxy S7, Samsung Galaxy S7 Edge, Samsung Galaxy S6 Edge+, Samsung Galaxy A7 (2016) (2017) and Samsung Galaxy A5 (2016) (2017).

How Samsung Pay works

The above mentioned smartphones user can download the Samsung Pay app and save their credit card and debit card information in the app. So, the next time you need to make the payment, you can do so by using the Samsung Pay services using the smartphone.

The Samsung Pay mobile payment service supports Magnetic Secure Transmission (MST) and Near Field Communication (NFC) technologies. It replicates physical cards like debit or credit cards to make payments on card terminals and therefore does not require internet services but can work offline and can be used just like credit or debit cards -- sans the lengthy process -- to make the payment.

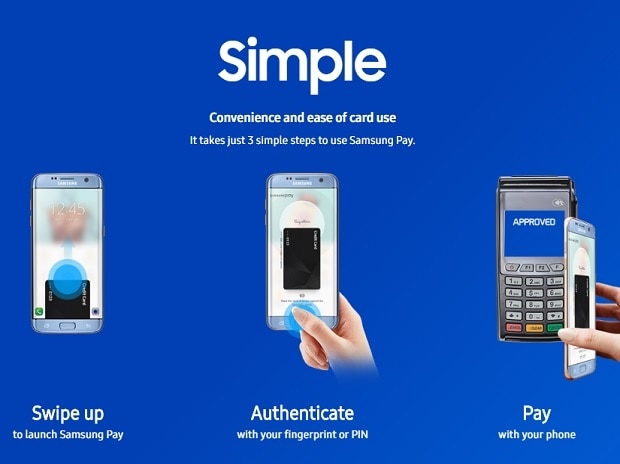

Samsung Pay also eliminates the need to enter user’s confidential account information such as CVV code, debit card and credit card pin. With Samsung Pay the mobile payment is authenticated using fingerprint, tap & pay and swipe up feature.

The user can make the payment by tapping the smartphone on NFC enabled Point-of-Sale machine, authenticating the transaction through fingerprint scanner and it is done. With other cards terminal that does not support NFC feature, the payment can be made using MST and thus is convenient to use everywhere.

Banks supported in India

Currently, the Samsung Pay app supports credit and debit cards of Axis Bank, HDFC Bank, ICICI Bank and Standard Chartered Bank. For State Bank of India, only the credit cards are supported while the support for debit cards will be added sometime in the future. Support for American Express and Citibank will be added soon, according to the official Samsung Pay website.