India's gold jewellery exports to the United Arab Emirates (UAE) declined by a massive 56 per cent in January 2017 due to a 5 per cent import duty levied by the local government there.

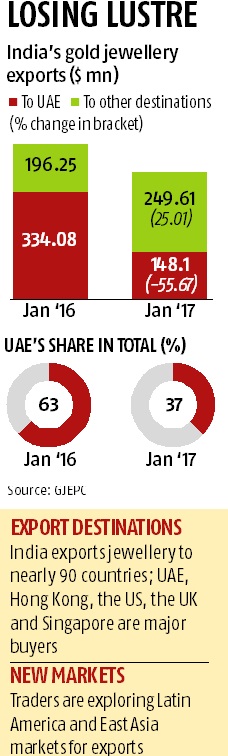

Data compiled by the apex representative body, the Gems and Jewellery Export Promotion Council (GJEPC), showed India's gold jewellery exports to the UAE at $148.1 million for January 2017, down from $334.08 million for the corresponding month last year. The decline in exports of gold ornaments coincided with the applicability of import levy by the UAE government effective January 1.

UAE, led by Dubai, is a gateway for India's jewellery exports not only to other Arabian nations but also to Europe. As a matter of practice, Indian gold jewellery exporters dispatch their consignments to Dubai and, along with precious ornaments and jewellery originating from other countries such as Turkey, for further exports to European and Asian countries. This gives a perfect blend of global contemporary designs for European and Asian consumers. Post import duty levy, however, the practice of blending gold ornaments from global manufacturers has declined, and jewellery manufacturers in other countries have started shipping their ornaments to consumers directly. Hence, the routing business (through Dubai) has come to standstill.

"The decline in gold jewellery exports to the UAE can be partly attributed to the import duty levy. When India levied 15 per cent import duty on gold jewellery, many companies that were engaged in blending ornaments shifted their manufacturing bases to the UAE. Under the World Trade Organisation (WTO) guidelines, an import duty of up to 25 per cent can be levied. Even India has levied 15 per cent import duty on gold jewellery. Exports of precious ornaments must have gone up in neighbouring regions including Sharjah. But, we need to explore new markets for our growth," said Praveen Shankar Pandya, Chairman, GJEPC.

Global customers in Dubai were enjoying tax relief on gold jewellery purchases. Hence, leading gold jewellery manufacturing countries in the world were routing their export consignments through Dubai. Following 5 per cent import duty levy, shipment of gold ornaments to Dubai declined dramatically from all over the world including India.

"Since the effective date of import duty levy i.e. January 1, 2017, gold jewellery exports to Dubai stopped for the first three weeks due to uncertainty over system of tax payment. Later, the shipment revived in very minuscule number. But, the declining trend in gold jewellery exports is going to continue in future as well hitting thereby Indian exporters hard," said Rajiv Popley, Director, Popley & Sons, a city based gold jewellery manufacturer and exporter with showrooms in Dubai.

In fact, the share of Dubai - led UAE markets shrunk to 37 per cent in January 2017 from a staggering 63 per in the corresponding month last year. The decline in UAE's share has pulled down India's overall gold jewellery exports in January 2017 to $398 million, a decline of over 25 per cent from $530.33 million in the comparable month last year.

In Dubai, "Gold Souk" is a major gold jewellery retailing hub for local consumers with presence of almost all leading global jewellery manufacturers. Indian jewellery manufacturers also have their presence in great number in and outside "Gold Souk".

Dubai itself is a big jewellery market with an estimated annual consumption of 350 tonnes. While routing business has declined due to lack of volume to make it a full consignment, local consumption continues to remain robust in Dubai. For routing business, however, exporters need to sign a bond with a commitment of re-shipment to other destinations in a specified time.