Street sees high rollover to March, inflows likely to support indices

MUMBAI: March is likely to be a month of uncertainty for the stock market with the US Federal Reserve meeting to decide on rate increases and results of various state elections due. But, that did not stop traders from carrying forward record positions to the March futures and options series (F&O) on expiry of February contracts as the Nifty hit hit 52-week high on Thursday.

Rollover in Nifty futures to March was 73%, higher than the three-month average of 69%. The marketwide rollovers at 77% were in line with the average. The market-wide open interest of Rs 1.08 trillion on Thursday was an all-time high and the open interest of 27 lakh contracts in the Bank Nifty was the highest since July 2010.

“Market-wide open interest is at the highest level ever indicating huge leverage positions in the market. Since the market is over-leveraged, any negative newsflow can lead to a knee-jerk fall,“ said Yogesh Radke, head of quantitative research at Edelweiss Securities.

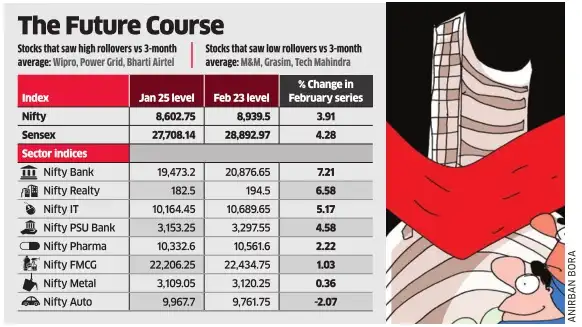

On Thursday, the indices rose 0.1% to close at a five-month high.The Nifty scaled a 52-week high of 8,982.15 and the Sensex crossed the 29,000-mark for the first time since September 8. The closing level of 8,939.5 for the Nifty was the highest a series has expired at since January 2015. Nifty's open interest on Thursday was Rs 20,200 crore compared to Rs 16,500 crore when the January contracts expired.

Since positions are on heavier side and Nifty is near the resistance of 9,000, a correction could be on the cards. “9000 will come but it will be tough to sustain. Risk reward is not favourable as the market has rallied sharply from the lows even as the overall trend is positive,“ said Chandan Taparia, derivative analyst, Motilal Oswal.

BJP's performance in the state elections will be a test of the government's popularity and if the US Fed raises rates in March and signals more over the next, that would weigh down market sentiment.

However, continued liquidity sup port from DIIs will prevent a big fall in indices, analysts said. Nifty March options data showed highest concentration at 9,000 strike among call options and at 8,500 strike among put options followed by 8,800 strike. “If everything goes fine, market can go to 9,200. The lower volatility period will continue and corrections may not be too large,“ said Amit Gupta, head of derivatives, ICICIdirect.

Rollover in Nifty futures to March was 73%, higher than the three-month average of 69%. The marketwide rollovers at 77% were in line with the average. The market-wide open interest of Rs 1.08 trillion on Thursday was an all-time high and the open interest of 27 lakh contracts in the Bank Nifty was the highest since July 2010.

“Market-wide open interest is at the highest level ever indicating huge leverage positions in the market. Since the market is over-leveraged, any negative newsflow can lead to a knee-jerk fall,“ said Yogesh Radke, head of quantitative research at Edelweiss Securities.

On Thursday, the indices rose 0.1% to close at a five-month high.The Nifty scaled a 52-week high of 8,982.15 and the Sensex crossed the 29,000-mark for the first time since September 8. The closing level of 8,939.5 for the Nifty was the highest a series has expired at since January 2015. Nifty's open interest on Thursday was Rs 20,200 crore compared to Rs 16,500 crore when the January contracts expired.

Since positions are on heavier side and Nifty is near the resistance of 9,000, a correction could be on the cards. “9000 will come but it will be tough to sustain. Risk reward is not favourable as the market has rallied sharply from the lows even as the overall trend is positive,“ said Chandan Taparia, derivative analyst, Motilal Oswal.

BJP's performance in the state elections will be a test of the government's popularity and if the US Fed raises rates in March and signals more over the next, that would weigh down market sentiment.

However, continued liquidity sup port from DIIs will prevent a big fall in indices, analysts said. Nifty March options data showed highest concentration at 9,000 strike among call options and at 8,500 strike among put options followed by 8,800 strike. “If everything goes fine, market can go to 9,200. The lower volatility period will continue and corrections may not be too large,“ said Amit Gupta, head of derivatives, ICICIdirect.